Agentic AI Drives Enterprise Returns, Tests Market and Policy

Stocks slid as investors weighed fragility in AI linked names against cooled expectations for a December Federal Reserve rate cut, highlighting a tension between technology advances and macroeconomic uncertainty. The market reaction matters because some firms are finally reporting returns from agentic AI while others confront rebuilding costs and new governance risks, a dynamic that will shape valuations and policy choices into 2026.

Listen to Article

Click play to generate audio

At 12:22 PM Eastern on November 14, 2025 markets extended a selloff as investors digested mixed signals from the artificial intelligence sector and diminishing odds of a near term Federal Reserve easing. The S&P 500 fell about 32 points or roughly 0.5 percent, the Dow Jones Industrial Average dropped around 467 points or about 1 percent, and the Nasdaq Composite slipped as technology valuations cooled. European benchmarks including the FTSE 100, DAX and CAC 40 also closed lower.

The market pullback reflects two converging forces. First, an episodic pattern of sharp moves in AI linked stocks has made sentiment more reactive, analysts said, even as some fundamentals remain intact. Adam Crisafulli of Vital Knowledge urged patience, noting that while AI fundamentals remain strong, investor attention has shifted to erratic price action in AI names. Second, remarks by Federal Reserve officials this week tempered expectations for a December rate cut, and futures tracked by the CME FedWatch tool showed pricing cooled to roughly 53 percent odds of a cut this year.

Taken together, these developments leave two core questions for markets. How much valuation relief remains for richly priced technology companies if policy stays less accommodative for longer, and when will the Fed shift if inflation and labor market data evolve differently than expected. Growth reliant sectors, including software and AI services, are particularly sensitive to changes in long term discount rates because a larger share of their value depends on future earnings.

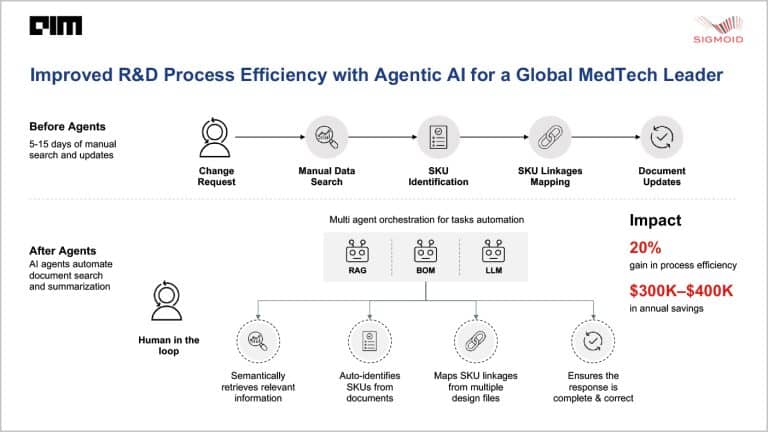

Into this macro backdrop the term “agentic AI” has jumped from marketing playbook to boardroom agenda. Agentic AI refers to systems that pursue goals autonomously across tools and datasets, and as of November 14 it had become the enterprise buzzword of the year. Importantly the latest news flow suggests that the label now corresponds to measurable outcomes for some firms. A subset of enterprises are reporting improved workflow automation, faster decision cycles and early productivity gains that translate to revenue uplift or cost reduction. These tangible returns are supporting a cohort of software vendors whose products embed agentic capabilities.

At the same time a second group of companies is grappling with the practical costs of adoption. Firms with legacy architectures are scrambling to rebuild tech stacks, strengthen access controls and implement oversight frameworks to manage emergent risks from autonomous agents. Those transition costs and governance investments will weigh on near term margins and could slow the pace at which benefits scale across entire industries.

For investors and policymakers the coming months will test whether agentic AI is a catalyst for durable productivity gains or a source of concentrated disruption. If more companies convert pilot wins into sustained returns, software winners may justify higher multiples despite tighter policy. If instead governance failures or execution gaps proliferate, the result could be further valuation compression and renewed calls for regulatory intervention. In either scenario the interplay between enterprise adoption economics and Federal Reserve timing will be decisive for markets heading into 2026.

%2FGettyImages-496030068-29ec863cca36413ab111277d250fe964.jpg&w=1920&q=75)