AI Investment Sends Markets Higher While Main Street Struggles to Stay Afloat

Heavy corporate spending on artificial intelligence has driven equity markets and contributed to headline GDP strength, but the gains are concentrated among a handful of big tech firms while many small and mid-sized businesses face cost pressures and weakening demand. Policymakers and investors are confronting a widening gap between Wall Street’s winners and a real economy where consumers and small firms are increasingly cautious.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Outside the glass towers of Silicon Valley and Manhattan trading floors, business owners describe an economy that feels markedly different from the headlines. While Nvidia, Alphabet and Broadcom have underpinned fresh stock-market highs and helped lift GDP through outsized investment in AI-capable hardware and cloud services, proprietors such as Pappas and local retailers like Norton's are struggling with higher input costs and softer demand.

That divergence is visible in surveys and sectoral performance. A Deloitte poll published this month found 57 percent of U.S. consumers expect the economy to weaken over the next year, up from 30 percent a year earlier. The shift in sentiment is material: lower consumer confidence typically translates into reduced spending on discretionary services and goods, hits cash flow for small enterprises and compounds the effects of elevated operating costs.

One major source of those cost pressures is the tariff regime instituted under the Trump administration. Tariffs raised import prices for goods and materials used across retail, construction and hospitality, squeezing margins at a time when demand has become less reliable. For small-business owners without the pricing power of large corporations, passing higher costs to customers is often impractical, leaving profitability and survival at stake.

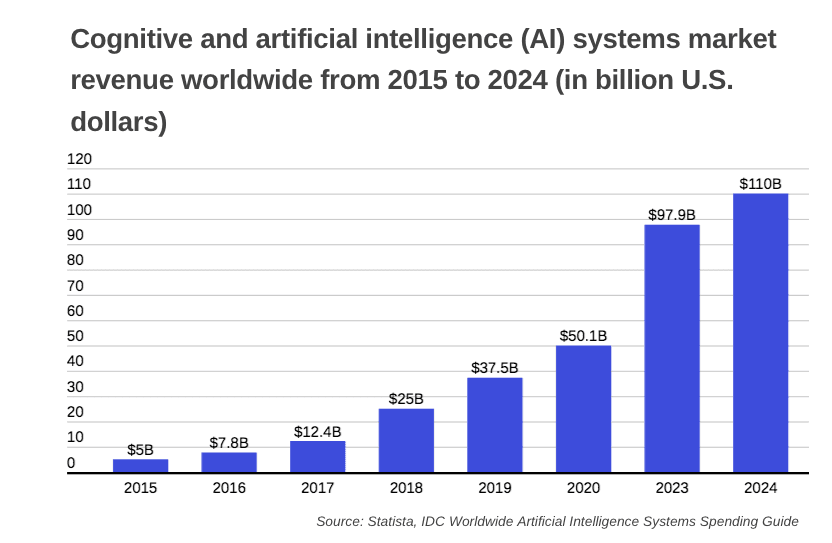

The macro picture is ambiguous. Corporate investment in AI — from chip purchases to data-center expansion — contributes directly to GDP through capital spending and indirectly by boosting productivity in some industries. That concentrated investment has translated into large gains for a narrow set of firms, lifting headline indices and market-cap-weighted measures of corporate health. But those gains do not automatically diffuse through supply chains to every corner of the economy.

Financial markets are signaling confidence that AI will generate future earnings growth, and that optimism has had spillover effects on aggregate demand via wealth effects for shareholders. Yet stock-market strength can mask underlying fragility when the benefits of new technology accrue primarily to capital-intensive firms and highly skilled workers, while smaller firms and lower-wage employees face higher costs and weaker demand.

For policymakers, the current picture raises trade-offs. Maintaining broad-based growth will likely require targeted measures that reduce input-cost burdens on small businesses, restore consumer confidence and expand access to credit and training for workers displaced by technological change. Reassessing tariff policy could ease immediate cost pressures, while carefully tailored fiscal and regulatory steps could improve the transmission of productivity gains to the wider economy.

Investors should note the asymmetric nature of the rally: a few large firms have become central to growth expectations, increasing concentration risk if broader economic activity disappoints. For Main Street, the key challenge remains survival: navigating higher costs and cautious consumers until investment-driven productivity translates into more widespread demand and wage gains. The coming quarters will test whether the AI-led expansion can broaden its benefits beyond the balance sheets of tech giants and into the shops, job sites and kitchens that make up the broader American economy.