Alphabet’s Rally Surges Past Microsoft — Can the Momentum Hold?

Alphabet’s shares have outpaced Microsoft at the fastest 60-day clip since January 2006, fueled by resilient ad demand, product upgrades and cloud share gains. Analysts warn the rally is technically stretched — the stock’s relative strength index of 75 signals overbought conditions — even as AI tailwinds and ad-market durability give the company structural advantages.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

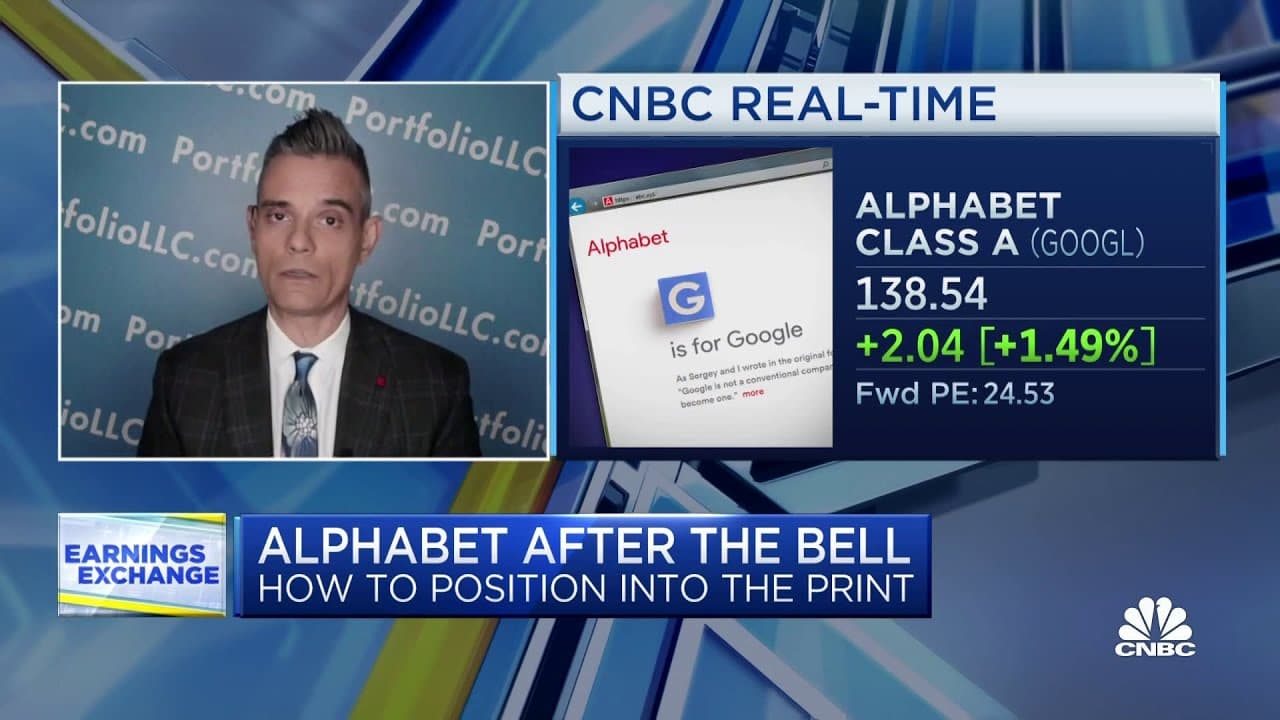

Alphabet’s stock has staged a forceful comeback, leaving its longtime peer Microsoft in the dust over the past two months and prompting fresh debate about how sustainable the rally will be. A CNBC analysis showed Alphabet’s 60-day outperformance relative to Microsoft last week reached its highest level since January 2006, a striking signal of investor rotation and renewed conviction in the search-and-ads leader.

Analysts point to a cluster of near-term catalysts: durable advertising demand, steady product upgrades across search and YouTube, and incremental cloud market share gains that have improved revenue durability beyond legacy ad sales. “Given Ad spend resiliency, Google's ongoing product upgrades, and Cloud share gains, Google remains one of our NT top picks,” Reitzes wrote in a Sept. 16 note, echoing a broader positive view among some sell-side strategists.

At the same time, caution is growing in trading rooms. The stock’s relative strength index, a popular momentum measure, sits near 75 — above conventional overbought thresholds and a level that typically leaves equities vulnerable to short-term pullbacks. Market technicians warn that even fundamentally sound firms can see rapid profit-taking when momentum indicators run hot.

Complicating the competitive picture is Microsoft’s positioning in the generative-AI boom. “Microsoft’s stock may be clouded by a lack of clarity around its relationship with OpenAI (the big driver of Azure) especially after 2030, but it should be a big help for a while,” the analyst wrote, underscoring the paradox in which Microsoft may both lag Alphabet on recent returns and yet possess one of the clearest long-run AI profit engines through its deep partnership with OpenAI. That relationship, and Microsoft’s broader enterprise footprint, leave it uniquely exposed to a surge in AI inference workloads that could boost Azure utilization and margins.

The current tussle between the two giants reflects larger structural trends in the tech sector. Digital advertising, long a cyclical business tied to broader economic activity, has shown surprising resilience this year, which supports Alphabet’s near-term sales trajectory. At the same time, cloud computing and the commercial rollout of AI are reshaping revenue mixes and long-term margins across Big Tech. For investors, the question is whether ad-driven momentum can be converted into sustainably higher revenue growth and margins as cloud and AI scale.

Policy and regulatory risk also remain an undercurrent. Alphabet faces ongoing scrutiny from antitrust regulators in the United States and Europe, and any substantive enforcement action could constrain advertising practices or product integrations that have helped the company recover. Microsoft, too, operates under regulatory watch as it deepens AI partnerships and integrates new capabilities across enterprise offerings.

For now, investors are weighing a familiar trade-off: entrenched franchise value and multiple growth levers against stretched technicals and regulatory uncertainty. If advertising durability and cloud share gains continue to materialize, Alphabet can plausibly keep the momentum. If momentum fades or regulatory pressures intensify, the stock’s current overbought readings suggest a meaningful pullback could follow.