American Axle Sees Sales Up but Profits Slip, Lowers 2025 Sales Band

American Axle & Manufacturing reported third-quarter adjusted earnings that declined even as net sales rose, prompting the supplier to set a 2025 sales range that closely tracks Wall Street estimates. The mixed quarter underscores margin pressure in the auto-supplier sector and leaves investors weighing thin earnings against modest top-line resilience.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

American Axle & Manufacturing disclosed a mixed third quarter on Friday, with adjusted earnings falling while net sales increased, and updated its 2025 sales guidance to a range that is essentially in line with analysts' expectations. The company set 2025 sales guidance at $5.8 billion to $5.9 billion, compared with a FactSet consensus of $5.86 billion, signaling only a modest deviation from market forecasts.

The juxtaposition of rising revenue and shrinking adjusted profits points to margin compression that has been affecting many auto suppliers this year. In the absence of detailed segment figures in the release, the most likely drivers include product mix shifts, higher input and labor costs, and continued investment in restructuring or new-product development amid an industry transition toward electrification. For investors, the signal is clear: American Axle can grow sales but is not yet turning that top-line momentum into stronger bottom-line results.

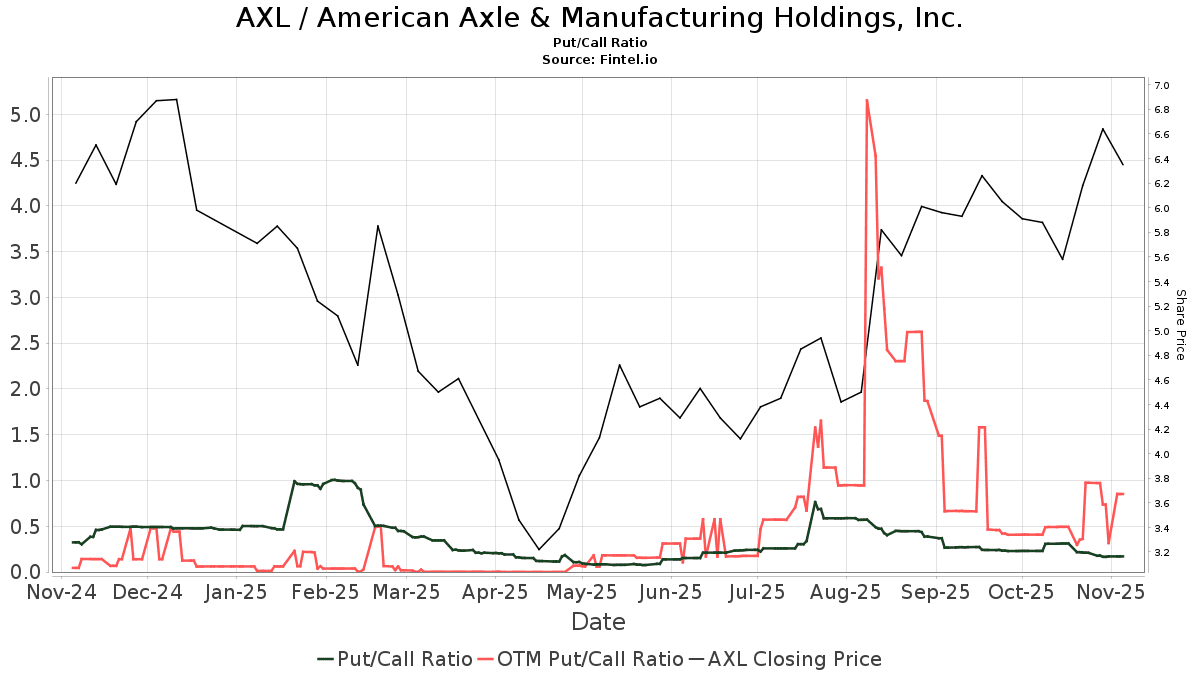

Market reaction to the announcement was muted-to-negative. The shares were last reported at $6.17, trading down roughly 2.8% on the most recent session, reflecting investor caution over falling adjusted earnings despite the sales uptick. The stock has shown modest resilience year to date, up approximately 5.8% from the start of the year, but remains subject to volatility typical of suppliers tied to cyclical auto demand and capital-spending cycles at original equipment manufacturers.

Analysts have taken varied stances this year as they reassess the outlook for suppliers navigating the shift to electric vehicles and ongoing macro uncertainties. Stifel initiated coverage with a Hold rating and a $6 price target, while RBC adjusted its target to $6 from $5 earlier in the summer. Those actions reflect a broader recalibration among brokerages as they balance the company’s revenue stability against margin pressures and the capital intensity of technology transitions.

The company’s guidance band sitting essentially on the FactSet consensus means 2025 could be a year of execution rather than surprise. For the market, that reduces the likelihood of a sharp re-rating driven by upside to sales; instead, investors will likely focus on margin trends, free cash flow and the company’s ability to lower costs or shift product mix toward higher-margin components. Credit markets and suppliers watch such developments closely because sustained margin erosion could force more aggressive cost-cutting or capital allocation shifts.

Looking further ahead, American Axle’s performance illustrates the structural stresses facing many parts suppliers: steady vehicle production and rising content per vehicle are supporting sales, but the transition to electric drivetrains, rapid product reengineering and uneven commodity costs are keeping pressure on profitability. How the company manages that squeeze—through pricing, efficiency programs, or product portfolio changes—will determine whether modest top-line gains translate into durable shareholder value in 2025 and beyond.