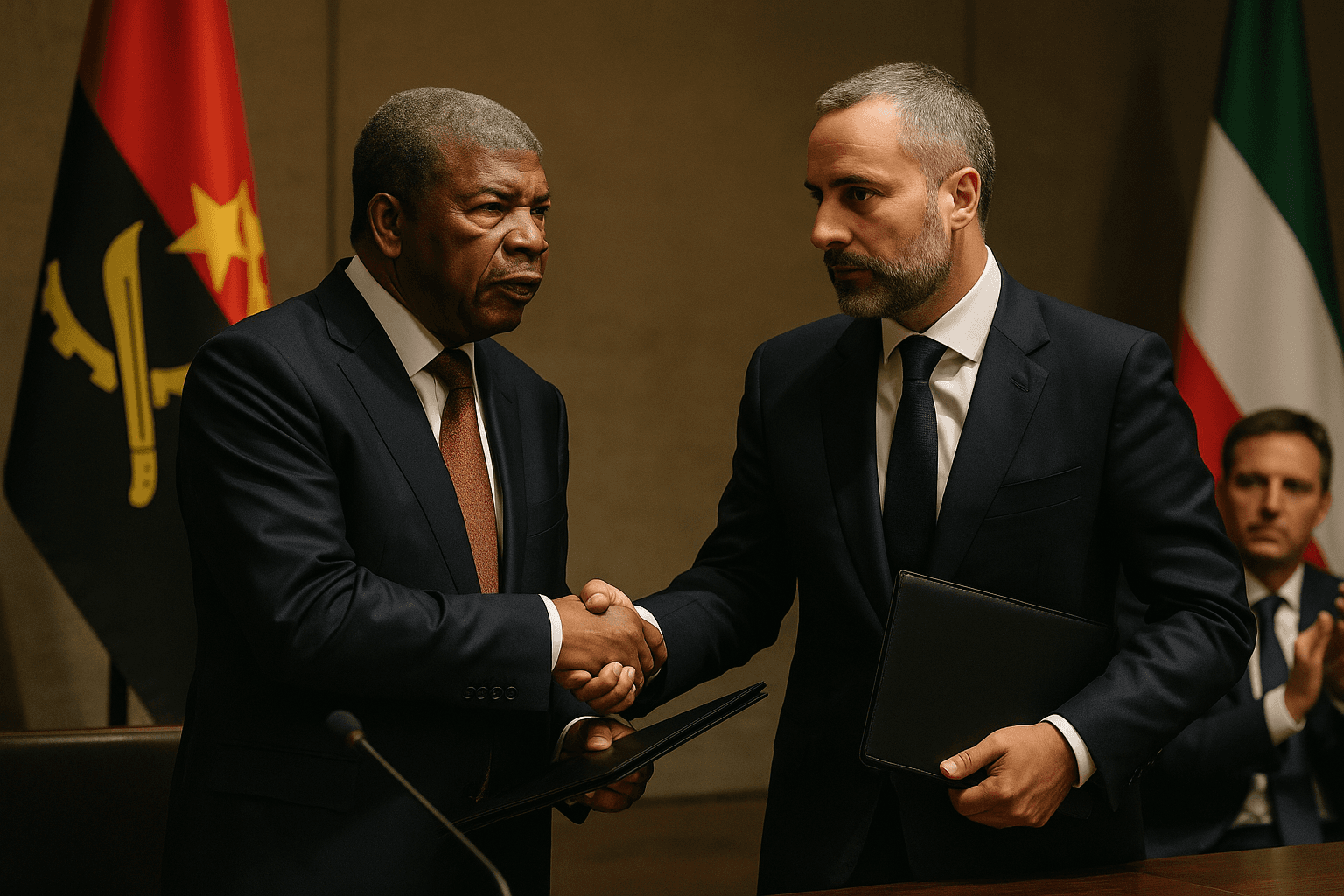

Angola and Gemcorp Create $500 Million Pan African Infrastructure Fund

Angola's sovereign wealth fund and London based Gemcorp announce a $500 million Pan African infrastructure fund today, seeking to marshal Gulf and international institutional capital into underfunded projects across the continent. The vehicle, domiciled in Abu Dhabi, aims to shift Angola's savings into productive investments in energy transition, critical minerals, water and food security while testing governance, regional development and geopolitical balances.

Angola's sovereign wealth fund, the Fundo Soberano de Angola known by its acronym FSDEA, and London based Gemcorp Capital announced today the launch of a $500 million Pan African Infrastructure Fund designed to channel private capital into priority projects across Africa. The fund will focus on energy transition, critical minerals, water, food security and other infrastructure priorities, and it will be domiciled in Abu Dhabi to engage Gulf investors more directly.

FSDEA will seed the vehicle with an initial $50 million, with the option to increase its commitment up to $200 million. Gemcorp has committed up to $50 million. The remaining capital is expected to come from international institutional investors and Gulf region sources, including pension funds, family offices and other sovereign investors. Organizers described the fund as a vehicle to mobilize private sector finance into projects that public budgets and traditional development lenders have struggled to fund at scale.

The move reflects a broader trend among African sovereign wealth funds to shift away from liquid securities into direct investments that generate tangible economic activity on the continent. FSDEA framed its participation as a diversification away from passive holdings toward productive investments that can support industrialization, value addition and job creation. Establishing the fund in Abu Dhabi is a pragmatic step to tap deep pools of Gulf capital, but it also raises questions about where decision making will be located and how benefits will be shared across host countries where projects are deployed.

Strategically, the fund targets sectors that are central to global competition over energy and raw materials. Critical minerals, which are key to batteries and renewable technologies, are the subject of intense demand from Europe, Asia and North America. Concentrating investment in these areas offers African states opportunities to capture higher value in supply chains, yet will require robust governance standards to ensure environmental protections, community consultation and equitable revenue sharing.

The fund's emphasis on water and food security signals sensitivity to the continent's climate vulnerabilities and to the social dimensions of infrastructure investment. Translating capital into effective projects will hinge on credible pipelines, regulatory certainty, and public private partnerships that respect local land and labor rights. International legal frameworks, including investment treaties and anti corruption standards, will influence investor confidence and host country oversight.

Domiciling in Abu Dhabi also reflects shifting financial geographies. Gulf sovereign wealth and private capital have grown as prominent financiers of global infrastructure, and their involvement can bring scale. At the same time, African policymakers and civil society will be attentive to questions of transparency, procurement, and local content, seeking to avoid a repeat of extractive patterns that have characterized some foreign investment flows.

Fund managers and FSDEA now face the immediate task of fundraising and identifying early projects that can demonstrate impact and returns. Success would mark an example of an African sovereign investor leveraging partnerships to unlock private capital for continent building. Failure to meet governance and development benchmarks could prompt criticism and undermine the potential long term benefits for communities the fund is designed to serve.