Art’s-Way Posts Q3 Gains as Demand for Farm Equipment Strengthens

Art’s-Way Manufacturing released third-quarter and nine-month results showing revenue growth and a return to profitability, driven by stronger orders for agricultural equipment. The small-cap stock ticked higher on the news, highlighting how cyclical recovery in farm investment and financing conditions can quickly move niche industrial shares.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Art’s‑Way Manufacturing Co., Inc. said on Tuesday that it had posted year‑over‑year revenue gains in the third quarter and across the first nine months of fiscal 2025, a performance the company attributed to increased demand for seed meters, feed processing and crop‑handling equipment. The Nasdaq‑listed manufacturer’s shares rose 4.5% to $3.02 in late trading, extending a year‑to‑date advance of roughly 39%.

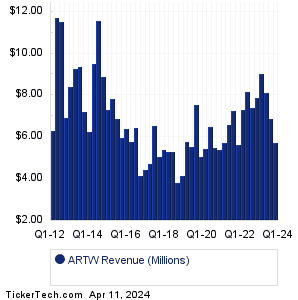

According to the filing published by MarketScreener, Art’s‑Way reported third‑quarter revenue of $8.3 million, up 27% from $6.5 million in the same period a year earlier, and net income of $0.4 million compared with a loss in the prior‑year quarter. For the nine months ended Aug. 31, 2025, revenue increased to $21.5 million from $16.7 million a year earlier and the company recorded cumulative net income of $1.1 million, reversing prior‑year deficits. Diluted earnings per share in the quarter were $0.05.

“Improved farm margins and an uptick in equipment replacement cycles supported orders across our core product lines,” Art’s‑Way’s management said in the release. The company pointed to stronger domestic demand and selective international sales as drivers, while noting continued cost discipline that helped expand gross margins modestly versus the prior year.

The results underscore a larger pattern in agricultural manufacturing: equipment makers sensitive to farm cash flow are benefiting as commodity prices and government support programs stabilize rural incomes. Corn and soybean futures have been less volatile this year than in 2024, easing farmer uncertainty about capital expenditures. At the same time, higher short‑term interest rates have made financing more expensive, creating a mixed backdrop in which higher margins on new equipment must offset increased borrowing costs for buyers.

Analysts and investors watching small industrials say Art’s‑Way’s performance illustrates the industry’s cyclical character. “This is a classic recovery story for a niche manufacturer tied to agricultural cycles,” said an independent small‑cap analyst. “The market will want to see whether order momentum sustains into the winter and whether the firm can convert backlog into cash.”

Market reaction was modest but positive, reflecting the company’s size and liquidity profile. Art’s‑Way’s market capitalization remains small, leaving the stock prone to pronounced swings on incremental news. The firm’s balance sheet shows an improved cash flow trend in the first nine months, though capital expenditures and working capital needs for seasonal production remain relevant risks.

Longer‑term implications for investors hinge on two forces: structural demand for modernized seed and feed equipment as farms consolidate and adopt precision tools, and access to financing for both manufacturers and buyers in a higher‑rate environment. Policy developments—such as crop insurance adjustments or shifts in federal farm spending—could materially affect demand patterns for companies like Art’s‑Way.

For now, the company’s operational rebound provides a near‑term uplift and a reminder that small, specialized industrials can lead or lag broader manufacturing cycles depending on commodity markets, credit conditions and agricultural policy.