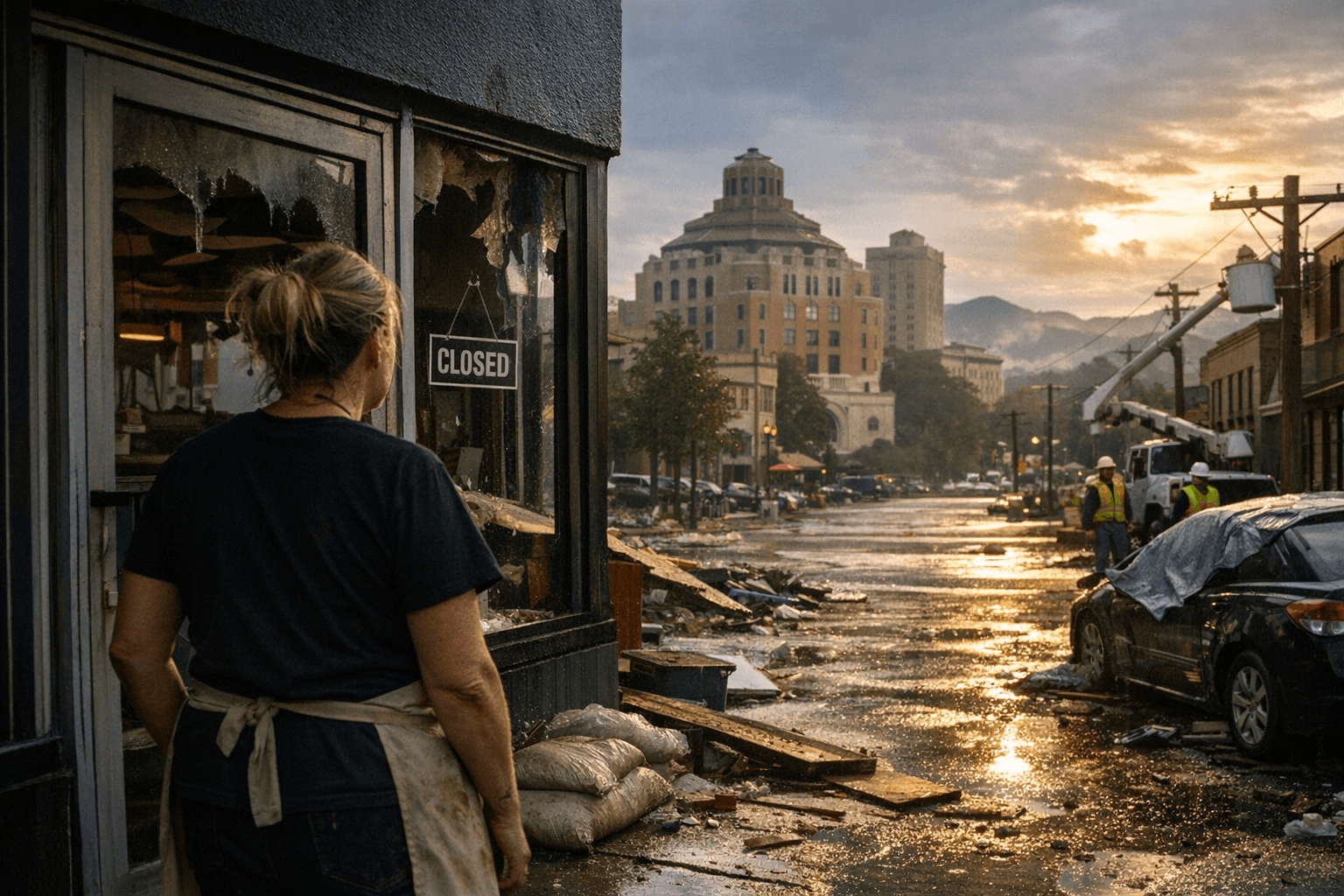

Asheville plans $17 million small business recovery program, delayed

City will use $17 million in CDBG-DR funds for small business recovery after Tropical Storm Helene; grants likely will not reach businesses until March 2026 or later.

Asheville city staff announced plans for a $17 million Small Business Support Program funded with federal CDBG-DR disaster recovery dollars tied to Tropical Storm Helene, but warned the program is still in planning and due-diligence stages and likely will not begin distributing grants until spring 2026. That timeline reflects federal requirements and a partner-selection process the city must complete before awards can flow.

City officials told council members the program is being designed to combine direct grant awards with technical-assistance services, and that 70 percent of the funds must benefit low- and moderate-income households under CDBG-DR rules. Those constraints shape both who can receive aid and how quickly the program can be launched, since the city must identify an eligible partner to administer funds, complete federal compliance checks, and design application and reporting systems.

The delay has prompted frustration among some council members and small-business advocates who say many local firms remain cash-strapped months after Helene. Nonprofit organizations such as Mountain BizWorks and other local funders have already provided emergency loans and grants to numerous businesses, softening immediate damage. Still, city staff and advocates report unmet needs across downtown and neighborhood commercial corridors, especially in hospitality, retail and small manufacturing that rely on steady foot traffic and seasonal sales.

The planned city program sits within a broader recovery landscape that includes state and regional relief dollars. Officials expect the $17 million federal allocation to play a distinct role by targeting businesses in low- and moderate-income areas and pairing capital support with capacity-building services. The requirement that most dollars benefit LMI households narrows the pool of eligible businesses but aims to direct funds where recovery gaps have been deepest.

For local economies, timing is critical. Delayed grant distribution increases the risk of permanent closures, layoffs and lost tax revenue for Buncombe County. Small businesses typically face tight cash flows and limited access to affordable bridge financing, so even a few months’ wait can determine whether an operator survives to the next season.

The city’s next steps include vetting potential nonprofit or private-sector partners, finalizing program rules in line with federal CDBG-DR standards, and setting up application processes. Mountain BizWorks and other intermediaries will likely play a role in outreach and technical assistance once administration is set.

The takeaway? Start preparing now: document losses, gather payroll and revenue records, and stay connected to Mountain BizWorks and city announcements so you can move quickly when applications open. Our two cents? The faster businesses get organized, the better positioned they will be to claim funds when the city finally opens the program.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip