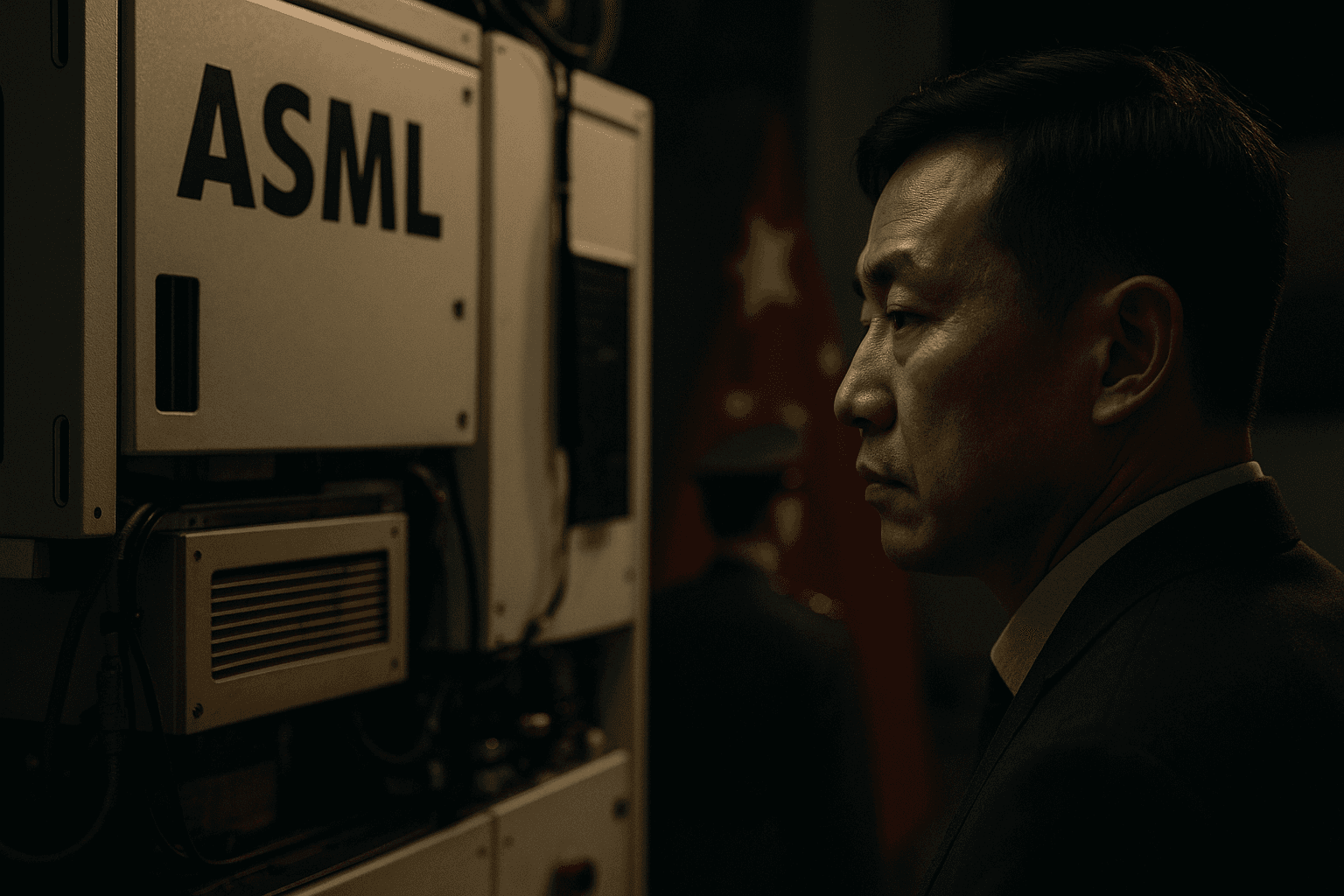

ASML Customer Linked to Chinese Military Raises Export Control Alarm

Dutch television programme Nieuwsuur reported today that at least one customer of chip equipment maker ASML has links to China’s military, prompting an immediate review by the company and Dutch authorities. The allegation underscores growing concerns about supply chain transparency for advanced semiconductor tools and could accelerate tighter end use checks and export licensing scrutiny internationally.

Nieuwsuur said on December 9, 2025 that its investigation identified at least one ASML customer with reported links to China’s military. ASML responded that it could not confirm the allegation and reiterated that it complies with export controls and licensing requirements. Dutch government officials and the company said they would review the claims.

The episode focuses attention on a persistent challenge for advanced technology export controls. ASML produces some of the world’s most sophisticated lithography machines, equipment that industry and governments classify as dual use because it enables production of high end chips that can have civilian and military applications. Ensuring such equipment does not reach inappropriate end uses depends on end use checks, transparent customer records, and international cooperation among export control authorities.

Policy makers say the case raises three interlocking issues. First, tracing ultimate end users in complex global semiconductor supply chains is increasingly difficult as equipment travels through multiple agents and service providers. Second, licensing regimes can be undermined by opaque ownership structures or ambiguous corporate links. Third, enforcement relies heavily on company compliance and timely sharing of information between private firms and state regulators.

Dutch officials now face a definitional and procedural test. The Netherlands administers export controls that have guided ASML’s sales for years and that form part of broader Western efforts to limit transfer of cutting edge chip manufacturing capabilities to military end users. A formal review by authorities could trigger enhanced licensing checks, targeted audits, or temporary restrictions, but it would also require demonstrable evidence to support any enforcement action. That balance between precaution and legal standards is likely to shape next steps.

Export control experts say the report could intensify calls for rigorous end use verification protocols and enhanced cooperation between exporting countries. Some experts argue for stronger due diligence requirements, more frequent on site inspections, and expanded information sharing between the European Union and allied states. Critics caution that overly restrictive measures risk fragmenting global supply chains and driving investment away from jurisdictions that impose heavy controls.

For ASML, the reputational stakes are high. The company sits at the intersection of commercial demand for advanced equipment and national security concerns across several governments. Its response and transparency in forthcoming reviews will be watched by customers, regulators, and lawmakers in Europe and the United States. For democratic institutions charged with oversight, the case offers a test of whether existing export controls and corporate compliance mechanisms can adapt to the opaque and rapid evolution of semiconductor supply chains.

As investigations proceed, the central question will be whether the evidence substantiates the television programme’s claims and how authorities will calibrate regulatory responses to protect security interests while preserving the integrity of global technology trade.