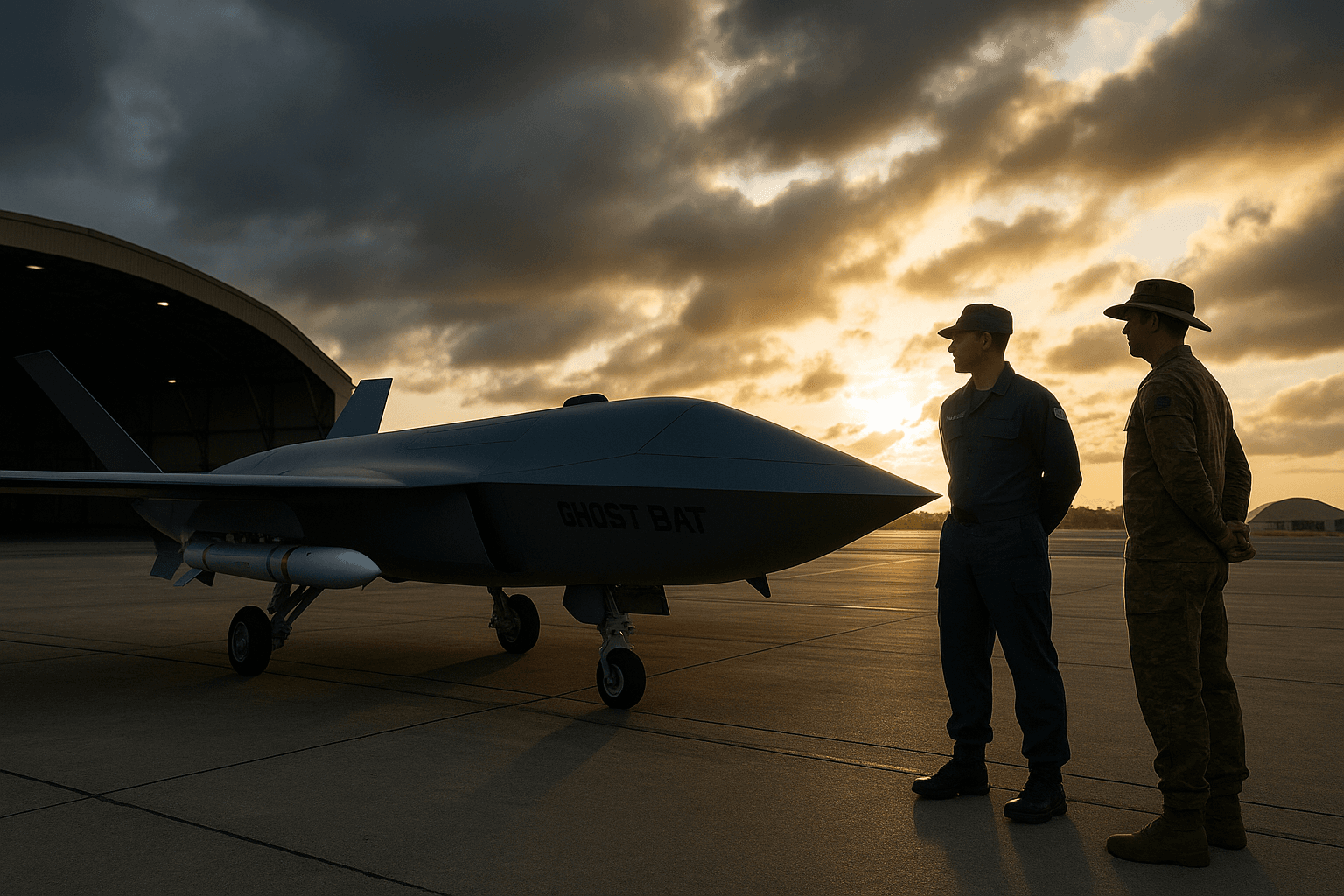

Australia buys six Ghost Bat drones, deepens allied strike ties with U.S.

Canberra announced a A$1.4 billion purchase of six operational MQ 28A Ghost Bat drones after a live weapons test demonstrated the platform employing an AIM 120 air to air missile. The acquisition arrives as allied talks in Washington advance cooperation on hypersonic cruise missiles and expanded U.S. bomber rotations, and as Australia prepares infrastructure in its north to host greater allied air activity.

Australia announced today that it has signed a A$1.4 billion contract with Boeing Defence Australia to acquire six operational MQ 28A Ghost Bat unmanned combat aircraft following a live weapons test that showed the platform employing an AIM 120 air to air missile against an aerial target. The purchase, valued at about $930 million, is the most concrete step yet in Canberra’s effort to field crewed uncrewed teaming assets with extended reach.

The defence purchase was announced as Australian and U.S. officials meet in Washington for allied talks that Canberra said included steps toward joint production and maintenance of hypersonic cruise missiles and arrangements to increase U.S. bomber rotations to Australia. Defence Minister Richard Marles, who highlighted the weapons trial and the decision to expand air base infrastructure in northern Australia, described the moves as integral to bolstering regional deterrence and interoperability with allies.

The MQ 28A platform has been promoted by its manufacturer as a force multiplier that can fly ahead of strike packages, extend sensor reach, and operate alongside crewed fighters to complicate an adversary’s calculus. The live test cited by Canberra is intended to mark a transition from developmental trials to an operational role, though the government did not provide a delivery timetable or detailed rules of engagement for the new aircraft.

Strategically the purchase signals Canberra’s intent to deepen integration with U.S. air power while investing in sovereign defence capacity. The emphasis on northern infrastructure underscores Canberra’s focus on the Arafura and Timor seas, and on sustaining frequent allied air operations from Australian soil. Increased bomber rotations and joint hypersonics work will require expanded logistics, maintenance hubs, and training ranges, steps that carry diplomatic as well as technical implications.

Legal and diplomatic questions will follow, including export control and technology transfer arrangements for advanced munitions and propulsion systems, and the governance of crewed uncrewed missions in crowded airspace. Joint production and maintenance of hypersonic cruise systems raises novel issues of liability, certification, and compliance with existing arms control regimes, even as proponents argue the work is necessary to maintain deterrence in the face of accelerating capabilities in the Indo Pacific.

Regional capitals will watch Canberra’s moves closely. Neighbouring states that prefer a low risk security posture may register concern about the widening footprint of allied strike assets in Australian skies, while others may welcome what they see as a stabilising balance of power. Canberra appears to be seeking a calibrated message, stressing interoperability and defensive intent while accelerating capability deliveries.

The Boeing contract comes at a transition point for unmanned combat aviation globally, as militaries weigh the operational promise of long range autonomous platforms against political and legal constraints. For Australia the investment in six operational Ghost Bat aircraft and the associated infrastructure commitments reflect a strategic bet that crewed uncrewed teaming will be central to allied air strategy in the years ahead.