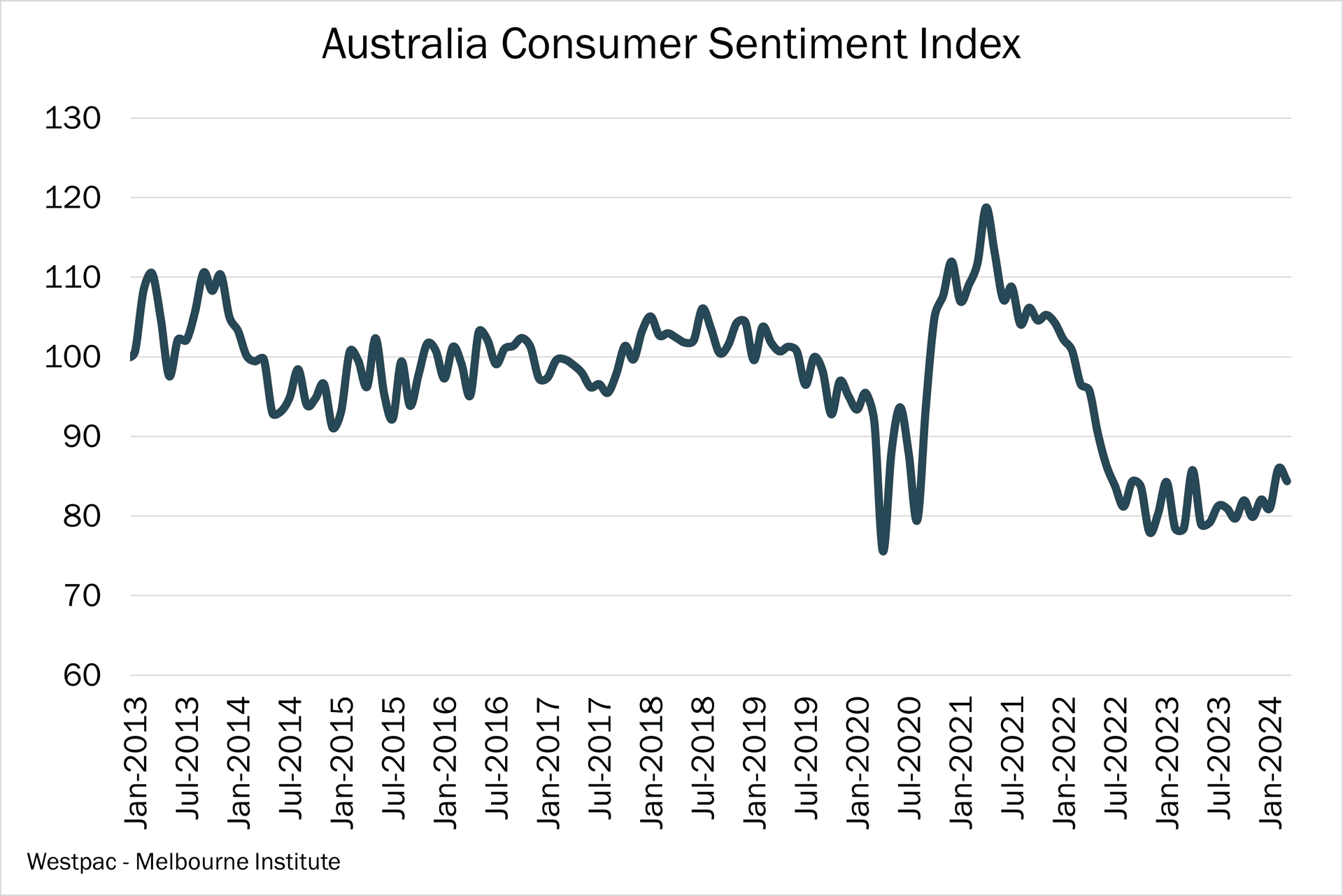

Australian Consumer Sentiment Drops Sharply, Inflation Worries Rise

The Westpac Melbourne Institute Consumer Sentiment survey released today shows the headline index fell 9 percent to 94.5 in December from 103.8 in November, reversing a 12.8 percent surge the prior month. The decline, driven by renewed concerns about inflation and mortgage costs, pushes sentiment below neutral and raises risks for spending and the housing recovery heading into 2026.

The Westpac Melbourne Institute Consumer Sentiment survey, released on December 16, 2025, recorded a sharp deterioration in household confidence as inflation and interest rate worries returned to the forefront. The main sentiment index dropped 9.0 percent to 94.5 in early December from 103.8 in November, moving the reading back below the 100 neutral threshold and signalling that pessimists now outnumber optimists.

December’s reversal came after a broad based improvement in November when the index rose 12.8 percent. This month the decline was widespread across forward looking measures. The panel’s assessment of economic prospects over the next 12 months fell 9.7 percent, while the five year outlook slid 11.7 percent. Willingness to make major purchases weakened, with the measure of whether it is a good time to buy a major household item down 11.4 percent to 98.9.

The bulletin highlights a sharp turnaround in consumer mortgage rate expectations, alongside deteriorating views on family finances and the economic outlook. Homebuyer sentiment eased and household expectations for house prices were pared back over the month, suggesting the earlier momentum in housing demand could stall if rate expectations remain elevated.

A notable feature of the survey’s nuance was the prominence of inflation in news recall questions. Around 78 percent of respondents described inflation related news as unfavourable, making it the most frequently recalled topic. Survey commentary linked that heightened negative recall to upside surprises in third quarter inflation data and a strong initial read from monthly CPI in October, which appear to have fed fears that the official cash rate may stay higher for longer.

Despite the broad decline in confidence, respondents were not uniformly downbeat. Perceptions of the labour market remained comparatively resilient, with the survey noting that employment stability is acting as a partial buffer against cost of living pressures. That resilience could limit near term cutbacks in spending, but it has not been sufficient to offset the weight of inflation and rate concerns.

The move below 100 has immediate implications for demand sensitive sectors. Lower confidence and deteriorating mortgage expectations increase the risk of weaker household consumption and a softer trajectory for the housing market in early 2026. For policymakers, the survey underscores how fragile sentiment is to inflation news and rate paths. Central bank decisions on official rates will be watched closely by households who now expect borrowing costs to rise or remain elevated.

Westpac Melbourne Institute charts place the December swing in a longer term historical context and underline the inherent volatility of sentiment series across cycles, noting that past patterns do not guarantee future outcomes. For the coming months, inflation newsflow, mortgage rate expectations and the Reserve Bank’s communication on rates will be the key variables shaping whether consumer confidence stabilises or slides further.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip