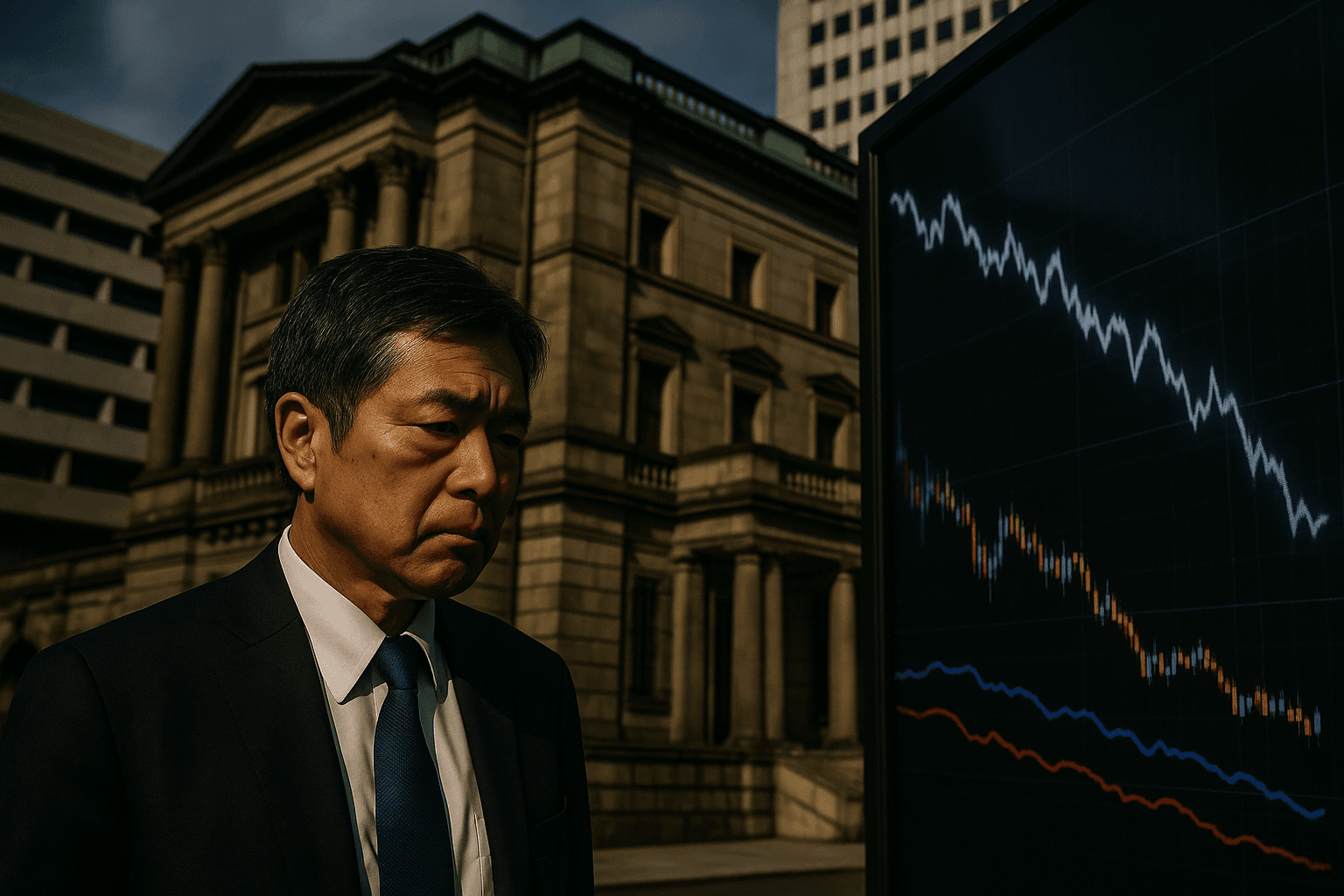

Bank of Japan Signals Possible December Rate Hike, Markets Reprice

Reuters reports that the Bank of Japan is shifting public messaging toward the risks of a weak yen and preparing markets for a potential rate increase as soon as its December meeting, a move that could upend expectations for global interest rates and currency flows. Investors are recalibrating portfolios as economists in a Reuters poll now show a slim majority expecting a December hike, raising stakes for markets and policy makers worldwide.

Reuters reports that the Bank of Japan has begun to prepare markets for a near term policy shift, reviving hawkish language and flagging the economic risks posed by a weaker yen. Multiple people familiar with BOJ thinking told Reuters that officials, including some who have recently signaled support for higher rates, are increasingly vocal about the danger that a soft currency could drive import driven inflation and complicate the central bank's price stability goals.

The change in tone follows high level meetings between the BOJ governor and government leaders, according to the report. Those exchanges appear to have accelerated a recalibration within the central bank, which has maintained an extended period of exceptionally loose monetary policy to support growth and lift inflation toward its 2 percent objective. A Reuters poll released alongside the coverage finds a slim majority of economists now expect the BOJ to raise rates at its December meeting, a marked shift from market expectations just months ago.

Market reaction to the signaling was immediate. Investors have begun to reconsider the timing of BOJ normalization, recalibrating currency exposures and global rates positioning. The prospect of higher Japanese policy rates would likely support the yen, shrink carry trade incentives and pressure longer dated government bond yields in other advanced economies. Traders and portfolio managers are watching closely for changes in forward guidance, minutes and any concrete steps to unwind long standing accommodation that has anchored yields and currency dynamics.

Policy makers face a delicate trade off. A firmer monetary stance would help contain imported price pressures stemming from a weaker yen, but it would also raise borrowing costs in an economy with one of the highest public debt burdens among advanced nations. Higher yields would increase government interest expenses, tighten financial conditions for credit dependent corporations and could strain a still fragile domestic demand recovery. Those macro fiscal implications are likely part of the internal debate that has produced more hawkish public messaging.

The pivot also has broader implications for global markets. Japan has been a major source of low cost funding for international investors and central banks, and any material shift in Japanese yields can ripple through global risk assets and financing markets. Currency markets in particular are sensitive; a durable appreciation of the yen would prompt reassessments of trade competitiveness, corporate earnings forecasts and cross border investment flows.

Looking ahead, the key signals to watch are the BOJ's December policy statement, forward guidance on the pace of tightening, and any operational steps that would reduce accommodation. For markets, the decisive indicators will be the language around the timing of hikes, movements in Japanese government bond yields, and the immediate reaction of the yen. If Reuters reporting proves prescient, the BOJ's next moves could mark a turning point in the post crisis era of global monetary policy, with consequences for inflation, exchange rates and financial stability worldwide.