Big Tech Reorganizes Sales Forces for an AI 'Tectonic' Shift

Major technology companies are retooling their commercial teams as artificial intelligence moves from lab experiments to enterprise-scale products, a shift that will determine which firms capture the largest share of AI-driven revenue. This matters because the battle will reshape corporate procurement, pricing power and regulatory scrutiny while influencing how quickly businesses realize AI productivity gains.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Companies from Microsoft to Meta and Google are quietly reconfiguring their sales organizations as they race to turn AI research into repeatable, high-margin enterprise contracts. Business Insider’s coverage captures a broader industry view: “Let the sales guy figure out the business side of things while the rest of us cook up cool AI stuff,” one internal memo quipped, underscoring that go-to-market muscle may now decide winners as much as engineering prowess.

Executives say the change is more than a product launch. It is a structural pivot. Firms are building specialized AI-selling teams, retraining account executives to sell outcomes rather than software licenses, and redesigning pricing to reflect compute-intensive models and ongoing data services. That work involves expensive coordination: tighter integration between research, cloud infrastructure and customer success, plus new commercial terms for access to proprietary models and data-cleaning services.

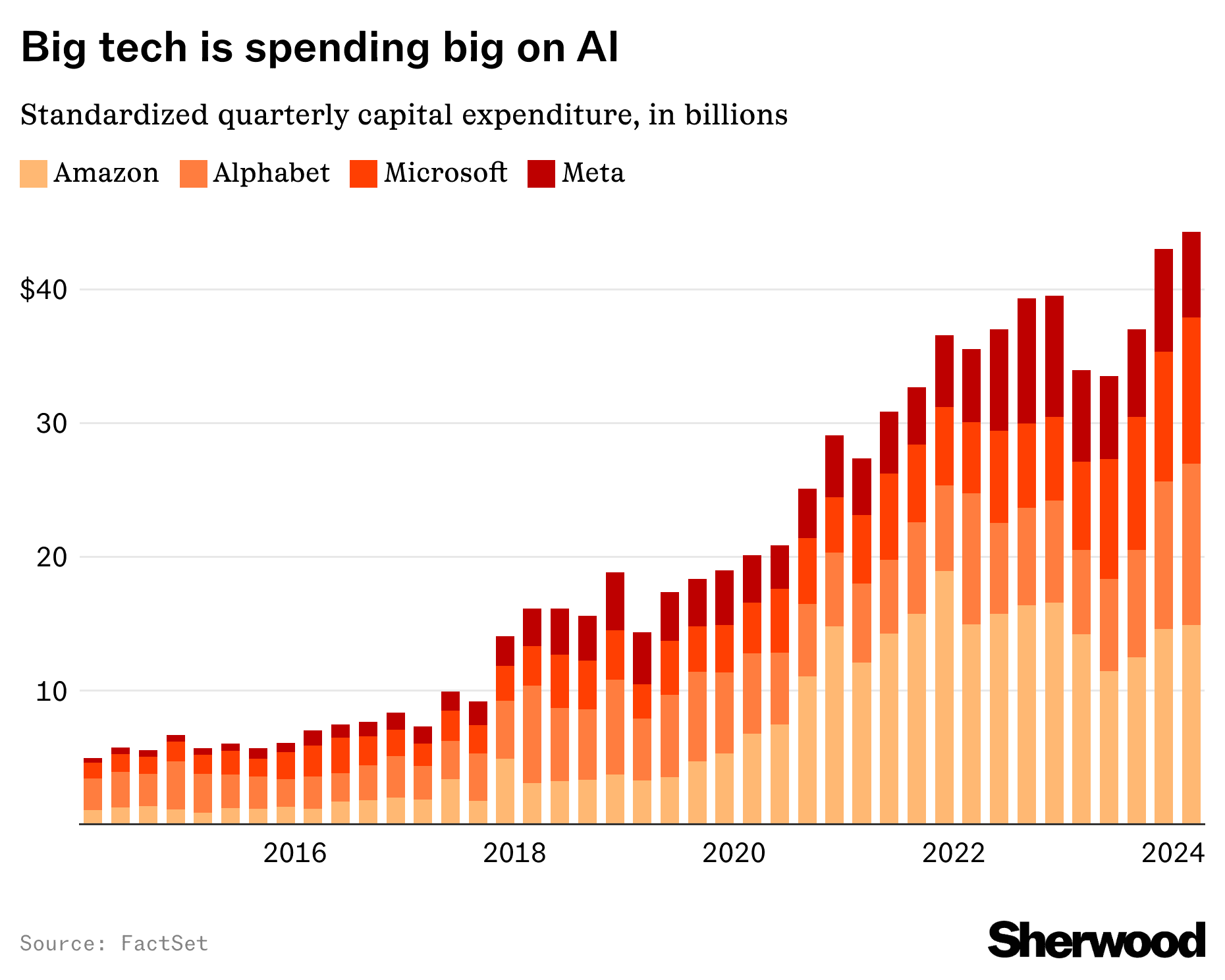

The stakes are large. McKinsey estimates that AI could create up to $13 trillion in incremental global economic activity by 2030, a figure that has prompted technology giants to commit “tens of billions” to data centers, AI chips and commercial partnerships. Microsoft’s multibillion-dollar relationship with OpenAI, for example, has been widely cited as a template for how platform providers hope to capture downstream services revenue. How sales teams package and price these offerings will directly affect adoption curves in sectors such as finance, healthcare and manufacturing.

Industry analysts say this is where market power will consolidate. “Engineering determines capability; sales determine adoption,” said one consultant who advises enterprise software buyers. The immediate market implication is simpler: suppliers that move fastest to translate AI capabilities into predictable cost savings and compliance assurances will win the largest enterprise deals. That will pressure competitors to match not just technology but service-level guarantees, data governance terms and integrated workflows.

Policy questions follow. As companies bundle proprietary models, cloud infrastructure and data-cleansing services into single contracts, regulators may scrutinize potential anti-competitive tying and gatekeeping over essential training data. Governments are already considering rules around model transparency, data portability and supplier discrimination; concentrated control of both models and customer relationships could invite closer antitrust attention.

For corporate buyers, the transition offers both upside and risk. Early adopters can capture productivity gains and new product capabilities, but they also face lock-in and rising switching costs if vendors combine models with unique data services. In the labor market, the reorientation will shift demand toward sellers who understand AI economics—pricing for compute, risk-sharing models and measurable ROI—while reducing need for traditional product-pitch skills.

Over the long run, the tectonic change envisioned by industry insiders suggests a market that prizes integrated AI solutions over standalone models. The winners will be those that can translate technical advantages into commercial contracts that scale, comply with emerging regulation, and deliver quantifiable business outcomes. For investors and policymakers, watching how sales teams are rebuilt may be the clearest signal of which companies will dominate the AI economy.