BlackLine Sees 2026 Upside but AI-Driven Deal Delays Cloud Near-Term ARR

BlackLine told investors it expects accelerating revenue growth and margin expansion in 2026, contingent on a stable macro backdrop, citing a strong pipeline, platform pricing adoption and operational gains. The company also disclosed that a small number of delayed deals tied to customer interest in AI offerings—amounting to a couple of million dollars—dented net new ARR at the close of the third quarter, underscoring demand timing risks as buyers evaluate AI capabilities.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

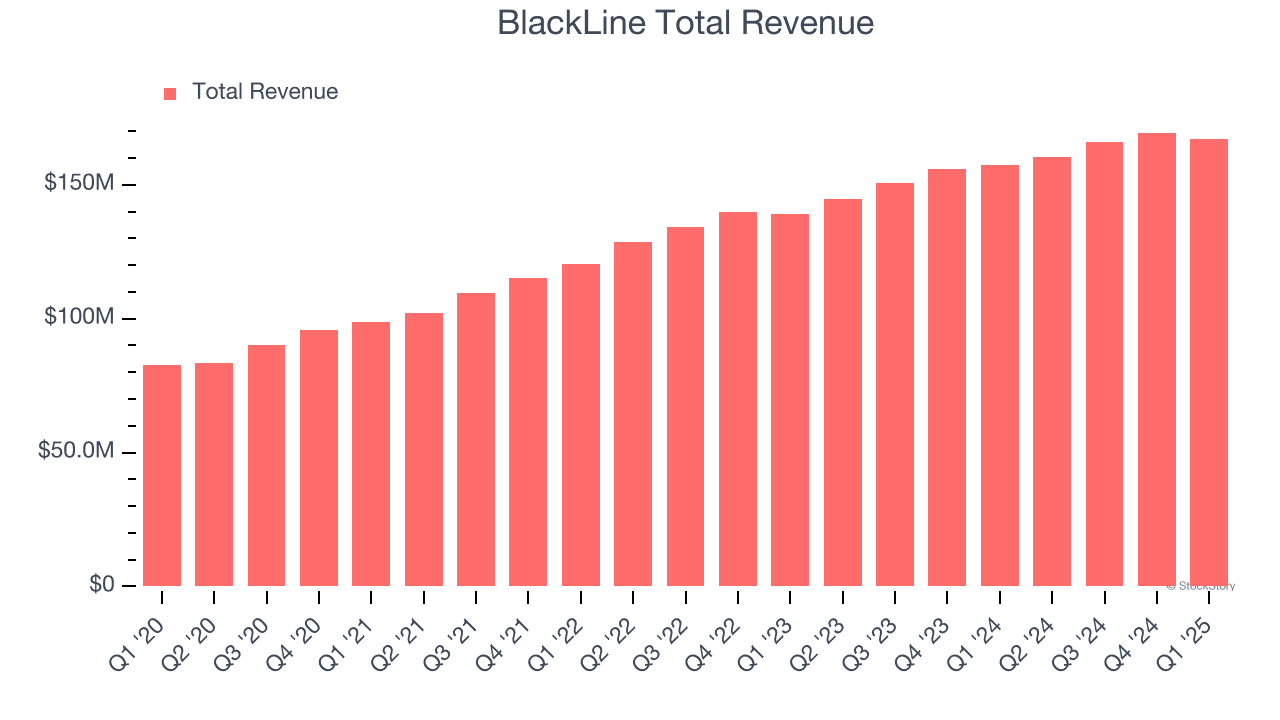

BlackLine, the financial close automation software provider, struck a cautiously optimistic tone in its latest earnings call coverage, outlining a pathway to faster revenue growth and ongoing margin improvement in 2026 while flagging near-term disruptions tied to the market’s appetite for AI-enabled features.

Management’s forward-looking scenario rests on three pillars: a robust sales pipeline, greater adoption of platform pricing that should lift average contract values, and continued operational improvements that management says will expand margins as the business scales. Those elements together form the company’s base case for accelerating top-line momentum into 2026, but executives were explicit that the plan presumes a stable macroeconomic environment—an important caveat given the sensitivity of enterprise software spending to broader economic and interest-rate conditions.

The caution was prompted in part by a timing issue at the end of the third quarter. BlackLine reported that a couple of million dollars’ worth of deals were delayed because prospective customers held off pending evaluation of AI offerings. Those postponements reduced net new annual recurring revenue (ARR) for the period and highlight an increasingly common market dynamic: enterprise buyers are stretching procurement cycles while deciding how and when to integrate generative AI and other advanced features into existing systems.

The episode exposes two related challenges for BlackLine and peers in finance software. First, product alignment: vendors must ensure their AI road maps and go-to-market messaging match buyer expectations or risk pushing deals into later quarters. Second, monetization: the shift toward platform pricing can increase revenue per customer but requires clear proof points of incremental value to overcome buying hesitation. BlackLine’s confidence in platform pricing adoption signals management’s belief that customers will pay more for integrated capabilities, but the recent delays illustrate how proof of AI value can affect timing.

Operationally, BlackLine points to efficiency gains as a lever for margin expansion, suggesting that scale and process improvements will support profitability even as the company invests in product development. For investors, the near-term story is therefore a trade-off between transitory ARR timing effects and a strategic shift toward higher-value, platform-based revenue that could yield stronger margins in 2026.

The broader implication for the enterprise software market is that AI interest is reshaping purchasing behavior, lengthening sales cycles and elevating the importance of demonstrable outcomes. For BlackLine, the next quarters will be a test of execution: converting the sales pipeline, proving AI-related product value, and delivering on operational efficiencies. Analysts and investors will watch net new ARR, platform pricing penetration and margin trajectories closely to see if the company can translate its 2026 aspirations into steadier, short-term results.