Bolivia Secures More Than 9 Billion Dollars in Loans, Targets Stability

Bolivia announced negotiations for multilateral financing exceeding 9 billion dollars to shore up public and private projects, stabilise the currency and ease fiscal pressures. The package marks the first major economic initiative of President Rodrigo Paz and could deliver a significant tranche within 60 to 90 days, shaping policy and markets across the Andean nation.

Bolivia moved to reassure markets and international partners after its economy minister disclosed talks to secure more than 9 billion dollars in multilateral financing aimed at stabilising an increasingly fragile economic outlook. Economy Minister Jose Gabriel Espinoza said the government is negotiating the package with a consortium of lenders that includes the World Bank and CAF, the Latin American development bank, and that roughly one third of the funds could arrive within 60 to 90 days.

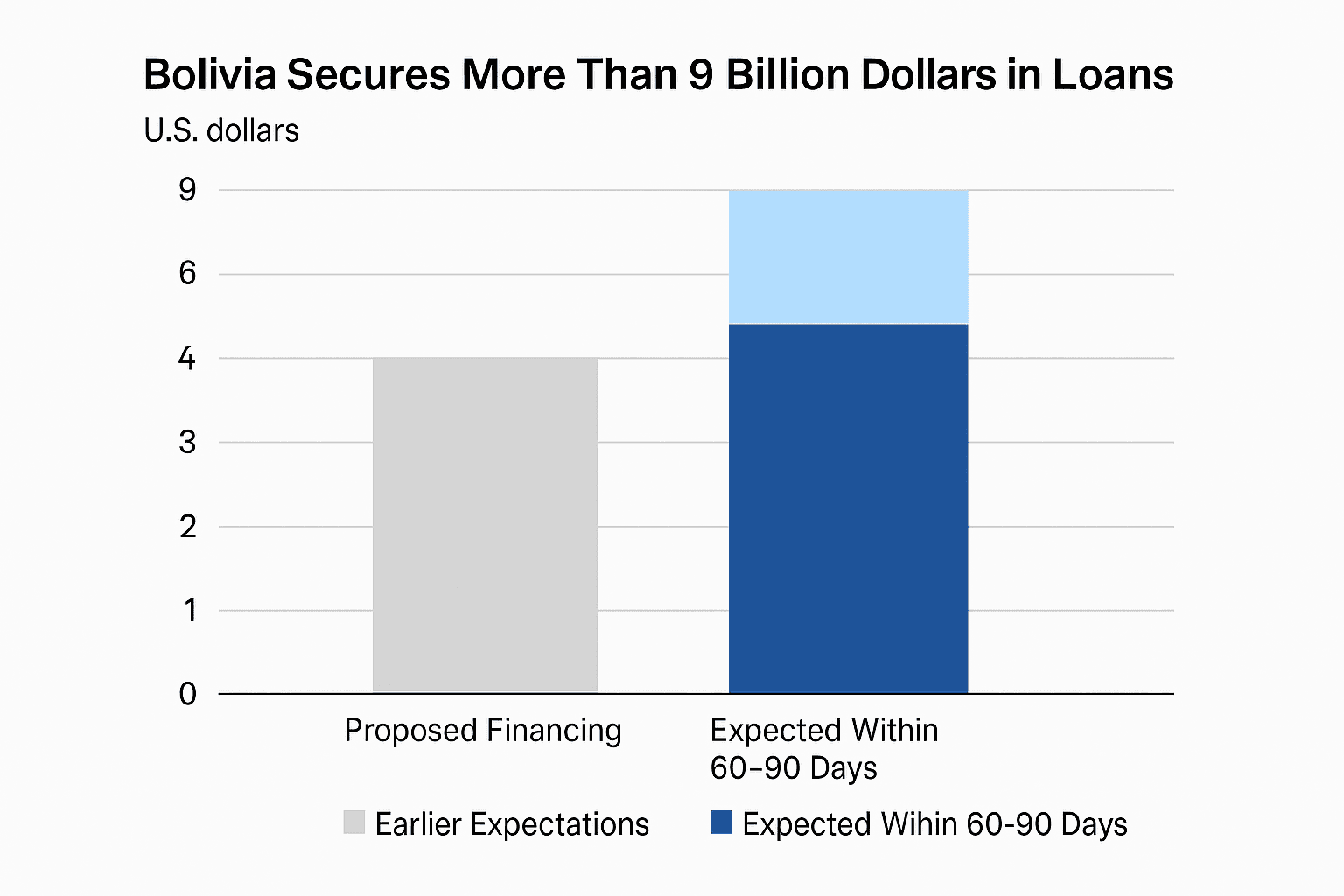

The size of the proposed facility far exceeds earlier expectations of 4 to 5 billion dollars and signals an attempt by the newly sworn in centrist President Rodrigo Paz to buy time while he advances tax and spending changes. Bolivian officials have framed the financing as support for infrastructure, renewable energy and financial inclusion projects, priorities that dovetail with wider regional and global efforts to mobilise investment in sustainable growth.

Bolivia faces acute macroeconomic strains, with high inflation, a widening fiscal deficit and persistent foreign currency shortages that have complicated payments for imports and increased pressure on the boliviano. The new financing is intended to bolster reserves, facilitate lending to the private sector and underpin public investments that could generate jobs and revenue. Officials have portrayed the package as both a liquidity measure and a development instrument to accelerate long deferred projects.

Securing large scale multilateral lending carries political and technical implications. Multilateral lenders commonly attach oversight, reporting requirements and policy benchmarks to reduce credit risk and ensure effective use of funds. For Bolivia, negotiating terms that respect domestic priorities while satisfying international standards will be a central diplomatic task for the Paz administration. The government must also manage domestic expectations, particularly among social constituencies wary of austerity measures and sensitive to any perceived erosion of public spending on social programmes.

Regionally the move will be watched by neighbours and investors as a test of multilateral cooperation in a country that has long depended on commodity exports. Investment in renewable energy aligns with global climate finance trends and could attract additional private capital if projects are structured to international standards. For international lenders, the consortium approach spreads risk and signals coordination at a moment when many Latin American economies face similar pressures.

Implementation risks remain. Rapid disbursement of a large tranche within two to three months will require expedited due diligence and clear project pipelines, while longer term stabilisation depends on credible fiscal adjustment and economic reform. President Paz has proposed changes to taxes and spending, but his ability to secure congressional support and social consent will determine whether the financing translates into durable recovery.

As Bolivia pursues this multilateral package, its leaders must balance urgent macroeconomic needs with inclusive development goals, navigating lender expectations and domestic politics to convert a headline figure into tangible improvements for citizens and the economy.