Brooksville Votes to Exit Firefighters Pension Fund with $3.7M Shortfall

On Jan. 8 the Brooksville City Council unanimously approved the first reading of an ordinance to end the city’s participation in the Firefighters’ Pension Trust Fund, a move that requires resolving a roughly $3.7 million funding gap tied to the city’s share. The decision affects retirees and beneficiaries and places responsibility on the pension board and actuaries to determine final funding mechanics before a final council vote on Jan. 26.

On Jan. 8 the Brooksville City Council voted 4–0 to approve the first reading of an ordinance that would terminate the city’s participation in the Firefighters’ Pension Trust Fund. The measure follows the earlier consolidation of Brooksville’s fire department into Hernando County Fire Rescue and sets in motion a formal process to disentangle the city from the joint pension arrangement.

City officials acknowledged the pension plan is underfunded and estimated that Brooksville’s share would require about $3.7 million to reach full funding. That shortfall is now central to negotiations and actuarial work that must be completed before the question returns to the council for a second reading and final vote scheduled for the Jan. 26 council meeting.

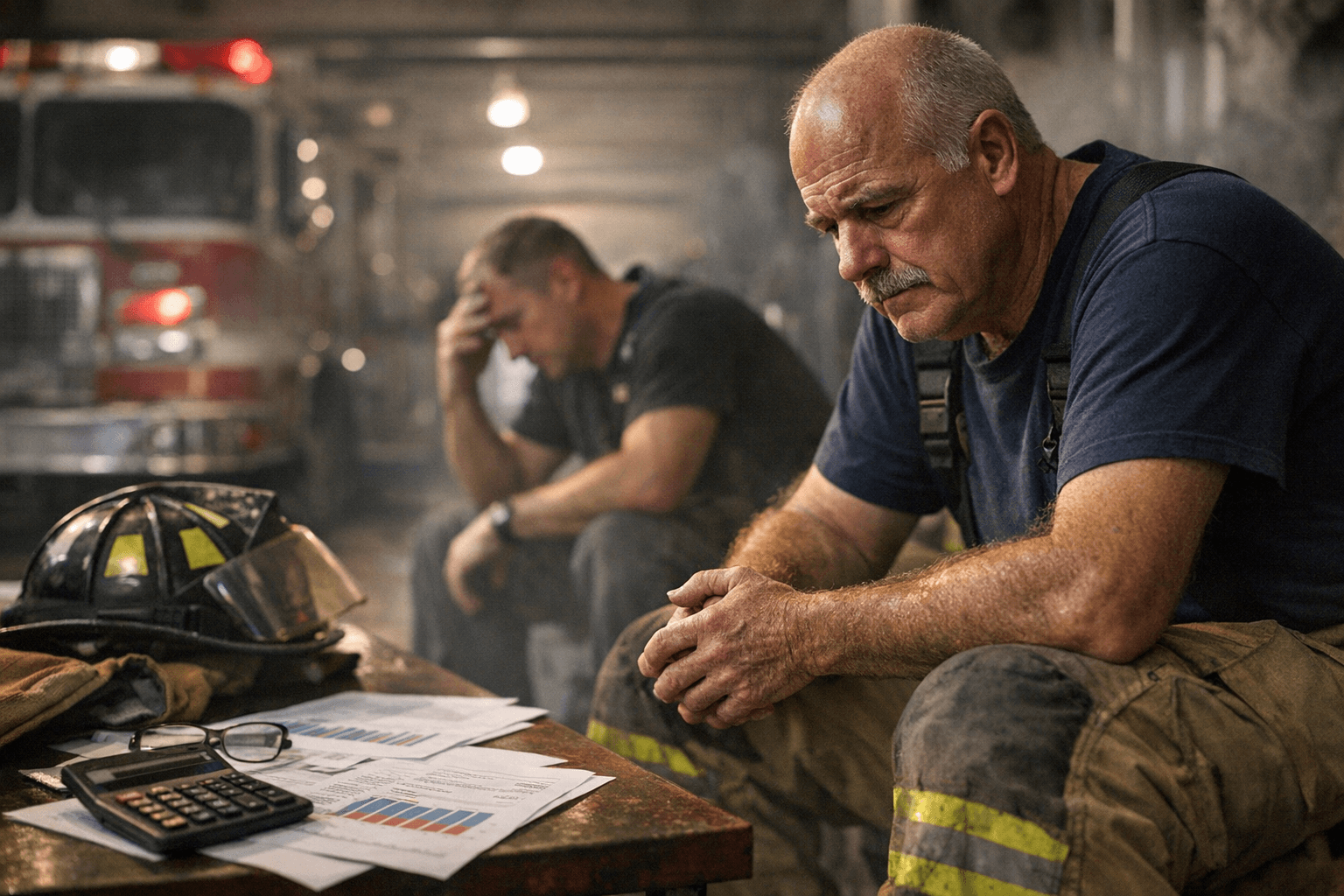

Retirees and current beneficiaries raised concerns at the Jan. 8 meeting about how benefits will be paid going forward and what protections will remain in place during and after the termination process. City leaders urged affected members to consult actuaries and financial planners as the formal funding mechanics are developed. Final determinations on the allocation of liabilities and the timing of any payments will be made by the pension board in consultation with actuaries, according to the city’s outline of next steps.

The council’s unanimous first-reading vote signals municipal intent to exit the trust, but it does not finalize the financial arrangements. Termination of a municipality’s participation in a multi-employer pension requires technical actuarial work to calculate the terminating employer’s residual liability and to establish payment schedules or lump-sum requirements. Those calculations will shape the ultimate fiscal impact on Brooksville’s budget and on the pension fund’s remaining participants.

For local residents and affected retirees, the stakes are both financial and institutional. A multi-million-dollar funding gap could influence future city budgeting decisions, potential service trade-offs, or arrangements between Brooksville and Hernando County. The process also raises questions about transparency and oversight as actuarial recommendations and pension board decisions will determine how beneficiary protections are preserved.

Brooksville residents and those receiving pension benefits should follow the process closely and may attend the Jan. 26 council meeting to hear the final reading and any fiscal details presented at that time. The pension board and actuaries will present the binding mechanics that resolve how the $3.7 million shortfall is handled and how benefits will be secured going forward.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip