Buncombe Property Tax Deadline Nears, Residents Urged to Prepare

Buncombe County officials reminded property owners that the last day to pay 2025 property taxes without interest is Jan. 5, 2026, and urged residents to plan ahead for holiday closures and possible winter weather. The county outlined mailing and payment rules, a relocated tax office in downtown Asheville, processing fees for card payments, and a concurrent general reappraisal that will affect assessed values in January.

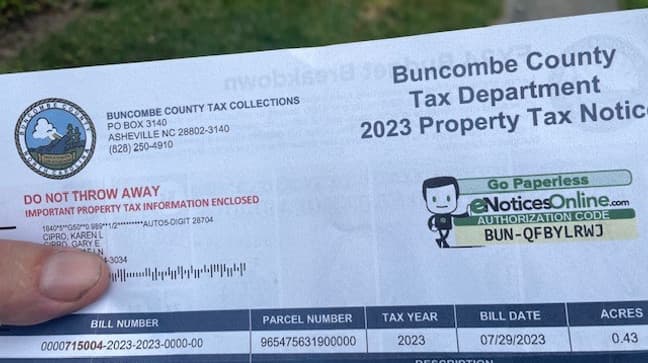

County staff posted notice December 10, 2025 that property owners who have not yet paid their 2025 property tax bill have until Jan. 5, 2026 to avoid penalties and interest. Bills were mailed in August and were originally due Sept. 1, 2025, but the county continues to accept payments through the January deadline without charging interest. Interest will begin to accrue on Jan. 6, 2026.

The notice lays out practical rules for mailed payments. The U S Postal Service postmark date is the date the county will consider a mailed payment received. If a mailed payment arrives without a USPS postmark, the county will use the date it arrives at the tax office. Mail metered by a third party is not considered postmarked by the U S Postal Service, and the postal service recommends stopping by a post office to ensure a same day postmark.

For in person payments the Property Tax Department has moved to 182 College Street in downtown Asheville, located between TD Bank and the county parking deck at 164 College Street. If you park in the county parking deck bring your ticket to the tax office for parking validation. The Tax Collections office will be closed Dec. 24 through Dec. 26 and Jan. 1 for winter holidays.

Residents may pay their bill online, by mail, in person, over the phone, or at a drop off box. Processing fees will be added by the payment processor on all credit and debit transactions, and these fees are not retained by Buncombe County. Credit card transactions will include a 2.35 percent fee and debit card transactions will include a $3.95 fee.

The county also noted that a General Reappraisal is underway and new assessed values reflecting current market conditions will take effect in January 2026. Questions about reappraisal may be directed to buncombenc.gov/myvalueBC or the Property Assessment team at (828) 250-4920. For tax collection questions contact Tax Collection specialists by calling or emailing (828) 250-4910.

Local residents are advised to plan payments early, account for processing fees when choosing a payment method, and allow extra time for mail and holiday closures to avoid unexpected interest charges.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip