Can COP30 Close a 9.4 Billion Dollar Amazon Finance Gap

An edie analysis estimates a 9.4 billion dollar shortfall to fully finance protection of the Brazilian Amazon, raising questions about whether COP30 can marshal the public and private capital needed. The outcome matters for global climate targets, commodity markets, and the economic futures of communities that depend on the forest.

Listen to Article

Click play to generate audio

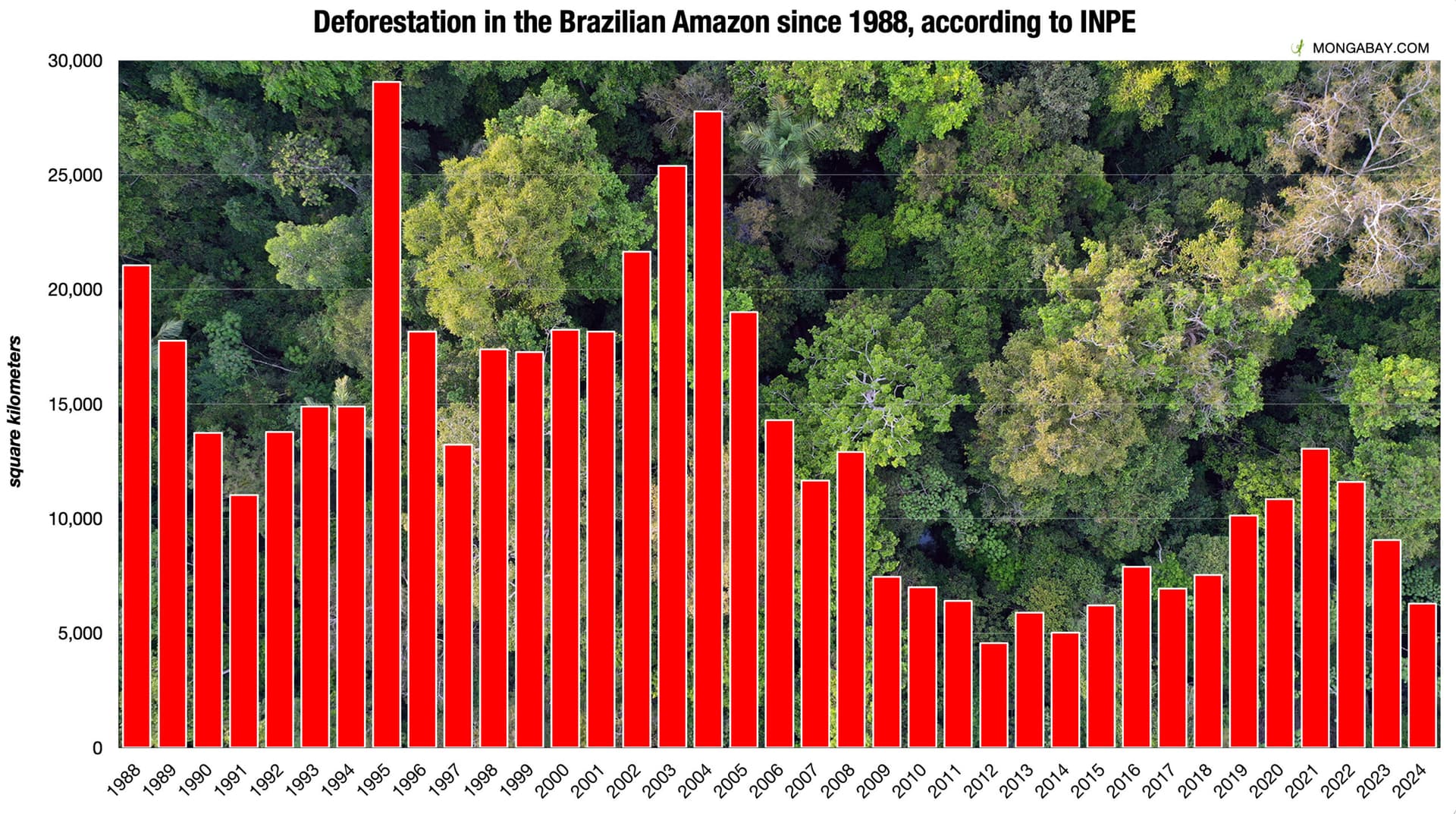

An analysis published by edie on November 14, 2025 highlights a $9.4 billion finance gap for the Brazilian Amazon, placing a spotlight on expectations ahead of COP30 for a package of money and mechanisms to halt deforestation. The figure crystallizes the tension between the scale of conservation needed and the limits of current international climate finance flows, private investment appetite, and domestic policy choices in Brazil.

Closing a multi billion dollar gap will require more than headline pledges. Historically, forest finance has relied on a patchwork of bilateral grants, multilateral climate funds, carbon market transactions and innovative tools such as debt for nature swaps and results based payments. Each of those channels faces practical constraints. Public budgets in donor countries are under pressure, multilateral funds move slowly, and private investors seek clear revenue streams and legal protections before committing large sums to long term conservation projects.

COP30 offers a forum to align incentives and reduce barriers to scaled investment. Negotiators can increase funding through expanded contracts for results based forest protection, clearer rules for integrity in carbon markets, and guarantees or first loss capital to mobilize institutional investors. Policy measures that improve land tenure clarity, strengthen monitoring and enforcement, and integrate forest protection into export country policies would also lower the risk premium for private capital. But none of those steps are automatic, and outcomes at the summit will depend on concrete modalities as well as conditionalities acceptable to Brazil and finance providers.

Market implications are broad. A credible package that channels $9.4 billion into verified forest protection could tighten global commodity supply chains, particularly soy and beef, by reinforcing zero deforestation sourcing requirements and increasing costs for actors that cannot demonstrate compliance. That would affect prices, trade flows and corporate risk assessments. Conversely, a failure to close the gap would perpetuate investor concern about regulatory and reputational risks in Amazon facing sectors, potentially increasing financing costs for agribusiness and infrastructure projects tied to deforestation.

Beyond markets, the finance gap reflects a distributional challenge. The Amazon is both a global public good and a source of livelihoods for indigenous peoples and local communities. Effective finance will need to support local stewardship through direct payments for ecosystem services, technical assistance and inclusive governance mechanisms. Otherwise, funds that are purely transactional risk delivering short term results without addressing the structural drivers of land conversion.

The clock to COP30 leaves limited runway for technical negotiations on carbon integrity, blended finance structures and bilateral commitments that together could approach the $9.4 billion figure. International cooperation will also need safeguards to ensure transparency and measurable outcomes. Absent a credible pipeline of investable projects and enforceable contracts, pledges are unlikely to translate into on the ground protection.

The conversation launched by the edie analysis underscores that money alone will not be enough. Closing the finance gap requires a coherent mix of scaled public funding, mobilized private capital, robust metrics for forest outcomes and domestic reforms that align local incentives with global climate goals. For delegates at COP30, the task will be to turn those finance building blocks into operational deals that can be implemented at scale and measured over time.

Separately, edie will convene sustainability and net zero leaders at edie 26 in London on March 25 and 26, 2026 to explore practical climate action, a forum where finance for nature is expected to figure prominently.