Candy Makers Replace Real Chocolate as Cocoa Prices Soar

Facing rising cocoa costs driven in part by climate shocks, major candy makers are increasingly swapping real chocolate for cheaper substitutes — a shift that could reshape product formulations, farmer incomes and consumer expectations. The move highlights how climate-driven commodity stress is forcing both supply-chain adjustments and policy debates about sustainability and food standards.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Candy companies are quietly altering what goes into familiar treats as cocoa markets feel mounting pressure from climatic disruption. Faced with tighter supplies and higher raw-material costs, some manufacturers are turning to compound coatings and vegetable fat blends that mimic chocolate’s texture and flavor while avoiding the full cost of cocoa butter and chocolate liquor.

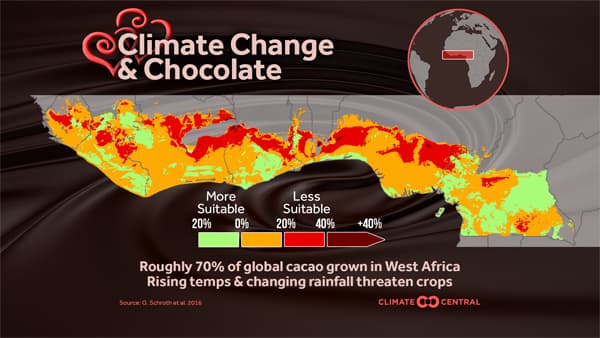

Cocoa production is concentrated: roughly two-thirds of the world’s cocoa comes from Ivory Coast and Ghana, where increasing temperatures, erratic rainfall and pest pressures have reduced yields and raised production risk. Studies tracking the industry's long-term outlook suggest climate change could shrink the land suitable for traditional cocoa cultivation substantially over the coming decades, forcing a structural tightening of supply even as demand for chocolate rises in China, Southeast Asia and other emerging markets.

The price signal has been noticeable. Cocoa has been volatile and reached multi-year highs over recent years, driving up input costs for confectioners already grappling with broader food inflation. For many companies, particularly makers of mass-market confections and seasonal candies, reformulating products with cocoa butter equivalents or full vegetable-fat coatings preserves margins and keeps shelf prices stable for consumers. Private-label supermarket brands and bargain-priced confections are most likely to shift ingredients first, industry analysts say, while premium chocolatiers generally resist substitution to protect brand identity.

Substitutes are not without controversy. Cocoa butter equivalents often rely on oils such as palm oil, which carries its own sustainability baggage because of links to deforestation and biodiversity loss in producer countries. Replacing cocoa also raises questions about nutrition and labeling: when a bar or coating no longer contains a specified level of cocoa solids, regulators and consumers may demand clearer disclosure and potentially new categories on packaging. Markets differ. Some jurisdictions have long allowed vegetable fats in chocolate under defined labeling rules; others preserve a stricter definition of “chocolate,” complicating multinational product strategies.

The shift has important implications for farmers and for climate and trade policy. In the near term, higher cocoa prices can boost farmer incomes, but volatility and long-term yield volatility can undercut investment in sustainable farming practices. Cocoa smallholders, who depend on annual harvests, face increased exposure to extreme weather events and pests at the same time they are being asked to adopt agroforestry, shade-growing and new, more resilient plant varieties — changes that require capital and extension support.

Policymakers and industry groups face a choice between short-term cost management and long-term supply stabilization. Investment in research on climate-resilient cocoa varieties, expanded extension services, and financing for producer adaptation could reduce the incentive to substitute away from cocoa while strengthening rural incomes. At the same time, clearer labeling standards and corporate commitments to avoid swapping cocoa for environmentally destructive oils would address consumer and conservation concerns.

For shoppers, the practical takeaway is simple: some candies may taste different or list alternative fats on the ingredient panel in coming seasons. For the broader economy, the trend is a reminder that climate change can operate through commodity markets to alter everyday products, corporate strategies and rural livelihoods — and that mitigation and adaptation investments remain central to maintaining both supply and quality in the global food system.

%3Amax_bytes(150000)%3Astrip_icc()%2FWarren-Buffet-berkshire-hathaway-9a0292ce51ba4f44ac3dd940d01af096.jpg&w=1920&q=75)