Chicago Fed Estimates U.S. Unemployment Held at 4.3% in September

The Federal Reserve Bank of Chicago's "real-time" model estimates the U.S. unemployment rate at 4.3% for September, unchanged from August, giving markets a provisional read amid a delayed official jobs report. With the Bureau of Labor Statistics release stalled by a government shutdown, this estimate could sway short-term market pricing and Federal Reserve deliberations on future interest-rate moves.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

The Federal Reserve Bank of Chicago published a "real-time" estimate on Thursday indicating that the U.S. unemployment rate likely remained at 4.3% in September, the same level recorded in August. The bank said its model, designed to produce timely labor-market indicators when official data are unavailable, offers a provisional lens on employment conditions now that the Bureau of Labor Statistics' monthly payrolls release has been delayed indefinitely by the federal government shutdown.

"The Chicago Fed's real-time estimate indicates the unemployment rate was 4.3 percent in September," the regional bank said in its note, underscoring the gap left by the paused BLS schedule. The shutdown, the 15th since 1981, has forced market participants and policymakers to rely on alternative gauges and private-sector surveys to assess the health of the labor market.

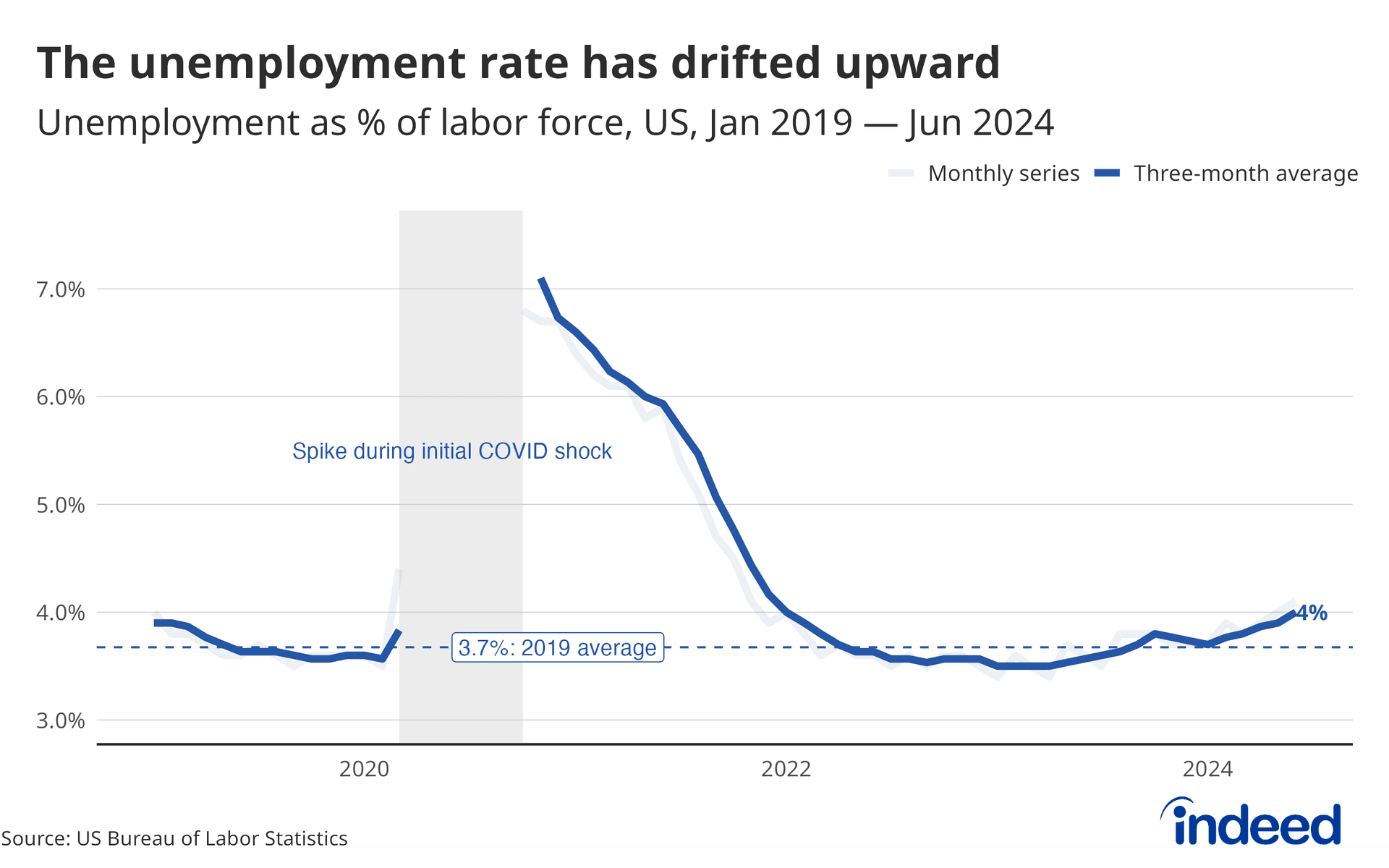

The timing matters. The Federal Reserve eased policy at its last meeting, cutting its policy rate by a quarter percentage point after a period in which job gains slowed sharply and the unemployment rate ticked up in August. With the central bank repeatedly emphasizing a data-dependent approach, a steady unemployment reading for September would suggest continued cooling in labor-market momentum but still a level historically low compared with the pandemic-era peak of 14.8% in April 2020.

For markets, the Chicago Fed estimate could temporarily substitute for the official BLS print in shaping expectations for the path of interest rates. Investors and traders often look to payrolls and the unemployment rate to gauge wage pressures and inflation persistence; in the absence of BLS figures, short-term moves in Treasury yields, stock futures and Fed funds futures may be more sensitive to these alternative indicators. Economists caution, however, that model-based estimates carry more uncertainty than the comprehensive BLS survey, which captures both household and establishment data.

Policy makers face a delicate calculus. A labor market that is cooling but not collapsing can give the Fed room to pause further rate cuts while monitoring inflation trends. If September's underlying data—once released—confirm weaker job gains and steady unemployment, the Fed could interpret that as evidence that prior tightening is still moderating labor-market tightness, reducing near-term pressure to cut rates further. Conversely, stronger-than-expected underlying payroll numbers would complicate arguments for additional easing.

Beyond the immediate tactical implications, the episode highlights a longer-term challenge for economics: maintaining real-time situational awareness when official statistical releases are disrupted. Central banks, asset managers and corporate planners increasingly rely on nowcasting models and private data to fill gaps, but those tools are complements rather than substitutes for the comprehensive household and employer surveys run by the BLS.

Until the government resumes normal operations and the BLS publishes its monthly report, policymakers and markets will be left to weight estimates like the Chicago Fed's alongside other indicators. For now, the headline — a steady 4.3% unemployment rate — suggests a labor market that is cooling but still considerably stronger than the depths of the pandemic recession, a dynamic that will remain central to the Fed’s outlook on inflation and the economy.