China Soybean Purchases Lift U.S. Prices, Spur Farmer Selling

Confirmed U.S. soybean sales to China this week marked the largest in more than two years, lifting futures and prompting farmers who had been holding supplies to move them to market. The shift tightened near term balances, raised the U.S. premium over Brazil, and left traders watching for Chinese confirmation and the pace at which shipments will be taken.

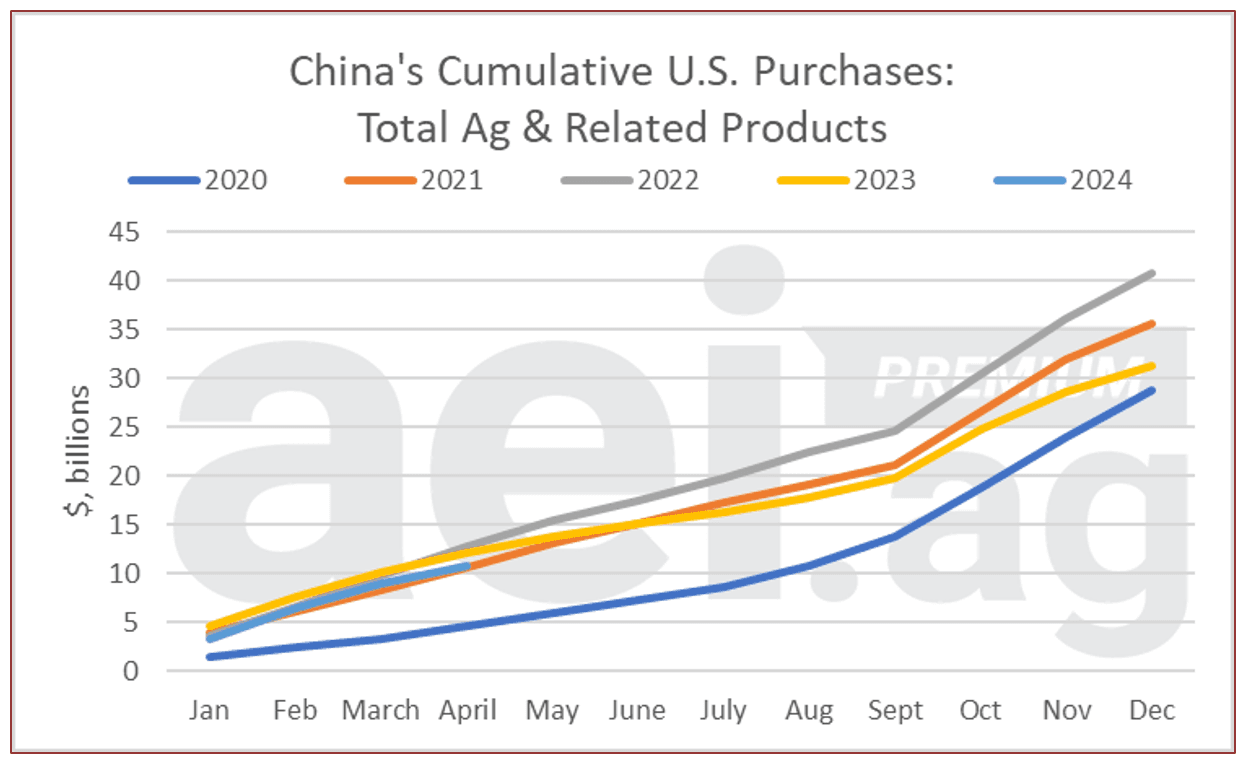

U.S. soybean markets rallied after the Department of Agriculture logged about 1.584 million tonnes of confirmed sales to China over three days, the largest single week of sales since late 2023. U.S. officials said Beijing had agreed to buy up to 12 million tonnes by the end of the year, although Chinese authorities had not formally confirmed the full volume. The sales announcement on November 21 pushed Chicago Board of Trade soybean futures to their highest levels since June 2024 and widened the price advantage for near term U.S. shipments over Brazilian supply.

The immediate market reaction was visible across cash markets and farmer behavior. Grain elevator managers and merchandisers reported a jump in offers from growers who had been carrying soybeans in expectation of higher prices. That selling released physical supplies into the market, strengthening basis bids in key Midwestern states as processors and exporters competed to secure cargoes. The influx of farmer material will help clear stocks more quickly than had been expected, but market participants cautioned that the overall tightening of availability for prompt shipments could persist while export logistics are sorted.

Traders noted that the U.S. premium to Brazil rose after the sales, reflecting a squeeze on available U.S. exportable supplies for immediate shipment. Brazil remains the world s largest soybean supplier, and its producers and exporters are likely to respond to the new pricing environment. Freight costs, seasonal harvest timing in South America, and vessel slot availability will all figure into how quickly Brazilian shipments can substitute if Chinese buyers accelerate purchases beyond current confirmations.

A central uncertainty is how and when China will accept the agreed volumes. Past large purchases have sometimes been followed by staggered lifting schedules as buyers manage domestic inventories and feed needs. Market analysts warned that if China draws heavily on its national reserves or delays lifting domestic holdings, the pace of U.S. shipments could slow, muting the price impulse over time. U.S. officials and traders are watching for formal Chinese confirmations and for details on the timetable for deliveries.

The episode has wider implications for farm income and planting decisions. Stronger late season prices can boost cash flow for producers and influence oilseed planting intentions for 2026. For processors and meat producers that rely on soybean meal for feed, a sustained price rise would increase input costs and could filter into animal protein margins. For consumers, effects are likely to be indirect and gradual, transmitted through feed costs and oilseed processing chains.

Policy matters are also in focus. The role of government held reserves and the mechanics of clearing them to make room for new imports will be important determinants of how quickly cargoes can be loaded. The surge in confirmed sales suggests a temporary shift toward tighter near term supply conditions, but the ultimate market balance will depend on Chinese confirmation of the full volume, the speed of deliveries, and responses from South American exporters. In the coming weeks, USDA weekly export sales announcements and shipping manifests will be closely watched as the market seeks clarity on how durable this rally will be.