China to Require Export Permits for Electric Vehicles in 2026

Beijing announced a new export-permit regime for electric vehicles and related equipment that will take effect in 2026, a move aimed at tightening oversight of a rapidly expanding industry. The policy could slow shipments, raise compliance costs and reshape where Chinese automakers build cars overseas, with significant implications for global EV markets and supply chains.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

China will require export permits for electric vehicles and closely related products beginning in 2026, a regulation intended to give Beijing greater control over the country’s fast-growing new-energy vehicle (NEV) industry and the technologies that underpin it. The measure, disclosed on Friday by state authorities and reported by Bloomberg, marks a notable tightening of trade oversight as Chinese firms push deeper into Europe, Southeast Asia, Latin America and Africa.

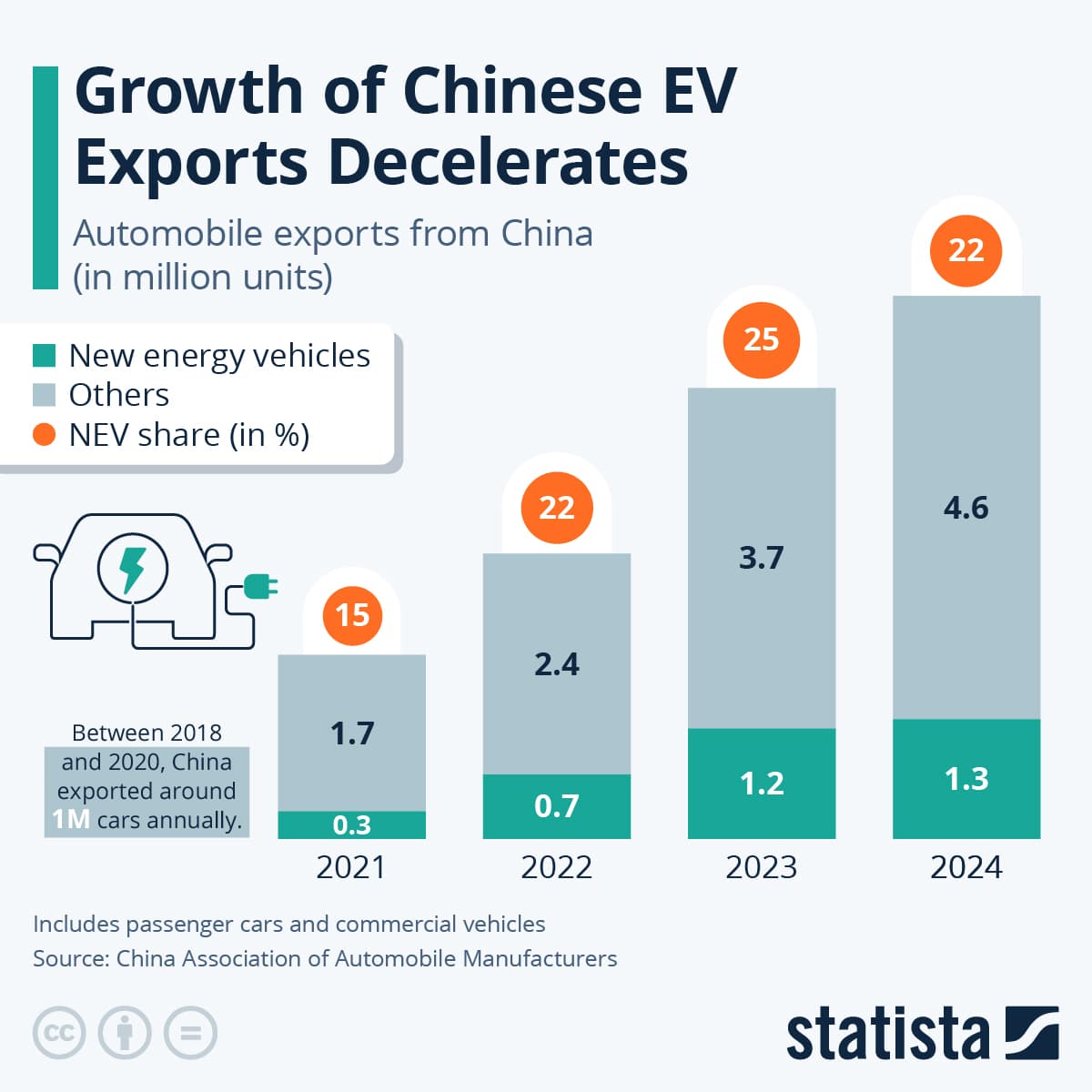

The permit system is designed to cover finished EVs and certain components, industry officials said, reflecting concerns that rapid export growth without stronger supervision could expose China to technology leakage, data-security risks and uneven product standards abroad. The announcement comes against a backdrop of explosive expansion: Chinese automakers have moved from peripheral players to dominant exporters in several overseas markets over the past few years, with NEV shipments abroad having increased severalfold since 2020.

Beijing framed the step as standard regulatory housekeeping to ensure safety and compliance. In statements accompanying the change, trade regulators emphasized that the permits will streamline cross-border supervision and align export practices with national security and industrial policy goals. Analysts, however, warn that the new rules will impose fresh administrative burdens on exporters and could add frictions at a delicate moment for global auto supply chains.

“This is not an outright ban, but it raises the cost and complexity of exporting, especially for smaller brands,” said a Beijing-based auto industry analyst. “Larger firms with established foreign networks and legal teams will adapt more quickly, which could accelerate consolidation in the sector.”

Market implications are immediate. Chinese manufacturers including BYD, SAIC and Geely have been racing to capture share in European and emerging markets by offering lower-cost EVs and rapidly expanding local dealer networks. Export permits will likely introduce lead times for shipping, add compliance-related costs and create uncertainty for overseas distributors that have been relying on steady deliveries. That uncertainty could encourage more onshore production: automakers may accelerate investments in factories abroad—already visible in regions such as Southeast Asia, Brazil and Eastern Europe—to avoid export restrictions and localize supply chains.

The policy arrives amid rising scrutiny of China’s industrial support for EV makers from Western capitals. European and U.S. officials have increasingly scrutinized subsidies, safety standards and the role of Chinese state-linked suppliers in battery and semiconductor supply chains. By asserting regulatory control, Beijing seeks to balance two competing objectives—maintaining rapid export-driven growth while ensuring perceived strategic safeguards.

In the longer term, the permit regime may alter the geography of EV production. If compliance costs remain material, expect greater foreign direct investment by Chinese firms into overseas assembly and component plants, and a renewed push to build out localized battery and chip production. For global markets, the move could both slow the pace of inexpensive EV imports in some countries and prompt price volatility as dealers and buyers adjust.

Investors and policymakers will be watching administrative guidance due over the coming months, which will clarify the categories covered, fee structures and timelines. Until then, dealers, logistics providers and smaller Chinese marques face a period of uncertainty that could reshape competition in the world’s fastest-growing segment of the auto industry.