China’s Rare Earth Stranglehold, U.S. Faces Long Road to Parity

China controls the lion’s share of the rare earths supply chain, leaving automakers and policymakers grappling with persistent vulnerabilities that cannot be solved by quick fixes. The gap reflects decades of investment, lower costs, and an integrated processing network, meaning the United States may be able to diversify but not quickly replicate China’s dominance.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Global electric vehicle and clean energy ambitions have sharpened attention on a little known group of 17 elements that are essential to permanent magnets, catalysts, and defense systems. China now dominates not just mining but the refining and separation that turn ore into the high purity materials needed by electric motors and advanced electronics, creating a supply chain bottleneck that late movers face for years.

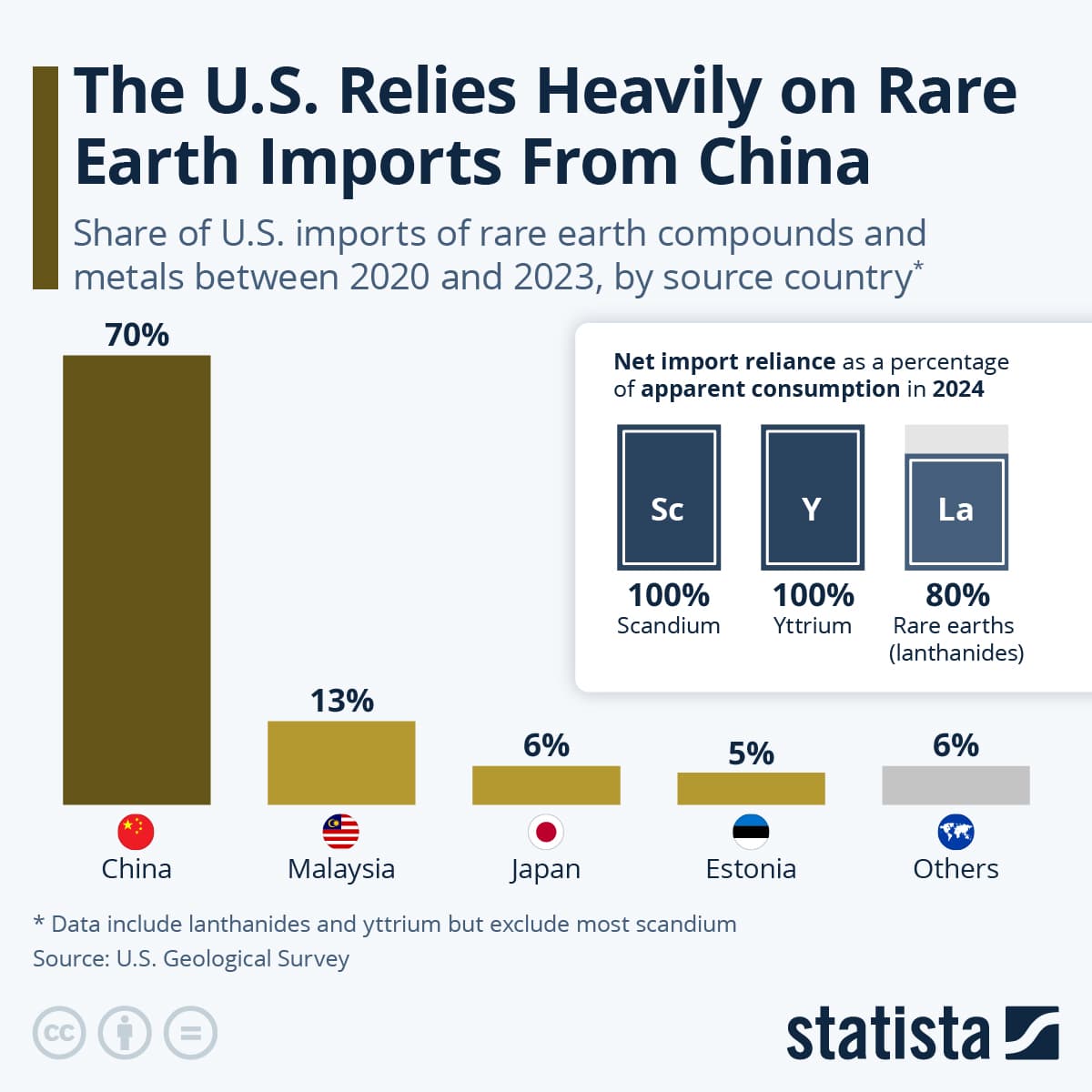

Industry data and government assessments indicate China supplies roughly 70 to 90 percent of processed rare earths and commands an even larger share of separation and refining capacity. That concentration developed over decades as Chinese firms built integrated facilities that capture economies of scale, and operated under regulatory and cost structures that made large scale processing economically viable. Outside China, few sites can take ore through the full value chain to produce the neodymium, praseodymium, dysprosium and terbium that high performance magnets require.

The United States has moved to reduce that dependence. Federal incentives under the Inflation Reduction Act and targeted Defense Department spending have mobilized private capital and accelerated projects from miners and newcomers. U.S. mines have restarted production, and companies from Australia, Japan and Europe are investing in alternative supplies and processing capacity. But policymakers and industry officials acknowledge the limits of speed. Building separation plants and magnet manufacturing requires complex chemical processing, rigorous environmental permitting and specialized labor, all of which raise costs and timelines.

For automakers the implications are immediate. Permanent magnets used in many electric motors rely on specific rare earths that are not readily substitutable without trade offs in efficiency and range. Supply disruptions or price spikes would add to the inflationary pressure on vehicle costs and could complicate model planning and sourcing strategies. Some manufacturers are already redesigning motors to reduce reliance on certain elements, while others are signing long term offtake agreements and investing in upstream projects to secure inventory.

Market reactions reflect this reality. Companies tied to alternative supplies have attracted capital and seen valuations rise as investors price in the strategic value of redundancy. At the same time commodity markets for rare earths remain prone to volatility, because production changes by a handful of plants can swing global output materially.

Policy choices will matter over the long run. The United States can narrow the gap by sustaining financial support, streamlining permitting, and fostering ties with like minded supplier countries. Yet even with aggressive policy, analysts expect a multi year trajectory for meaningful diversification rather than rapid parity. The durable advantage for China rests on a scale of processing, a mature industrial ecosystem and cost structures that are not easily matched.

The broader economic lesson is that strategic materials are as much an industrial policy challenge as a market one. The race to electrify transport and decarbonize energy systems will keep rare earths at the center of geopolitical competition, driving continued investment and regulatory focus. For U.S. industry and policymakers, the practical priority is resilience, not full replication, because closing a gap forged over decades will require patience, capital and sustained coordination across public and private actors.