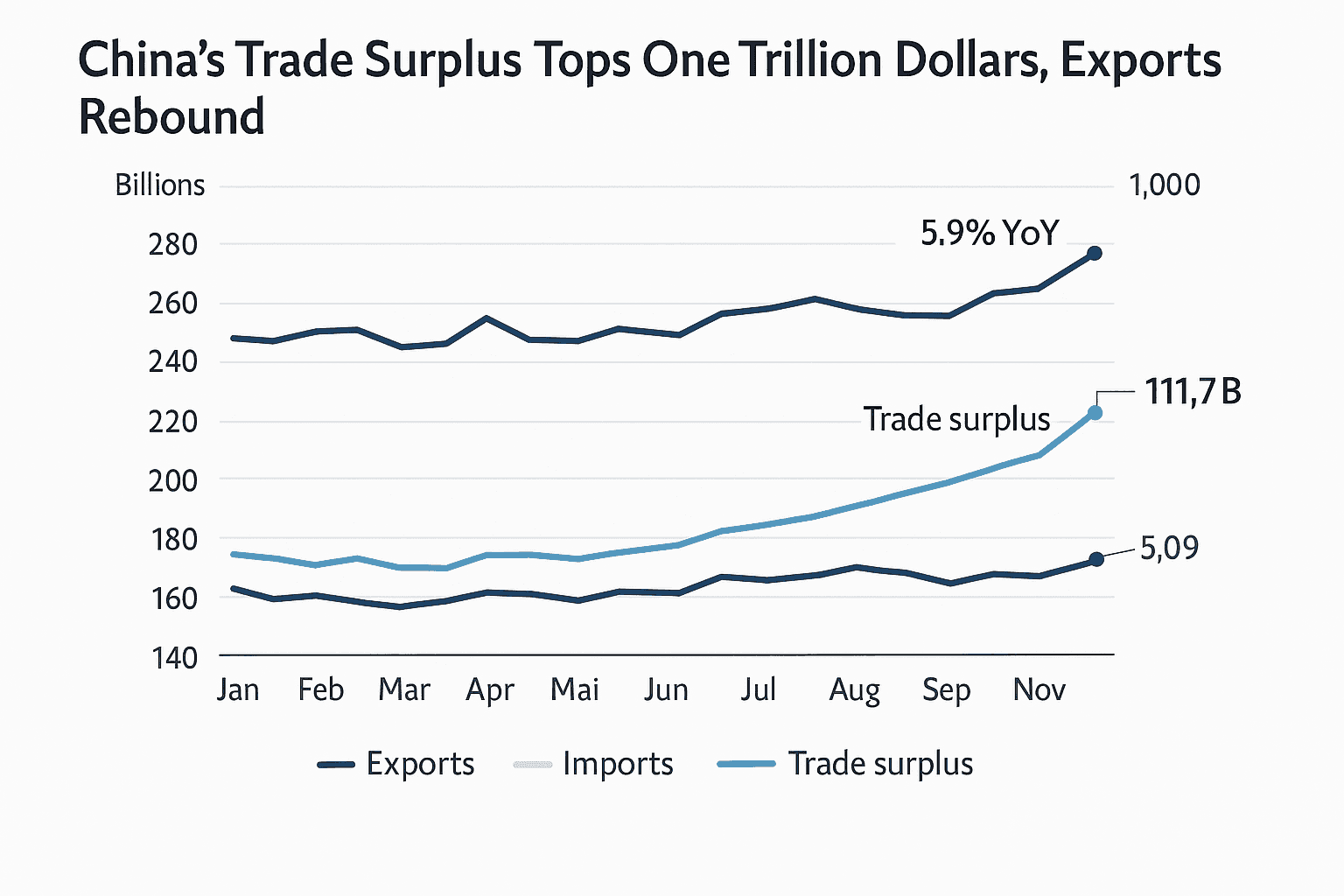

China’s Trade Surplus Tops One Trillion Dollars, Exports Rebound

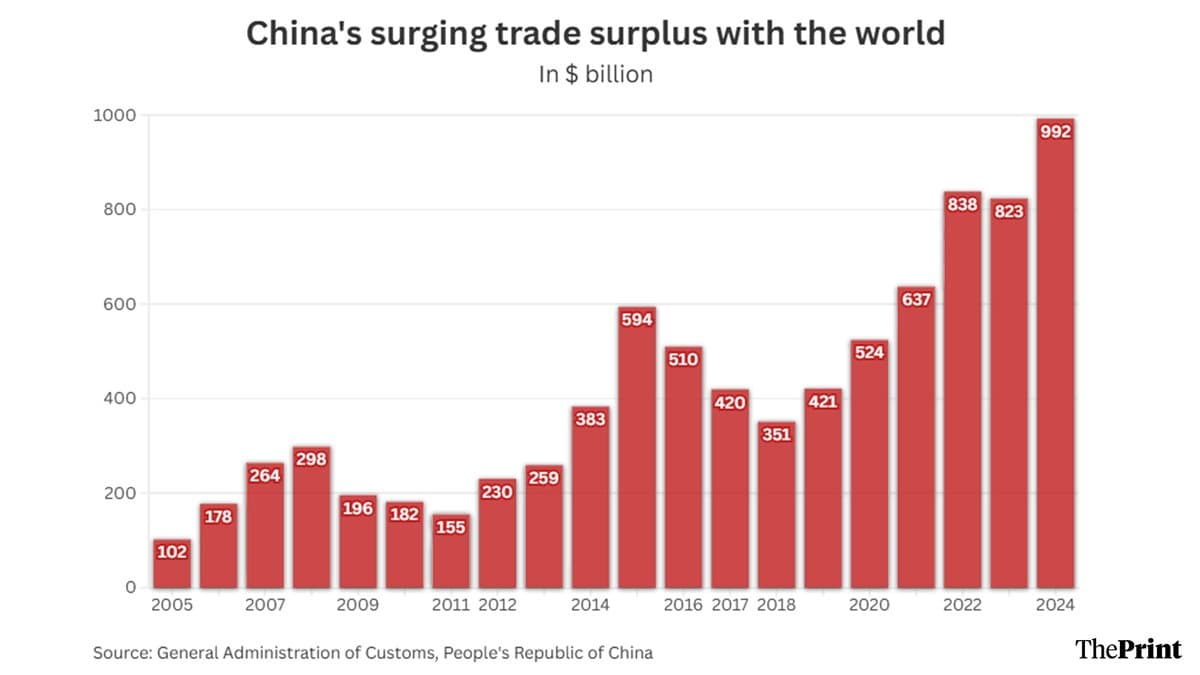

China reported a surprise rebound in exports in November, with shipments rising 5.9 percent year on year and driving the country’s goods trade surplus above one trillion dollars for the first 11 months of 2025. The data underscores Beijing’s growing reliance on foreign demand amid weak domestic consumption, and it will sharpen scrutiny from trading partners and policymakers worried about widening imbalances and geopolitical friction.

China's customs authorities reported on December 8 that exports rebounded 5.9 percent year on year in November, reversing a contraction in October and helping push the country's goods trade surplus above one trillion dollars for the first 11 months of 2025. November alone registered a monthly surplus of about $111.7 billion, a level that reinforces the scale of external demand for Chinese manufactured goods even as domestic demand remains subdued.

The export recovery was driven largely by shipments to markets outside the United States. Exports to the United States fell roughly 29 percent year on year amid tariff measures, according to the customs data, while sales to the European Union, Australia and Southeast Asia rose strongly. High value sectors played a notable role in the rebound, with ships, semiconductors and autos cited as key contributors to November's outperformance.

Imports climbed only modestly, up 1.9 percent in November, reflecting continued weakness in domestic consumption and investment. That muted import trajectory highlights ongoing headwinds inside China, including a troubled property sector that has constrained demand for commodities and intermediate goods. The combination of robust exports and soft imports widened the trade surplus and kept external flows a crucial source of growth for the economy.

Market participants and policymakers will parse the data for implications across several fronts. For global goods markets, the shift in trade patterns suggests supply chains remain geared toward Chinese production even as geopolitical rivalry prompts some buyers to diversify. For currencies and capital flows, an enlarged trade surplus can put upward pressure on the renminbi and complicate Beijing's efforts to manage cross border liquidity without triggering political backlash from trading partners.

Analysts and foreign governments cautioned that a swelling surplus could inflame trade and geopolitical tensions as China pivots to diversify export destinations while trying to balance slower domestic demand. The data is likely to be closely watched in capitals that have already signaled concern about uneven trade balances and the strategic implications of critical technology flows.

Domestically, the numbers add urgency to policymakers' longstanding task of reorienting growth toward consumption. Weak import growth and a property sector that continues to weigh on investment suggest fiscal and monetary authorities may face renewed pressure to deploy targeted measures to shore up demand. At the same time, the strength in advanced manufacturing exports such as semiconductors and autos points to a longer term shift toward higher value production that could sustain trade competitiveness even as global tensions reshape sourcing decisions.

China's November trade performance thus presents a complex policy picture. It delivers short term headline strength, but it also amplifies structural challenges for rebalancing the economy and raises the geopolitical stakes for Beijing and its trading partners going into 2026.