Cohere CEO Says U.S. and Canada Hold Edge in Global AI Race

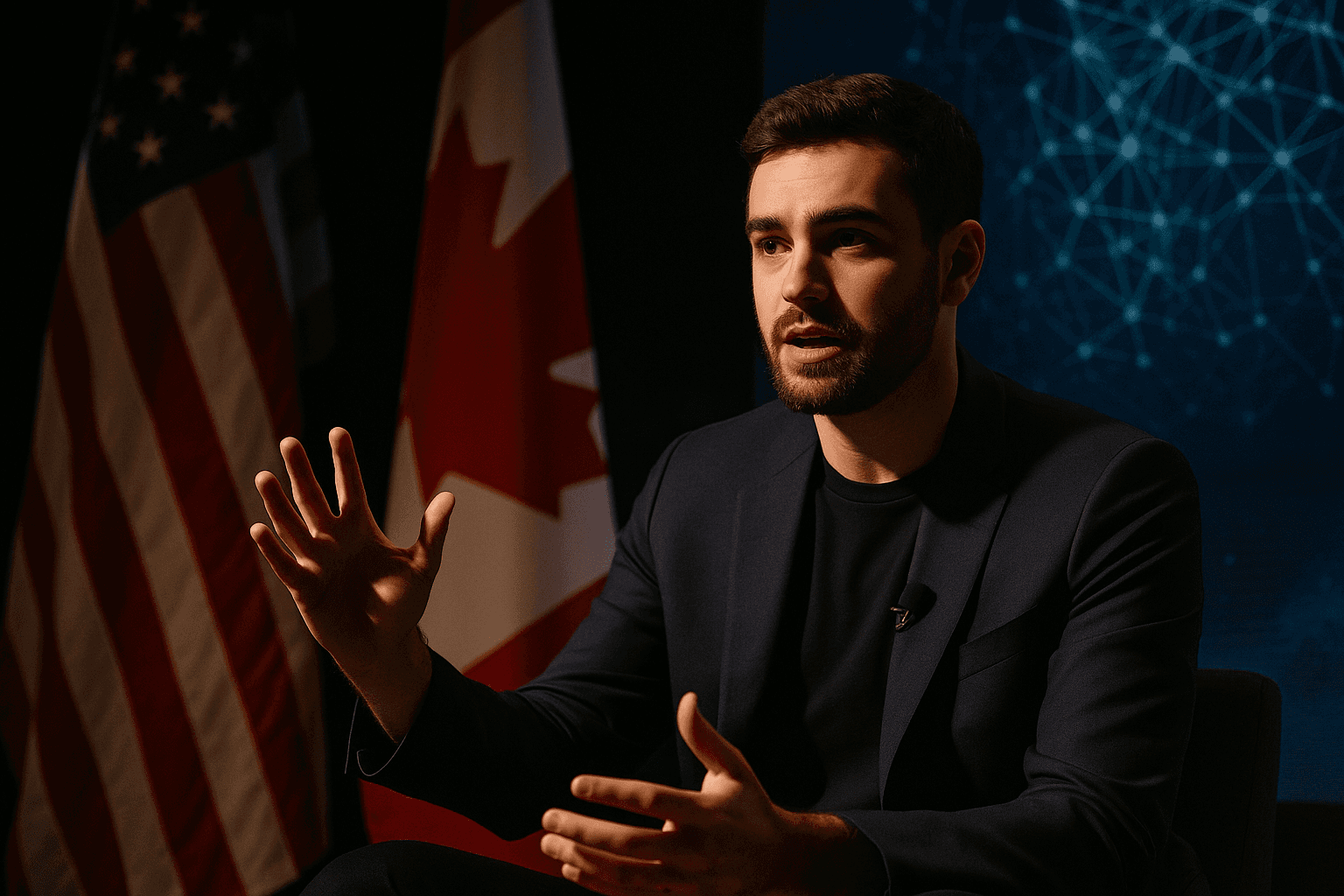

Speaking at Reuters NEXT in New York, Cohere CEO Aidan Gomez argued that the United States and Canada are strategically positioned to lead global AI adoption because of their ability to commercialize and partner internationally, not solely because of model performance. His remarks underscore a widening debate over export controls, technology policy, and what capabilities will decide which nations become primary providers of AI services.

At Reuters NEXT in New York on December 4, 2025, Cohere CEO Aidan Gomez laid out a case that the balance of power in artificial intelligence will be decided less by raw model metrics and more by which countries and companies can scale commercialization and form global partnerships. Gomez acknowledged the technical strength of Chinese models, but said that being the vendor of choice for enterprise services and applications is the decisive factor in market leadership.

Gomez argued that larger models are encountering diminishing returns, and that this economic reality is shifting attention toward targeted deployments that solve specific business problems. The focus, he said, should be on delivering reliable, scalable services to governments and corporations rather than pursuing ever larger model scale as an end in itself. That perspective reframes competition from a race for model size to a contest over productization, integration, and international market access.

The comments come amid a heightened policy fight over AI and semiconductors. Western governments have enacted or proposed export controls on advanced chips and other technologies amid concerns about strategic competition with China. Those controls aim to limit China’s ability to produce cutting edge hardware for large AI models, but Gomez’s remarks suggest that a broader ecosystem advantage may reside with countries that can integrate models into commercial offerings and global cloud infrastructure.

Industry observers say commercialization involves more than sales. It requires regulatory compliance, data governance, trusted partnerships, local support and long term service relationships. Those are areas where companies based in the United States and Canada have deep experience selling enterprise software and cloud services abroad, a capability that Gomez highlighted as a structural advantage that can translate into market share even when rivals produce technically competitive models.

Gomez also pushed back against dystopian narratives about near term catastrophic AI risk, portraying such scenarios as increasingly disconnected from day to day industry priorities. He emphasized the practical tradeoffs that businesses face when deciding where to deploy AI, from cost and latency to data privacy and the need for explainability in regulated sectors. Those considerations, he suggested, will shape corporate and government purchasing decisions more than speculative futures about runaway systems.

The debate over who will dominate AI goes beyond geopolitics and economics. If Gomez is correct, the winners will be determined by which firms can combine technological capability with regulatory savvy and operational scale. That has implications for policymakers weighing export controls, for companies planning where to invest their engineering and sales forces, and for governments that must decide how to foster domestic ecosystems without isolating industries from international markets.

As nations refine strategies to promote research, protect infrastructure and regulate use, the question of whether competitive advantage rests with model inventors or service integrators will shape both commercial strategy and public policy in the years ahead.