Conforming Loan Limit Rises to 832,750, Broadening Seminole Market

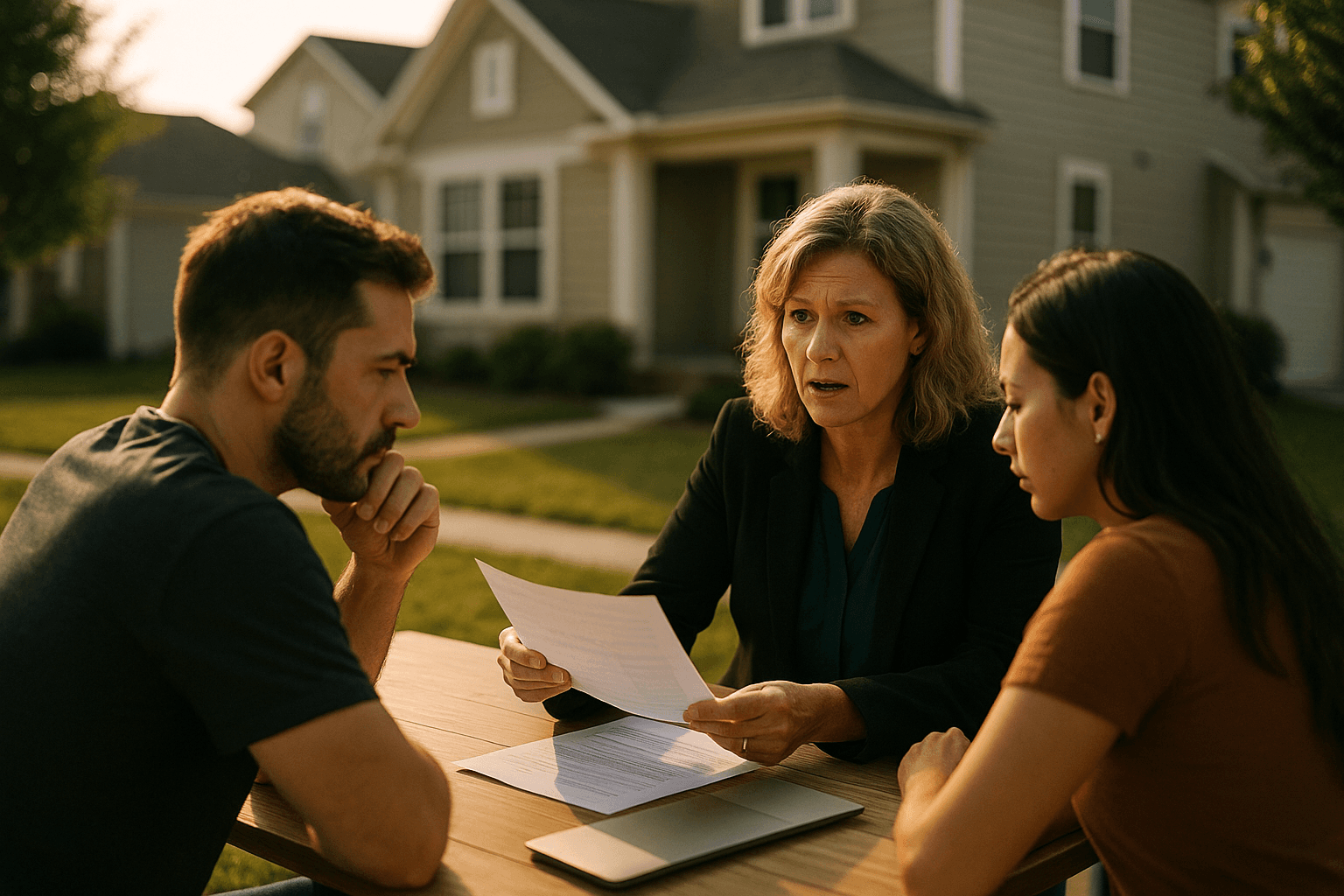

The Federal Housing Finance Agency raised the 2026 conforming loan limit to 832,750, a change that will allow more Seminole County buyers to qualify for lower cost mortgage options. Certified Mortgage Advisor Laura Meyers says the increase expands buying power and helps borrowers avoid the stricter requirements of jumbo financing.

On December 11, 2025 the Federal Housing Finance Agency raised the national conforming loan limit for 2026 to 832,750. The adjustment means a larger share of mortgages in Seminole County and Central Florida will meet the criteria for purchase by the major government sponsored enterprises, preserving access to cheaper and more standardized financing for many buyers.

“This increase is a game changer for buyers who want to stay within conforming guidelines and avoid the added requirements of jumbo financing,” said Laura Meyers of The Mortgage Firm. “It expands the buying power of many clients who were previously capped by lower limits.” Meyers, a Certified Mortgage Advisor, advised that the new ceiling will let many purchasers remain in the conforming category and access lower cost mortgage options and lower down payment thresholds compared with jumbo loans.

For Seminole County buyers this matters in practical terms. Loans that meet conforming guidelines typically offer more predictable underwriting and greater liquidity in the secondary mortgage market. That translates into lower loan pricing and more flexible product options for borrowers who would otherwise need jumbo loans that carry higher rates and stricter qualification standards. Sellers can also see an indirect benefit as a larger portion of prospective buyers may now qualify for financing under conventional programs.

From a policy perspective the FHFA reviews limits annually to reflect housing market conditions, and this increase is part of a broader trend of rising ceilings in response to higher home values. The move preserves the role of Fannie Mae and Freddie Mac in absorbing a substantial share of mortgage risk, which supports overall market stability and affordability. Locally lenders and real estate professionals will need to update eligibility models and borrower counseling to reflect the new threshold.

Homebuyers in Seminole County who were previously priced out of conforming markets should consult mortgage professionals to assess whether the higher limit changes their financing options. Lenders, appraisers, and real estate agents can expect modest shifts in demand for conforming product offerings as buyers respond to the expanded loan ceiling.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip