Copper’s Quiet Power: The Overlooked Commodity Driving the AI Era

As artificial intelligence, electric vehicles and renewable energy installations surge, copper demand is set to soar while supply remains constrained, creating strategic risks and market opportunities. Investors, policymakers and utilities are recalibrating exposure to a metal that underpins electrification but has been largely overlooked in AI-era planning.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

The march toward AI and electrification has a surprising linchpin: copper. Essential in wiring, transformers and electrical conductors, copper is already central to data centres, electric vehicles (EVs) and renewable grids. Yet despite its role as the physical backbone of digital and clean-energy infrastructure, markets and policy makers have been slow to treat copper as a strategic asset on par with semiconductors or rare-earth elements.

Demand drivers are straightforward. Large-scale data centres require substantial copper for power distribution and cooling systems. EVs use between three and four times more copper than internal combustion vehicles, largely in motors, batteries and charging infrastructure. Renewable installations and grid upgrades to integrate intermittent solar and wind generation similarly intensify copper usage for transformers, substations and cabling. Industry analysts point to sustained multi-decade growth in these sectors, implying a pronounced and enduring lift to copper consumption.

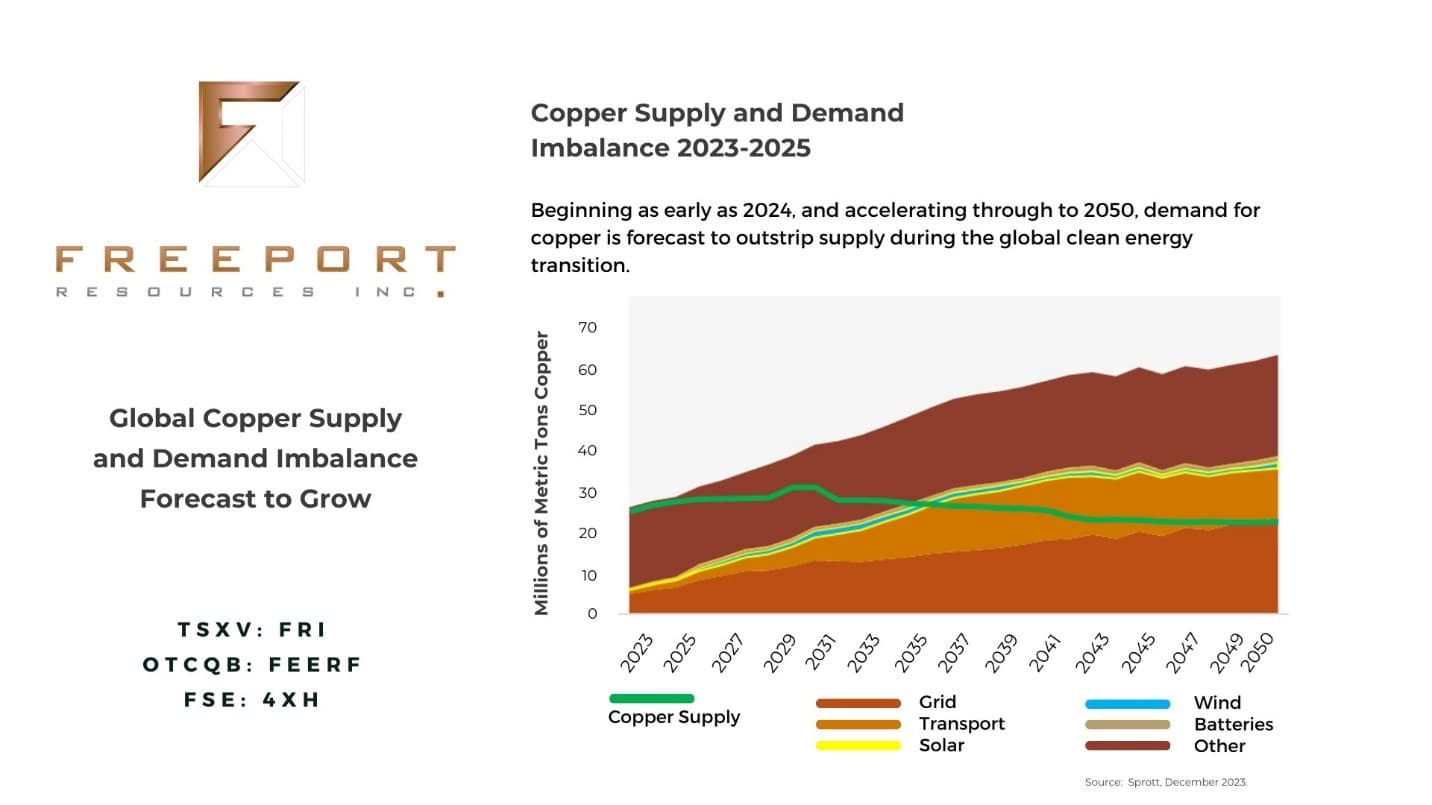

On the supply side, constraints are structural. New copper mine projects take years, often a decade, to move from discovery to production because of permitting, financing and technical hurdles. Existing large mines are maturing, and grade declines mean more ore must be processed for the same metal output. At the same time, global inventories tracked by exchange warehouses have been tight relative to historical averages, reinforcing price sensitivity to demand shocks. The result is a market where incremental demand from a single sector — for example, accelerated AI-related data centre buildouts — can have outsized effects on availability and price.

Market implications are already emerging. Copper prices have shown resilience in recent cycles, and investors are shifting capital into mining equities and related commodities exposure. Utilities and industrial firms face higher raw-materials costs for electrification projects, potentially raising project economics and timelines. Brokers and trading platforms, including ET Markets App, are highlighting commodity and power-sector stocks as investors look for ways to ride or hedge this trend. Retail investors are being presented with IPOs and secondary-market options contemporaneously; for instance, Nikita Papers’ initial public offering opens on May 27 with a price band of Rs 95-104 per share, underscoring that broader equity issuance continues even as strategic commodity dynamics evolve.

Policy makers confront trade-offs. Building strategic stockpiles, expediting permitting for critical-mineral projects, and incentivising recycling and substitution are all on the table. Recycling and urban mining could supply a growing share of copper demand over time, but scaling these streams requires investment and regulatory support. Governments must also balance local environmental and social impacts of mining expansion against national security and industrial resilience considerations.

Long-term, copper’s role in enabling electrification suggests secular demand growth regardless of short-term price cycles. For markets and planners, the crucial task is aligning investment timelines — in mines, recycling capacity and grid infrastructure — with the fast-moving timelines of AI, EV adoption and renewable rollouts. Overlooking copper is not just a commodity-market oversight; it is a strategic risk to the very technologies seen as future-proofing economies.