CSL to Invest $1.5 Billion in U.S. Plasma Supply Chain

CSL announced on November 19, 2025, plans to invest roughly $1.5 billion to expand onshore plasma collection and fractionation capacity in the United States, a move aimed at strengthening the resilience of plasma derived therapies and shortening fragile supply chains. The proposal, subject to board approval, signals wider industry momentum toward domestic production, with regulators and procurement bodies set to scrutinize phased rollouts over multiple years.

CSL, the global biopharmaceutical company, on November 19 disclosed a plan to invest about $1.5 billion to expand plasma collection and fractionation capacity in the United States. The company framed the investment as a strategic effort to bolster supply resilience for plasma derived therapies, accelerate distribution, and create U.S. jobs, while noting the plan remains subject to board approval and will be implemented in phases over several years.

Plasma based medicines, which include immunoglobulins, clotting factors and albumin, are critical for patients with immune deficiencies, bleeding disorders and a range of other conditions. Those therapies depend on two linked operations, collection of plasma from donors and fractionation, the industrial separation of plasma into its component proteins. CSL intends to upgrade both collection center networks and downstream fractionation and distribution infrastructure to keep more of that process onshore.

The announcement comes amid a broader industry push to onshore production and add capacity, driven by rising global demand for biologic and plasma based medicines and by supply chain fragilities highlighted during the pandemic and subsequent market disruptions. Companies across the sector have been citing national security, continuity of supply and regulatory preference as reasons to invest closer to end markets. CSL’s plan, if approved, would place it among a group of manufacturers betting that shorter supply chains will reduce shortages and logistical risk.

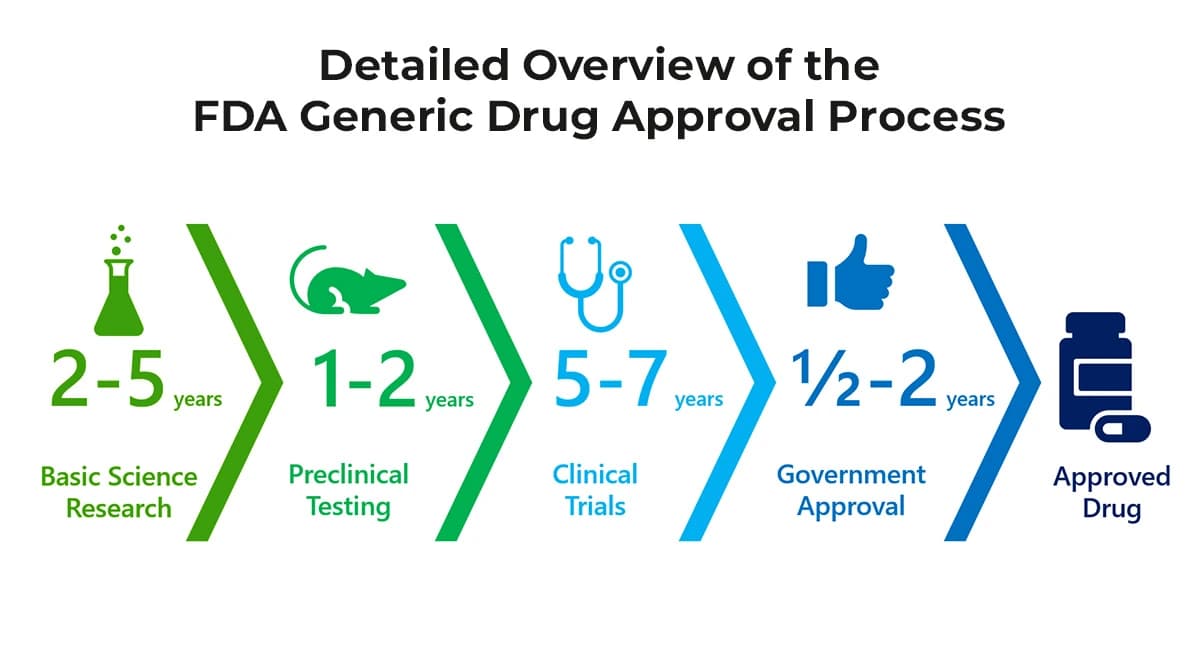

Regulators and public procurement agencies will be watching the project closely. Expanding plasma capacity requires heightened oversight to ensure donor safety, product quality and consistent manufacturing standards. The company said regulators and procurement bodies will monitor progress as facilities come online under a phased schedule that the company expects to roll out over multiple years. Those phases are intended to allow time for regulatory approvals, infrastructure buildout and workforce hiring.

Industry analysts say scaling up domestic plasma supply is not a simple engineering problem. Recruiting and retaining donors, securing trained staff for fractionation plants and coordinating distribution to hospitals and clinics present practical challenges that can limit how quickly new capacity relieves shortages. At the same time, closer geographic proximity between collection and manufacturing can shorten lead times and reduce transportation related vulnerabilities, potentially improving availability of critical therapies.

CSL stressed economic benefits as part of its rationale, pointing to planned job creation tied to new centers and facilities. Exact employment figures and precise locations of new capacity were not disclosed in the company statement. The investment will compete for attention with other capital demands across the industry, and the ultimate impact will depend on board approval, permitting timelines and how quickly regulators clear new operations.

If realized, the investment would deepen onshore production of plasma derived medicines in the United States and reflect an industry tilt toward building domestic resilience in essential biologic supplies. Policymakers, health systems and patient groups will be attentive to whether that promise translates into steadier access and lower risk of disruption for patients who rely on these life sustaining therapies.