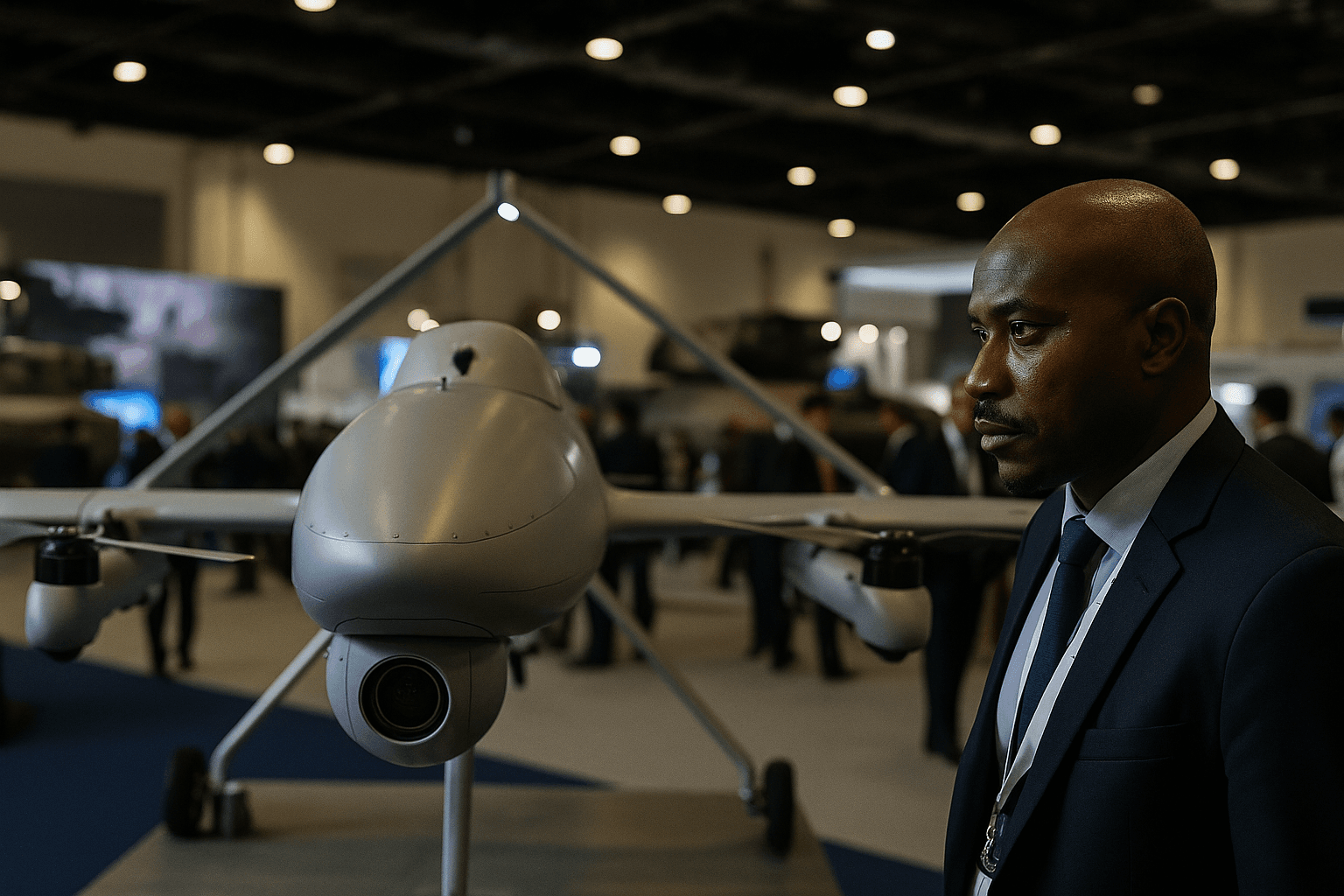

Defence Firms Flood Egypt Expo, Chase Lucrative African Drone Market

At Cairo’s EDEX arms fair, global defence companies are racing to sell quadcopters, electromagnetic rifles and AI enabled navigation systems to African states seeking cheaper, more flexible airpower. The contest matters because the spread of low cost unmanned aerial vehicles is changing how regional conflicts are fought, how governments buy weapons and how foreign suppliers compete for long term influence.

Exhibitors at EDEX in Cairo are showcasing a new generation of unmanned aerial vehicles and related systems as defence companies from Russia, China, the United States, Turkey, India and other countries press into a fast expanding African market. Quadcopters, electromagnetic rifles and AI enabled navigation suites sit alongside displays emphasizing “attritable” drones built to be inexpensive to lose and easy to operate, reflecting lessons drawn from the Ukraine war and other regional conflicts.

Delegations from Kenya, Rwanda, Zimbabwe, Azerbaijan and Saudi Arabia are among those inspecting the stands, underlining demand across diverse security environments from counterinsurgency to border surveillance. Suppliers are tailoring products for local conditions, stressing ease of use, modular payloads and after sales support rather than high end bespoke platforms. That shift is widening the buyer base beyond traditional state purchasers to border forces, internal security services and non state proxies.

Analysts at the expo describe the diffusion of cheap, effective UAVs and embedded artificial intelligence as a structural change in regional combat dynamics. Lower unit costs and simpler logistics shorten procurement cycles and reduce the barrier to entry for countries that historically relied on manned aircraft or costly foreign contractors. Procurement strategies are likewise evolving, with buyers placing greater weight on recurring supply, training packages, and integration with existing communications networks.

Market implications are immediate and strategic. Defence manufacturers are competing not just on hardware specifications but on financing, maintenance and local industrial partnerships. For exporters this means pressure to offer technology transfers, local assembly and training to lock in long term contracts. For African governments the options widen, but so do budgetary and policy questions about sustainability of purchases, lifecycle costs, and dependencies on foreign suppliers.

The technology shift also raises policy challenges. Regulators face the task of updating export controls, weapons licensing and rules of engagement for systems that can be produced at scale and used with limited pilot training. Military planners must adapt doctrine, develop counter UAV capabilities and invest in electronic warfare and airspace management. Civilian authorities must consider the implications for law enforcement and privacy as dual use platforms proliferate.

Longer term trends are likely to include increased regional competition and a growing domestic industry in some countries, as local firms and state arsenals move to assemble or modify imported systems. The ubiquity of AI enabled navigation and modular payloads suggests continued downward pressure on prices and upward pressure on deployment rates, which in turn will reshape strategic calculations across the Middle East and Africa.

As EDEX closes its doors for the day, the exhibit halls offer a clear signal to policymakers. The era of inexpensive, networked unmanned systems is no longer confined to textbook scenarios or distant battlefields. Governments will have to balance the tactical benefits of accessible airpower against the macroeconomic and security risks that accompany rapid technology diffusion.