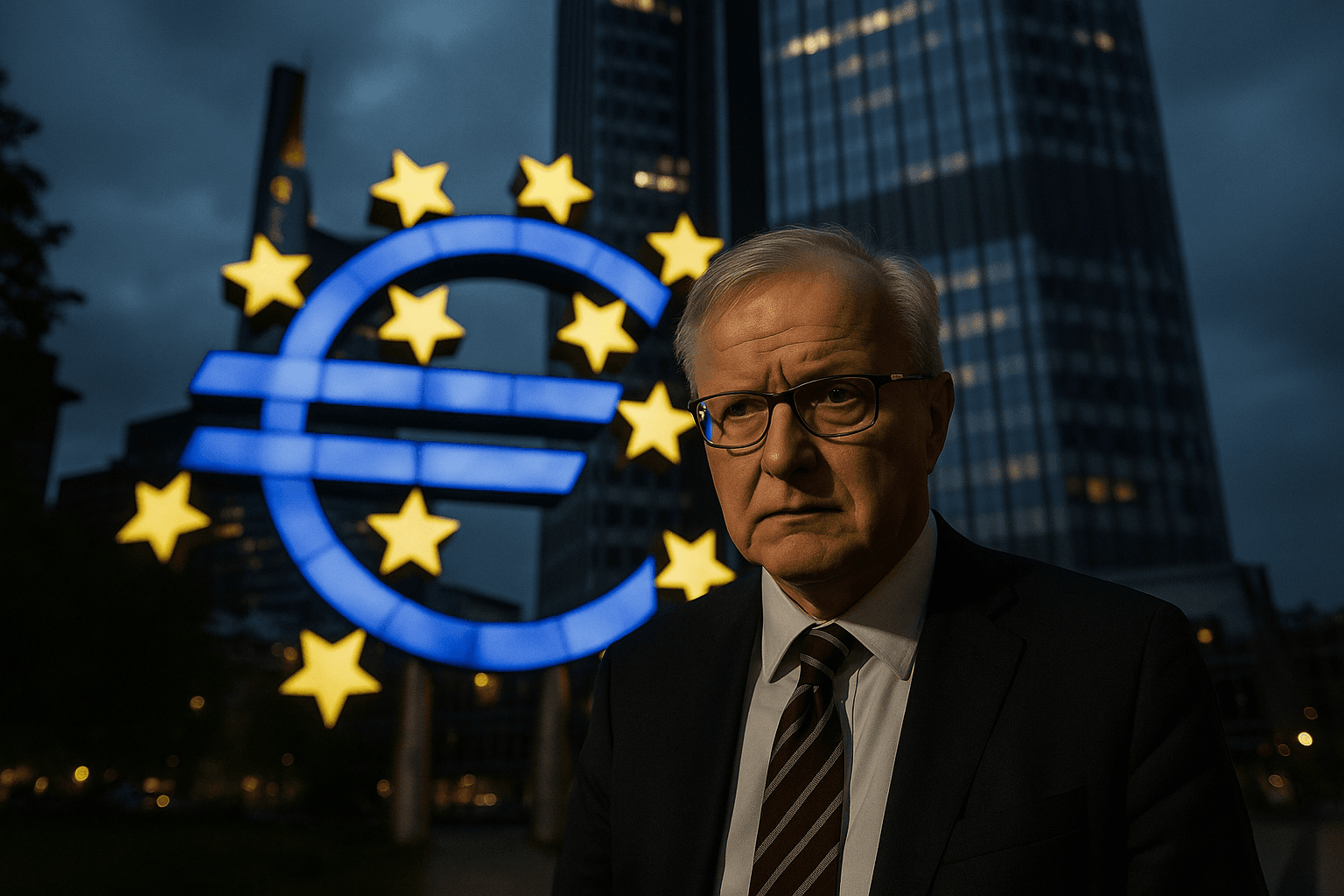

ECB Official Warns of Downside Inflation Risks, Urges EU Action

European Central Bank policymaker Olli Rehn told Milano Finanza that euro area inflation has returned near the ECB’s 2 percent goal, but medium term downside risks persist and policymakers must stay vigilant. He pressed EU leaders to break the impasse over using frozen Russian assets to fund a Ukraine repair loan, arguing legal and political choices now will shape monetary policy space and financial markets.

Olli Rehn, a senior European Central Bank policymaker, told Milano Finanza on December 6 that the euro area has returned to inflation close to the ECB’s 2 percent target, but that medium term risks point to potential weakness and warrant continued vigilance from policymakers. Rehn used the interview to press EU leaders to resolve a stalled plan to fund a Ukraine repair loan with frozen Russian assets, saying the move is essential while rejecting direct ECB involvement because that would breach EU treaty rules.

Rehn’s comments underscore a two track challenge for Europe. On the inflation side, the near target outcome gives the ECB room to reassess interest rate settings, but the identification of downside risks signals caution against assuming the inflation challenge is permanently solved. A sustained slide below target would complicate the transition back to conventional policy and could force the ECB to keep policy more accommodative than it would prefer, with longer term implications for bond markets and public finances.

On the fiscal and geopolitical side, Rehn focused on the proposal to convert frozen Russian assets into a multiyear Ukraine repair loan. He argued that direct ECB participation would be inconsistent with treaty constraints, and instead suggested using Article 122 of the Treaty on the Functioning of the European Union to authorize exceptional measures. That route would place responsibility firmly with member states and EU institutions rather than the central bank, but it would also require political agreement that has so far proved elusive.

Markets are likely to watch both threads closely. If downside inflation risks gather force, expectations for future ECB rate cuts could be delayed or diluted, keeping real yields and borrowing costs for governments and corporations structurally higher. Conversely, a decisive EU plan to provide Ukraine funding financed by frozen assets would reduce uncertainty about fiscal bearings in the euro area and could affect sovereign risk premia in countries with high debt burdens by clarifying potential contingent liabilities.

Legal and precedent concerns are central. Using frozen sovereign assets to finance reconstruction would test international legal norms and could invite legal challenges from third parties, raising execution risks and potential market volatility. Rehn’s insistence that the ECB not be a party to any financing operation is aimed at preserving the central bank’s independence and avoiding treaty violations that could undermine monetary credibility.

Politically, Rehn signaled momentum for his prospects as a candidate for the ECB vice presidency next year, saying he has received backing from across Europe. That bid will now hinge on how national capitals respond to his dual message: maintain monetary discipline in the face of softening inflation, while also taking collective fiscal and legal responsibility for Ukraine reconstruction financing. The choices made in coming weeks will reverberate through markets and shape the contours of European economic policy for years to come.