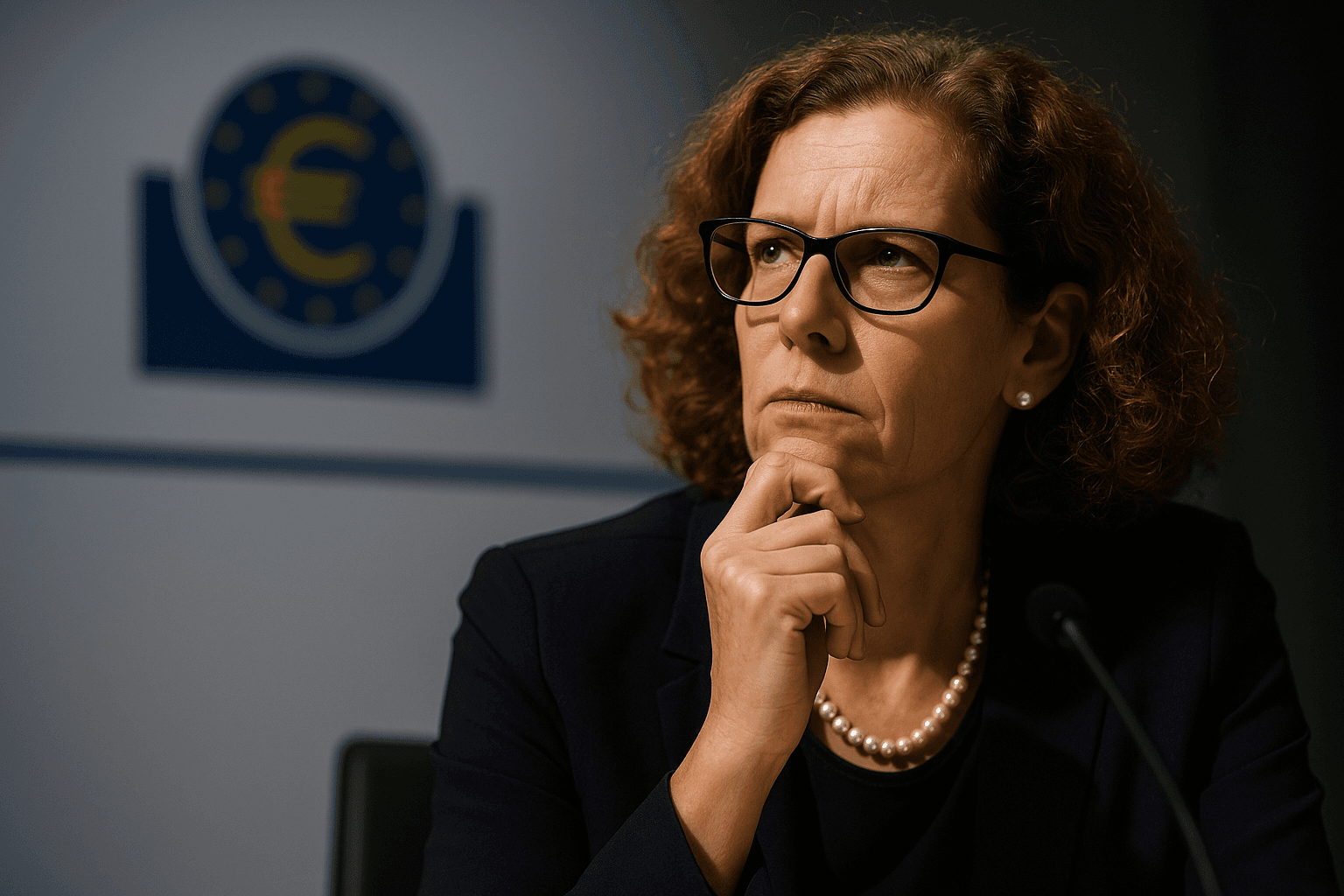

ECB’s Schnabel Signals Possible Rate Increase, Not Imminent Move

European Central Bank policymaker Isabel Schnabel told Bloomberg and Reuters on December 8 that while markets often expect looser policy, the ECB’s next move could be a rate increase depending on incoming data, though not in the immediate term. Her comments highlight growing divergence among major central banks as the Federal Reserve faces strong market pressure to cut rates this week, and they underscore the ECB’s readiness to respond if inflation surprises on the upside.

Isabel Schnabel, a member of the European Central Bank’s governing council, told interviews with Bloomberg and Reuters published December 8 that the ECB could ultimately move to raise interest rates again if incoming data warrant tighter policy, but she stressed that such a decision was not imminent. Schnabel said the Bank must weigh carefully whether recent policy easing has been sufficient and warned against complacency in the face of uncertain inflation dynamics.

Her remarks arrived as financial markets wrestle with divergent expectations for central banks. Investors have increasingly priced in near term rate cuts by the Federal Reserve, putting pressure on the U.S. central bank ahead of its monetary policy meeting this week. By contrast, Schnabel’s comments reinforced the view that the ECB is focused on assessing euro area inflation developments rather than following the Fed’s playbook.

The ECB’s mandate is explicit. It seeks price stability defined as two percent inflation over the medium term. While headline inflation in the euro area has moderated from its post pandemic peaks, core inflation measures remain stubbornly above target in many member countries and wage growth has shown resilience. That mix has left policymakers uncertain about how much recent policy easing, whether through slower pace of tightening or modest rate reductions in some markets, has affected underlying price pressures.

Markets interpreted Schnabel’s intervention as a reminder that the ECB retains optionality. Traders and portfolio managers have been debating whether the next move from Frankfurt will be a cut in the face of slowing headline inflation, or a hold and potential increase if prices accelerate again. The practical implications are broad. A future ECB rate increase would push borrowing costs higher across the euro area, influence bank lending, and likely support the euro against the dollar, complicating the global policy divergence already under way.

From a policy perspective, Schnabel’s stance signals prudence. The governing council faces a trade off between guarding against a resurgence of inflation and avoiding unnecessary tightening that could derail a fragile recovery. That calculus will be driven by data on wages, services inflation, energy prices, and the transmission of tighter financial conditions into the real economy.

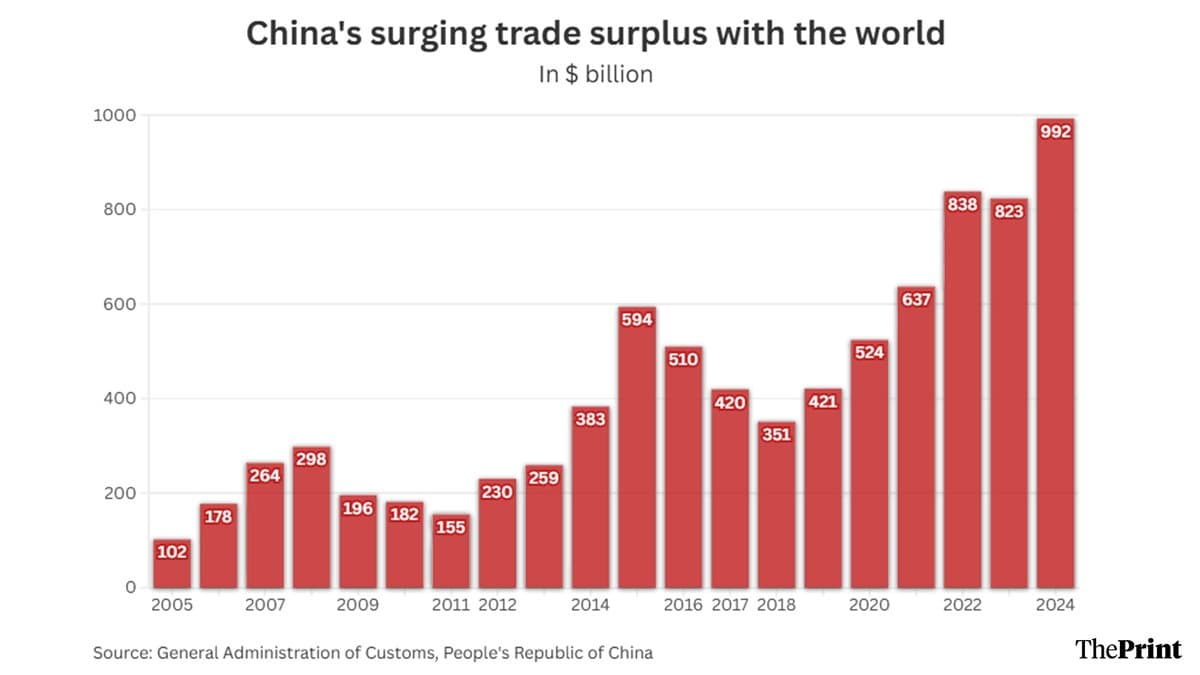

Looking further ahead, Schnabel’s comments reflect a longer term uncertainty about inflation persistence. Structural forces that supported disinflation during past decades, including globalization and technological advances, are being tested by supply chain shifts, geopolitical fragmentation, and labor market tightness. Those factors complicate the ECB’s path back to a durable two percent inflation rate.

For markets and policymakers, the message was clear. The ECB will not rule out tightening again, but any move will depend on evidence. Investors will be watching euro area data releases closely in the weeks ahead, sizing up whether inflation surprises warrant a change in direction.