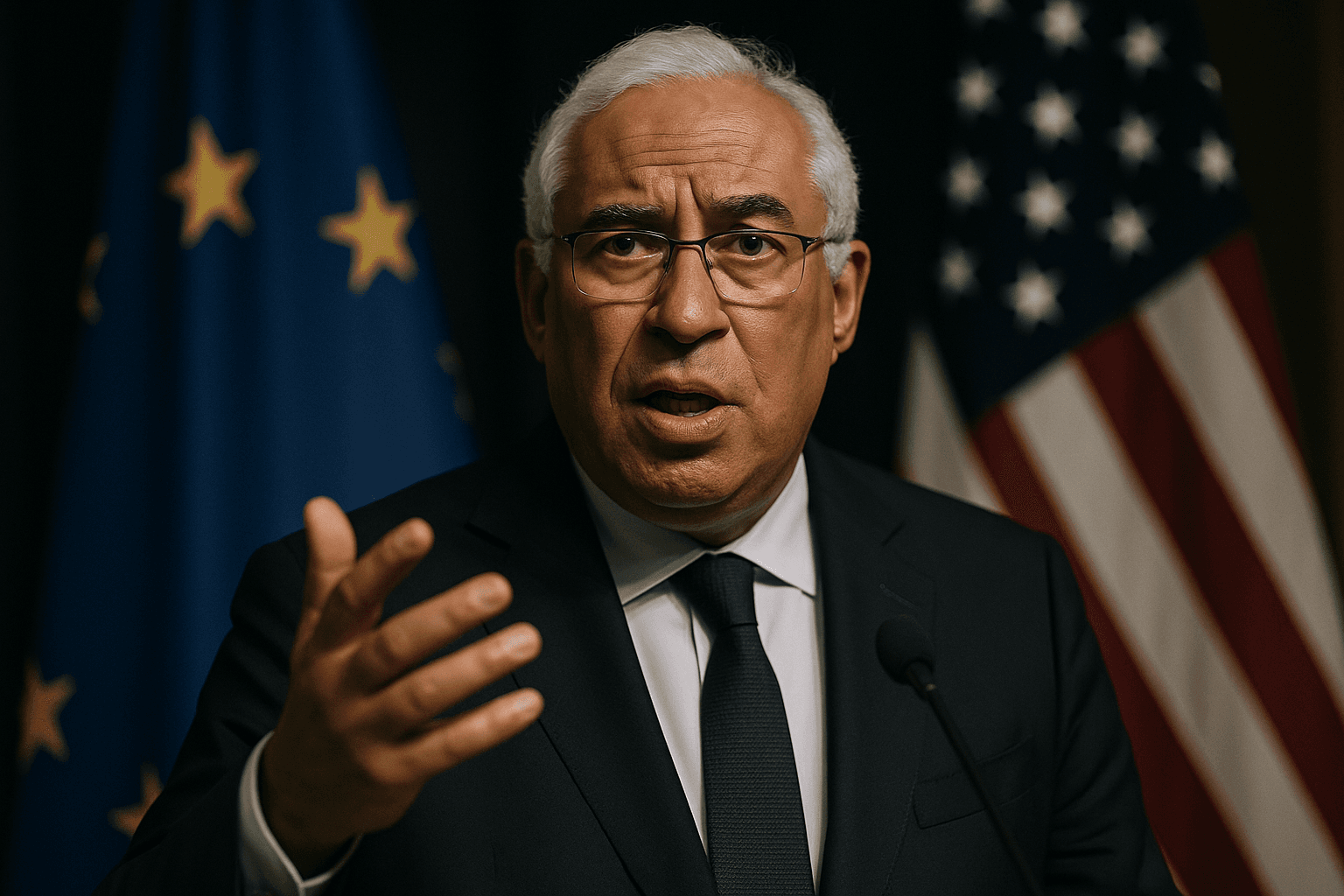

EU leader warns United States, do not interfere in European politics

European Council President Antonio Costa publicly warned the United States against efforts to influence which parties govern European countries, responding to elements of the Trump administration’s newly released national security strategy. The exchange highlights growing transatlantic strains that could affect trade, defense cooperation and the broader economic partnership that accounts for roughly 40 percent of global output.

European Council President Antonio Costa on December 8 cautioned Washington against attempting to shape political outcomes inside European democracies, a rebuke delivered after elements of the Trump administration’s recently published national security strategy were interpreted in Brussels as asserting a right to press allied political choices. Costa said that political decisions must be left to European citizens, and European leaders have since been seeking formal assurances that U.S. policy will respect sovereignty while preserving the security partnership.

The intervention crystallizes a widening gap between the transatlantic partners on several fundamental issues. The United States and the European Union together represent about 40 percent of global gross domestic product and more than one trillion dollars in annual two way trade in goods and services, making the relationship central to global markets and supply chains. At the same time, differences over China, Russia, migration management and trade policy have deepened since 2022, and the new U.S. national security strategy has intensified concerns in Brussels about political interference and conditionality in allied relations.

Economists and policy makers in the EU say the immediate economic consequence could be heightened policy uncertainty. Trade and investment flows are sensitive to expectations about bilateral cooperation, and businesses that rely on integrated transatlantic supply chains may delay hiring or capital projects if political frictions persist. Financial markets could reprice country risk and geopolitical premiums, with defense and cybersecurity firms likely to attract additional investor interest as governments pivot toward resilience. NATO spending patterns are in play as well, with the United States continuing to account for a large share of total alliance defense expenditure, a reality that underpins Europe’s security calculus even as several EU members boost defense budgets at home.

Brussels officials have framed their response as a careful balancing act. They want clear commitments that Washington will not seek to influence domestic political contests, while preserving intelligence sharing, joint military operations and trade ties. The European Commission and national capitals are pressing for language and mechanisms that would shield bilateral security cooperation from politicization. Failure to secure those assurances could accelerate a longer term trend toward strategic autonomy in Europe, a policy direction that over the last three years has included increased defense procurement within the EU and moves to diversify supply chains away from single source dependencies.

The dispute also has broader implications for global governance. If allied frictions complicate joint action, coordination on sanctions, export controls and technology standards could become more fragmented at a time when unified responses to China and Russia are increasingly seen as necessary by many governments. For markets, the path forward hinges on diplomatic outcomes over the next weeks. A firm diplomatic clarification that respects European sovereignty while recommitting to the core security relationship would likely calm investors, restore some policy certainty and limit the economic fallout. Continued ambiguity would push businesses and governments to price in higher geopolitical risk, reshaping investment and trade patterns over the medium term.