European Union Sells 3.268 Million Carbon Permits, Prices Hold Near €80

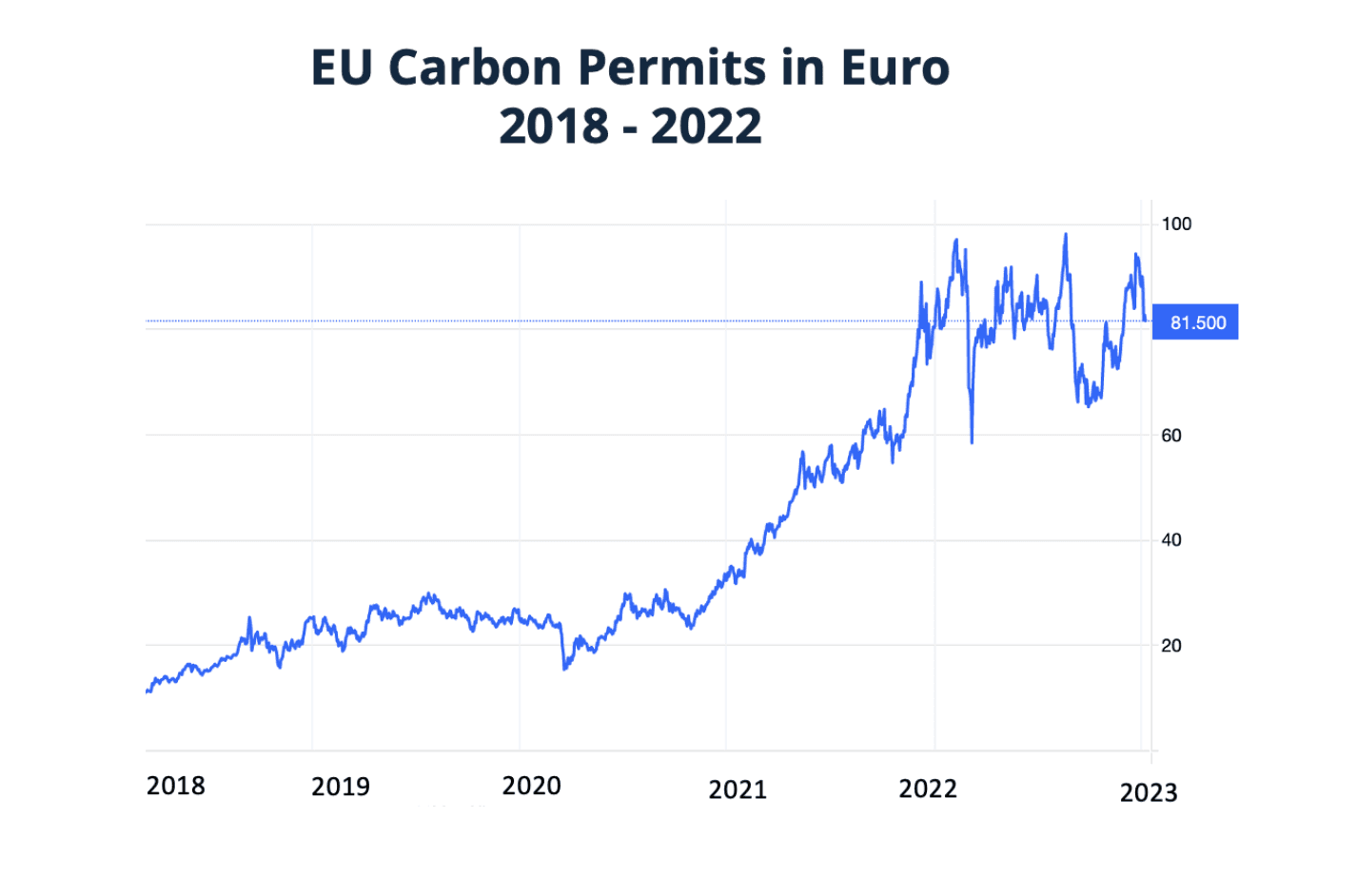

The European Union sold 3.268 million spot carbon permits on the EEX exchange at about €80 per tonne, generating roughly €261.4 million in primary market proceeds. The auction reinforces a month long pattern of EU Allowance prices near €80, a level that matters for energy costs, industrial compliance expenses, and the investment calculus for decarbonisation.

The European Union conducted an auction on November 24 that sold 3.268 million spot EU carbon permits on the EEX exchange at about €80 per tonne. At that price, the sale generated approximately €261.4 million for member states or for the designated uses under their national frameworks. The transaction continues a string of auctions this month in which EU Allowance prices have hovered around the €80 mark, underscoring sustained market attention on the balance between supply and demand in the bloc's Emissions Trading System.

Market participants view the auction result as confirmation of a relatively firm pricing environment for emissions allowances. For energy firms and heavy industry, the persistence of prices near €80 per tonne affects short term fuel switching and longer term investment choices. Higher carbon costs raise the marginal cost of fossil fuel generation, a factor that tends to lift wholesale electricity prices in markets where thermal plants set marginal prices. For energy intensive manufacturers the price level feeds into compliance budgets and decisions over hedging and product pricing.

Financial players and traders also monitor auction volumes and clearing prices as indicators of primary market liquidity and sentiment on future scarcity. The EEX auction is part of the primary supply that is released under the EU regime, while secondary market trading can amplify moves as participants reposition. The steady pricing this month suggests a market that is reconciling near term demand driven by energy market dynamics with supply expectations shaped by policy design.

Policy factors remain central to the market narrative. The EU Emissions Trading System is the anchor of the bloc's carbon pricing strategy, and regulatory signals about future supply have tightened expectations. Measures that reduce available allowances or accelerate the removal of surplus units have been cited by policymakers and analysts as long term drivers of higher prices, and ongoing European climate targets through 2030 continue to frame the expected trajectory of the cap. In addition, broader energy market conditions including gas and power prices influence emissions because they determine which generation sources run and therefore the demand for allowances.

The immediate economic implications of sustained €80 per tonne pricing are mixed. Consumers may face higher energy bills indirectly through increased wholesale prices, while firms facing higher compliance costs can pass some of that through to end prices or absorb it, affecting margins. At the same time, a stably higher carbon price improves the investment case for low carbon technologies by increasing the relative return to renewables, efficiency measures, and industrial decarbonisation projects.

Looking ahead, the auction outcome will remain one data point among many for markets watching Europe’s climate policy implementation. Continued auctions at similar volumes and price levels will test how quickly industry adapts, how governments deploy auction revenues, and whether the allowance market continues to signal scarcity that supports the EU’s long term decarbonisation goals.