Existing Home Sales Climb as Mortgage Rates Ease, Prices Hit Record

Sales of previously occupied U.S. homes rose 1.2 percent in October to a seasonally adjusted annual rate of 4.10 million units, the National Association of Realtors reported, the fastest pace since February. The national median sales price reached an October record of $415,200 even as inventory remained tight and a below normal share of first time buyers kept affordability a central concern.

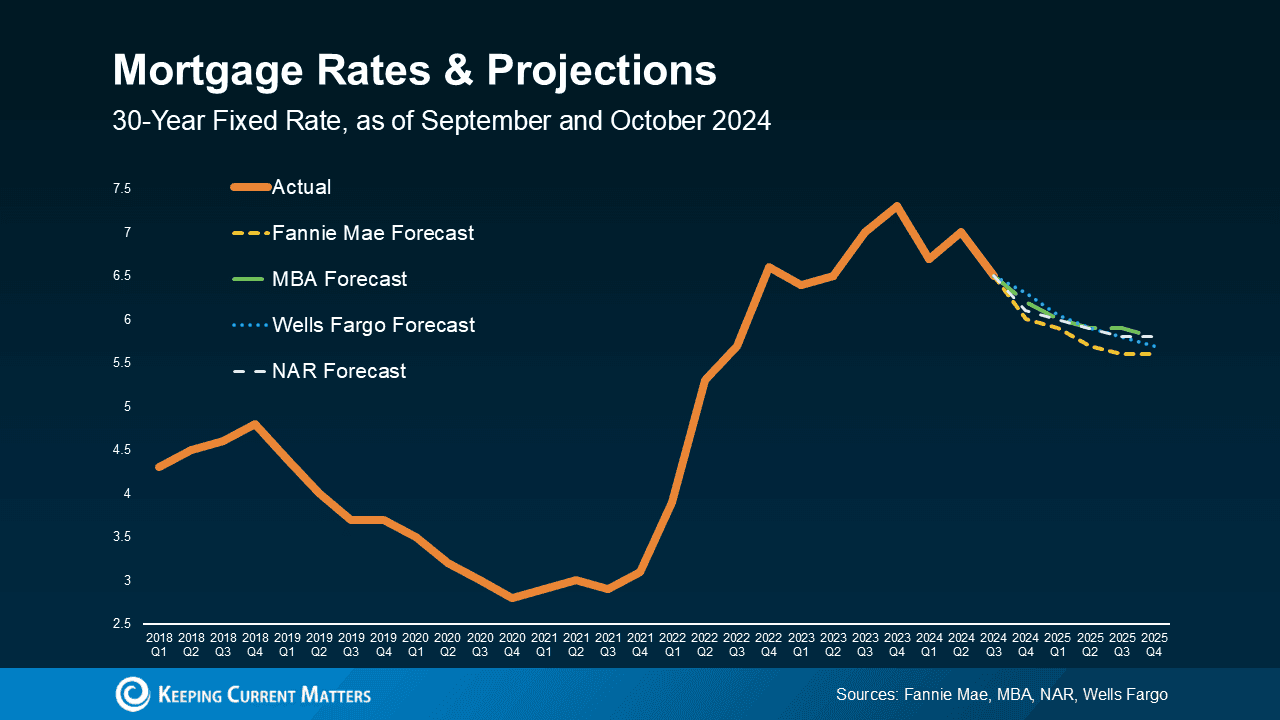

The housing market showed renewed momentum in October as existing home sales increased 1.2 percent to a seasonally adjusted annual rate of 4.10 million units, the National Association of Realtors reported on November 20, 2025. The pace was the strongest since February and represented a 1.7 percent gain year over year, signaling that modestly lower mortgage rates in October drew some buyers back into the market.

Despite the uptick in transactions, supply constraints and price pressure continued to dominate the narrative. The national median sales price for October rose to $415,200, an October record, underscoring persistent demand relative to available listings. Inventory remained constrained at about a 4.4 month supply, reflecting a market that favors sellers and limits choices for prospective buyers.

Economists and market participants view the October data as evidence that even a small easing of borrowing costs can revive activity among mortgage sensitive buyers. Lower rates improved monthly payment calculations for some households and helped bridge the gap between what buyers can afford and asking prices. Nonetheless the share of purchases by first time buyers stayed below normal, a signal that entry level demand remains impaired by down payment and financing hurdles as well as elevated home prices.

The combination of stronger sales and rising prices poses a policy conundrum. For household balance sheets, higher prices increase wealth for existing owners but reduce affordability for renters and younger households trying to buy. For the Federal Reserve, stronger housing activity could feed into broader inflationary pressures through rental markets and construction costs, but the central bank has few direct tools to ease home price appreciation. Supply side constraints stemming from limited new listings, local zoning restrictions, and a shortage of construction labor are structural factors that fiscal and local housing policies would need to address if affordability is to improve sustainably.

Regional differences are likely to persist, with high demand and limited supply concentrated in coastal and Sun Belt metros, keeping competition for affordable units intense. Mortgage market dynamics will remain a key variable. If rates stabilize or fall further, sales could continue to climb, but without a meaningful increase in inventory first time buyers will likely remain marginalized and prices are likely to keep rising.

Looking further ahead, the October report highlights the enduring imbalance between demand and supply that has characterized the housing market since the pandemic era. Short term shifts in mortgage costs can nudge activity, but lasting relief for affordability will require longer term policy solutions that expand supply and target assistance to households struggling to enter the market.