Expedia Gains Momentum, Google AI Tie Up, Dividend Deadline Looms

Expedia Group drew fresh investor focus on November 17 as analyst upgrades converged with corporate developments including a reported Google AI partnership and an upcoming dividend record date. For shareholders the moves matter because they affect near term income, sentiment and the valuation case ahead of earnings and next year s profit forecasts.

Expedia Group became a focal point for investors on November 17 as analysts raised targets and market attention turned to strategic technology ties and a near term dividend deadline. The combination of brighter earnings momentum, a reported partnership with Google on artificial intelligence and a quarterly cash payout has pushed sentiment in a more constructive direction heading into 2026 planning.

DA Davidson led the analytical momentum this morning by raising its price target on Expedia to $294 from $218 while reiterating a Buy rating. The firm lifted its 2026 revenue estimate by 3 percent and raised its 2026 adjusted EBITDA forecast from $3.46 billion to $3.72 billion, signaling expectations for both higher top line growth and margin improvement. Those moves followed third quarter results that investors and analysts have characterized as the backbone of the bull case, driven by double digit bookings growth and stronger B2B business trends across the travel sector.

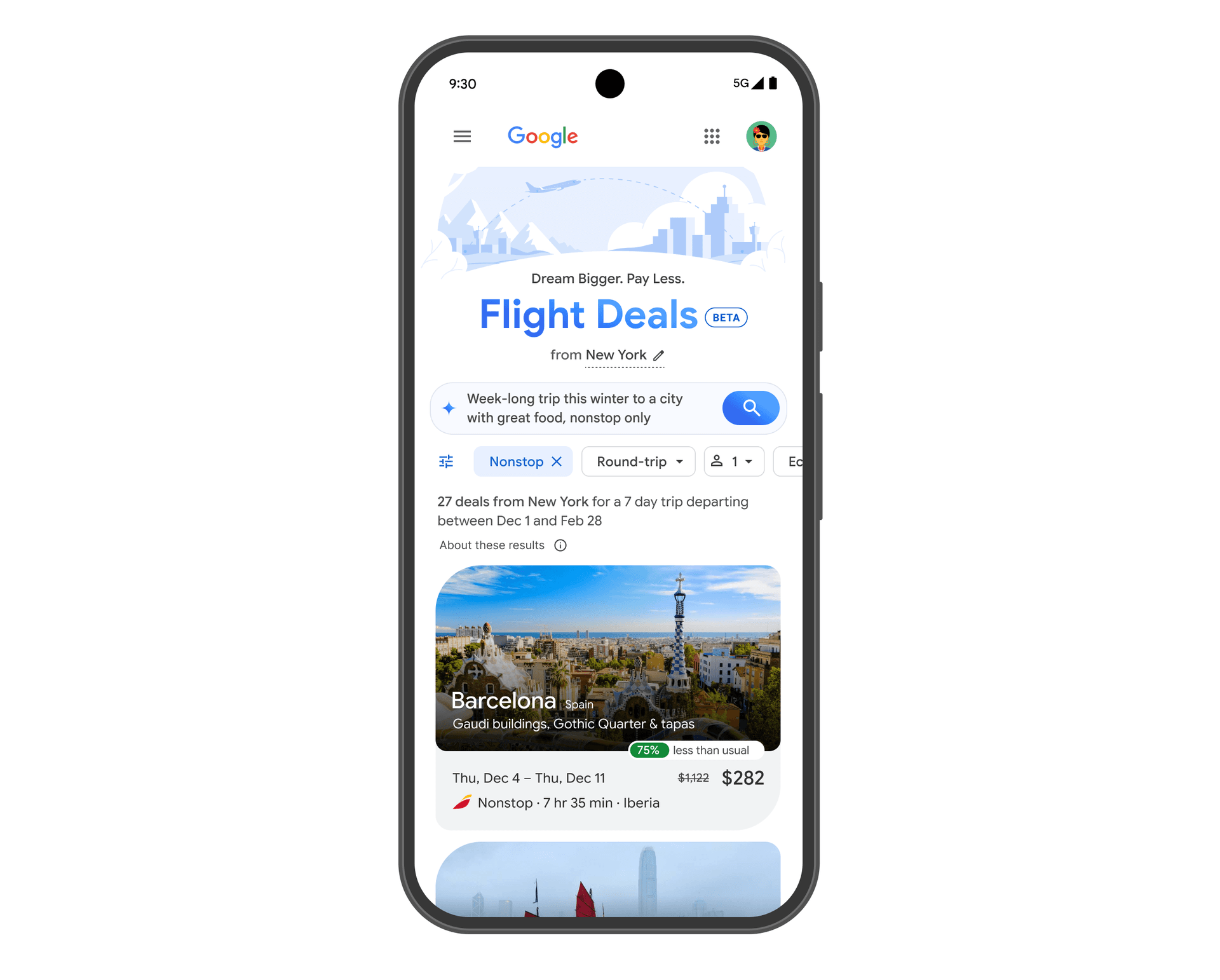

A reported technology partnership with Google to integrate artificial intelligence into search and booking workflows added another strategic angle to the story. Market participants see such collaborations as potentially amplifying distribution efficiency and personalized consumer experiences, trends that could accelerate revenue per booking and lower customer acquisition costs over time. The partnership narrative bolsters the growth thesis that underlies the recent analyst upgrades, even as details of implementation and economics remain to be watched closely.

The calendar also mattered to investors. Expedia s quarterly dividend of $0.40 per share goes ex dividend on November 19, with the payment scheduled for December 11. The approaching ex dividend date tends to concentrate trading around yield sensitive flows and can influence short term share price dynamics as investors lock in income before the record date.

Taken together the signals point to a more favorable market outlook for Expedia but also underscore risk around execution and macro sensitivity. Travel demand remains cyclical and exposed to consumer spending shifts, foreign exchange movements and potential changes in corporate travel policies. Analysts raising targets are implicitly betting that Expedia s product improvements and channel diversification will translate into durable revenue growth and expanding margins in 2026.

For shareholders the immediate implications are tangible. The ex dividend date offers a scheduled cash return of $0.40 per share, while the analyst revisions provide a fresh benchmark for valuation expectations. For the broader market the developments reinforce a narrative that the online travel sector is moving beyond post pandemic recovery into a phase where tech enabled differentiation and higher margin B2B contracts can meaningfully lift profitability. Investors will watch forthcoming quarterly disclosures and the pace of AI integration to judge whether the optimism is justified.