Falling Mortgage Rates Boost Demand, But Durability Is in Doubt

Mortgage applications jumped 9.2% in the latest weekly reading as borrowing costs fell to their lowest level since last October, signaling renewed buyer and refinancing interest. Whether the momentum holds depends on inflation, Treasury yields and Federal Reserve policy — forces that could reverse the decline quickly or cement a longer, supply-constrained housing recovery.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

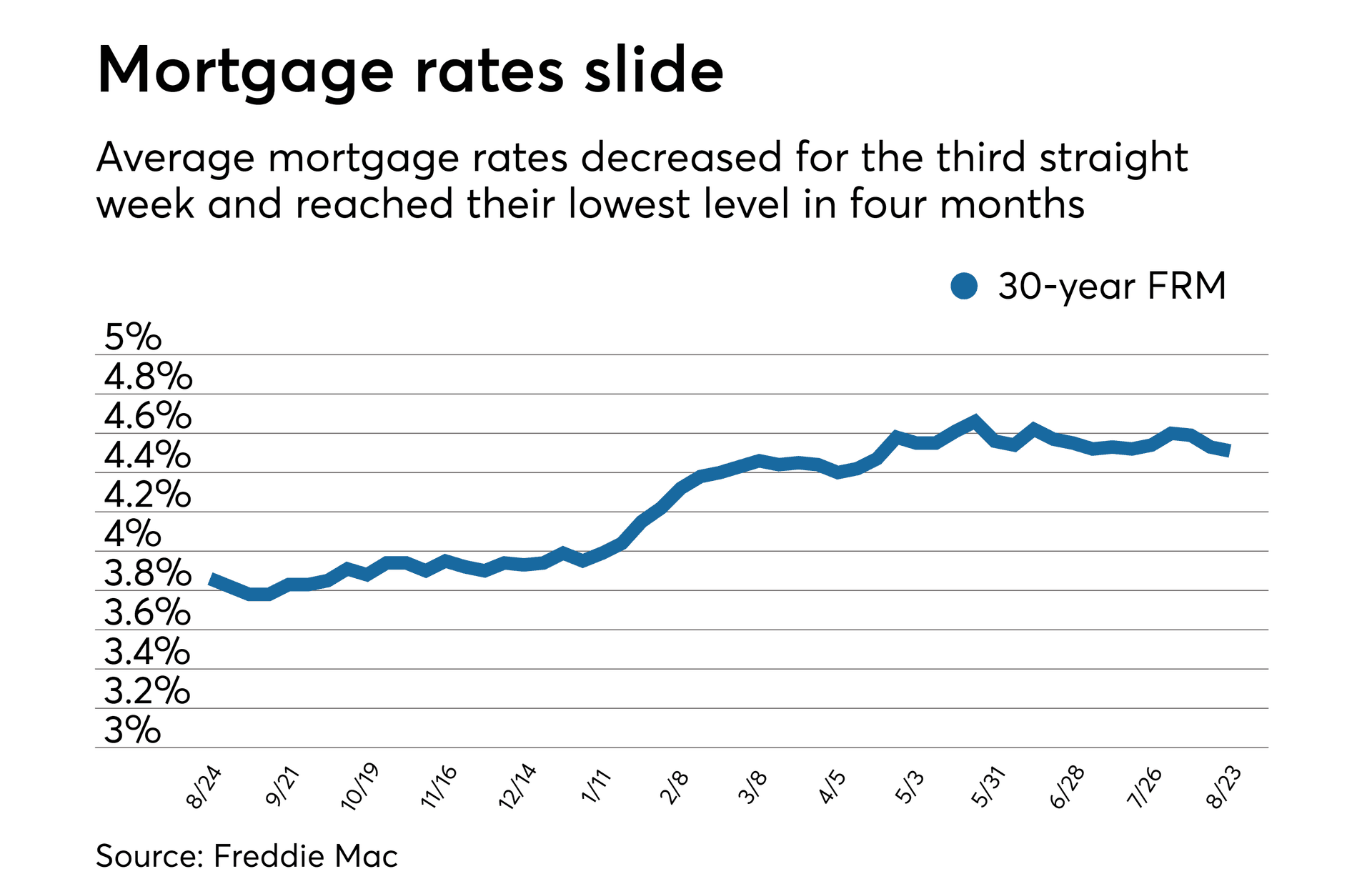

Mortgage market activity showed clear signs of life this week as the Mortgage Bankers Association reported a 9.2 percent increase in mortgage applications from the prior week, a response the trade group tied to mortgage rates slipping to their lowest level since last October. Lenders and brokers said lower rates coaxed some would-be buyers off the sidelines and nudged homeowners to consider refinancing, though the volume and sustainability of that response remain uncertain.

The immediate market mechanics are familiar: as investor appetite for longer-term Treasuries rose, yields on the 10-year Treasury eased, producing downward pressure on fixed mortgage rates and lowering monthly borrowing costs. That helped margin-sensitive buyers — particularly first-time and rate-sensitive move-up buyers — to see improved affordability relative to recent months. Mortgage bankers noted that purchase applications, a leading indicator of housing demand, showed the strongest lift in weeks.

Still, the backdrop tempers enthusiasm. Despite the recent dip, 30-year rates remain well above the cyclical lows reached during the pandemic-era affordability boom, and home prices across many markets have stayed elevated due to years of underbuilding. Low inventory, measured by tight listings and subdued new construction, has capped the supply response and means rate-driven demand may not immediately translate into a broad pickup in transactions or downward price pressure.

Policy will be decisive. The Federal Reserve has continued to emphasize data dependence, and policymakers have repeatedly warned that any decision to ease policy will hinge on further, durable disinflation and labor-market cooling. If inflation reports stabilize at or below target and payrolls soften, markets could price in a clearer path for policy easing, keeping Treasury yields and mortgage rates lower for longer. Conversely, upside surprises on inflation or strength in the jobs market would push yields higher and could erase the recent gains in mortgage affordability.

Refinancing is another conditional element. Historically, substantial refinancing waves require rates to fall several hundred basis points from prevailing levels. Lenders said the recent move did boost refinance inquiries, but many homeowners locked into lower rates in earlier years will not qualify for economically attractive refis unless rates retreat substantially. That limits the scope for a sustained refinancing surge to drive lender revenue or broader consumer spending in the near term.

For buyers and sellers, the immediate takeaway is pragmatic: lower rates have created a short window of improved affordability, but the durability of that window depends on macroeconomic data and investor sentiment. Market participants will be watching weekly mortgage application reports, the 10-year Treasury yield, incoming CPI and PCE inflation prints, and Federal Reserve commentary for signals. If those indicators align toward disinflation and lower policy expectations, the thaw could persist; if not, the brief respite in borrowing costs may prove temporary.