Falling Mortgage Rates Offer Relief — But Durability Remains Uncertain

Mortgage rates have trended downward in recent weeks, easing borrowing costs and nudging some buyers back into the market. Whether the decline is sustained depends on inflation, Federal Reserve policy, and global bond markets — factors that still point to volatility ahead for housing affordability and financial markets.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Mortgage rates slid again this week, bringing welcome relief to prospective homebuyers and owners weighing refinances, but economists and market participants warned that the drop may be fragile and reversible.

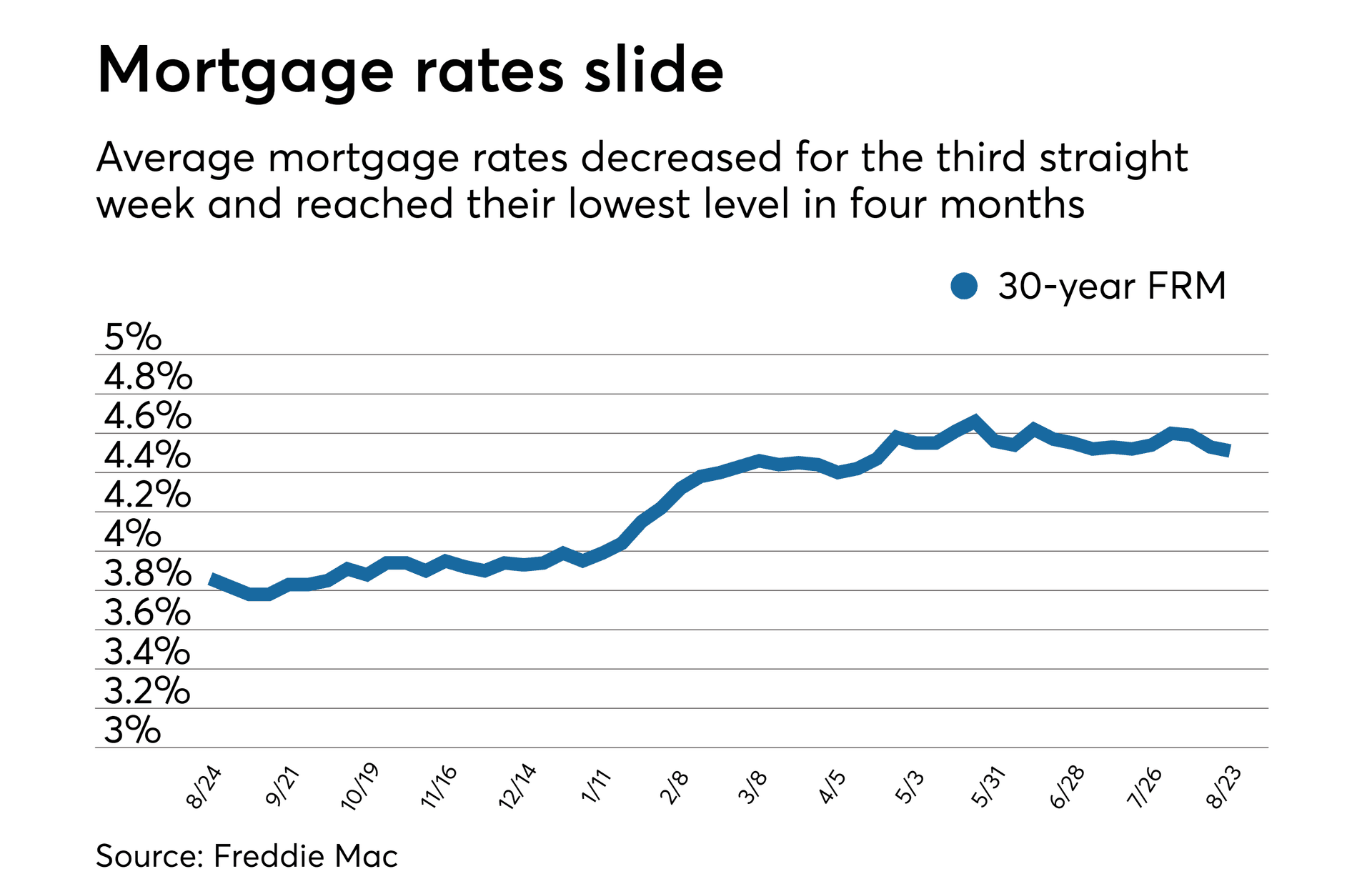

Freddie Mac’s weekly survey showed the average 30-year fixed-rate mortgage at roughly 6.8 percent this week, down from about 7.1 percent a month earlier and markedly lower than the peaks above 8 percent seen in 2022 and early 2023. The 15-year fixed averaged near 5.9 percent. The move followed a decline in the 10-year Treasury yield, a primary driver of long-term mortgage costs, which fell toward the 4 percent area after earlier trading above 4.5 percent this summer.

“We’re seeing rates come off a bit as inflation surprises have softened and Treasury yields retraced,” said Mark Zandi, chief economist at Moody’s Analytics. “That’s good news for buyers, but it’s contingent on inflation continuing down and the Fed ultimately signaling lower accommodation. Any reversal in either could push rates higher again.”

The easing has already nudged activity. The Mortgage Bankers Association reported a pickup in total mortgage application volume over the past two weeks, with purchase applications rising from multi-month lows and refinancing demand inching up as homeowners with rates in the high 6s and 7s evaluate savings from a modest decline. Nevertheless, application volumes remain well below the boom levels of 2020–2021, held back by elevated home prices and thin inventory.

Home price appreciation has cooled from pandemic-era surges. The S&P CoreLogic Case-Shiller national index shows annual gains moderating to the low single digits in recent months, reflecting slower demand and chronic supply shortfalls. Economists note that even with lower rates, affordability remains strained because prices and wages have not adjusted uniformly across markets.

Policy choices remain the central wild card. The Federal Reserve has signaled in recent communications that while inflation has eased from mid-decade highs, it remains above the 2 percent target in some measures and that policymakers will watch labor-market strength closely. If growth and wage gains remain resilient, the Fed could sustain restrictive policy for longer than markets expect, keeping Treasury yields and mortgage rates elevated.

“Mortgage rates aren’t on a smooth glide path,” said Danielle Hale, chief economist at Realtor.com. “Housing demand responds to a combination of rates, inventory, and local market dynamics. A small drop in the national rate helps, but it doesn’t erase affordability challenges in high-cost metros.”

Global developments also matter. A shift in investor sentiment — driven by geopolitical shocks, a surprise pickup in foreign growth, or changes in safe-haven flows — can lift Treasury yields and translate quickly into higher mortgage costs. Conversely, a pronounced deceleration in inflation could give policymakers room to cut short-term rates next year, sustaining the downtrend.

For policymakers, the current shift highlights a narrow runway for supporting housing without reigniting inflation. Lower mortgage rates could ease housing-related pressures in the consumer price basket, but only a sustained, broad-based cooling of inflation would justify significant Fed easing.

For buyers and homeowners, the practical takeaway is cautious optimism. A small window of lower rates may create opportunities for some, particularly first-time buyers and cash-constrained owners considering a refinance. But the durability of those opportunities will hinge on inflation data, Fed decisions and the global bond market — all variables that could reverse course with little warning.