Fannie Mae, Freddie Mac OTC Shares Become Meme Stock, Swing Wildly

Retail investor mania has pushed over the counter shares of Fannie Mae and Freddie Mac into meme stock territory, producing volatile rallies and abrupt reversals that drove extreme intraday swings. The episodes complicate policy debates over the future of the government sponsored enterprises and underscore risks for individual investors in illiquid markets.

Over the counter listings of Fannie Mae and Freddie Mac have erupted into a wave of retail trading that turned long dormant tickers into focal points for speculative rallies and sharp reversals, Bloomberg Law reports on November 22, 2025. The trading has unfolded as endorsements, social media driven buying and commentary from prominent market figures amplified demand in the thinly traded venues where both names now trade under the symbols FNMA and FMCC.

The rapid price moves have been notable for their intraday volatility. In markets where average daily volume is low, inflows of retail orders can move prices sharply and then reverse as liquidity dries up. That pattern has been evident in the Fannie and Freddie listings, where commercial market participants said price swings often bear little relation to the firms underlying mortgage exposures or to the complex policy choices facing regulators and the Treasury.

The timing is politically sensitive. The Trump administration is advancing proposals to alter the conservatorship structure that has governed the enterprises since 2008, and officials have discussed pathways for public listings or recapitalization. The retail driven rallies, however, complicate public assessment of demand and valuation for any future privatization. Price spikes in OTC markets can create misleading signals about investor appetite, potentially skewing political and market expectations at a moment when policymakers are weighing options that would reshape the secondary mortgage market.

Beyond headline volatility, the events highlight structural risks for retail investors. Over the counter markets are characterized by limited liquidity, wide bid ask spreads and price discovery that can be unstable when order flow concentrates. In that environment, small trades can trigger outsized movements and leave late participants exposed to sudden reversals. Regulators and consumer advocates view those dynamics with concern because retail investors may misinterpret short term rallies as evidence of sustainable valuation gains.

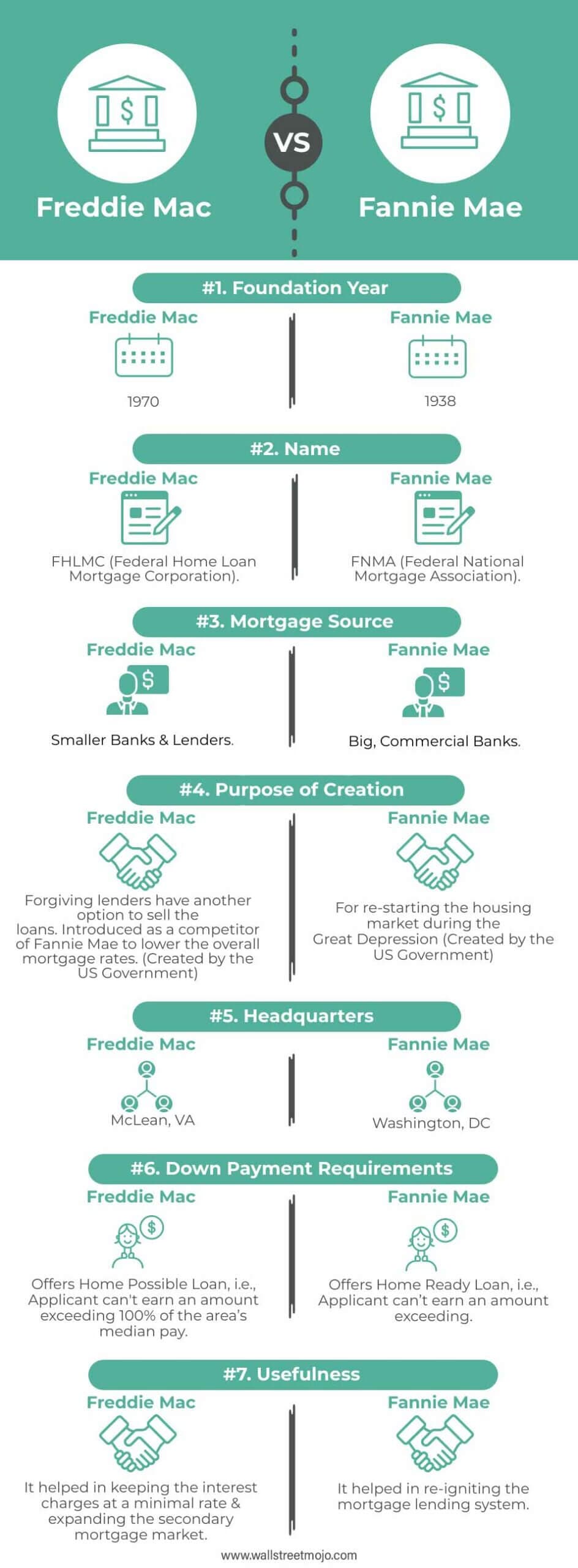

The underlying economics of Fannie Mae and Freddie Mac complicate the picture. As government sponsored enterprises they play an outsized role in housing finance, guaranteeing billions of dollars of mortgages and backing the secondary market for home loans. Since the 2008 crisis both firms have operated under conservatorship overseen by the Federal Housing Finance Agency, while the Treasury retains financial arrangements that have significant fiscal implications. Policy changes to end conservatorship or to pursue public listings would affect mortgage credit supply, capital structure and potentially taxpayer exposure to future losses.

Market participants caution that OTC price action is a poor substitute for institutional demand in assessing those policy trade offs. For policymakers, the episode is a reminder that market signals can be distorted by social media driven trading and that any move toward privatization will need to be based on deep, liquid markets and rigorous valuation frameworks. For retail investors, the message is to treat over the counter trading in systemically important mortgage finance entities as speculative and to be mindful of the heightened risks of trading in illiquid securities.