Fed 'Fear Gauge' Suggests Stagnation Risk Over Stagflation

Recent data showing slowing hiring and cooling inflation have shifted Federal Reserve officials' risk calculus, making a near-term rate cut more likely while reducing fears of persistent stagflation. The updated forecasts to be released with this week's policy statement will test whether policymakers are prepared to trade off higher unemployment for lower inflation risks — a decision with big market and political stakes.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

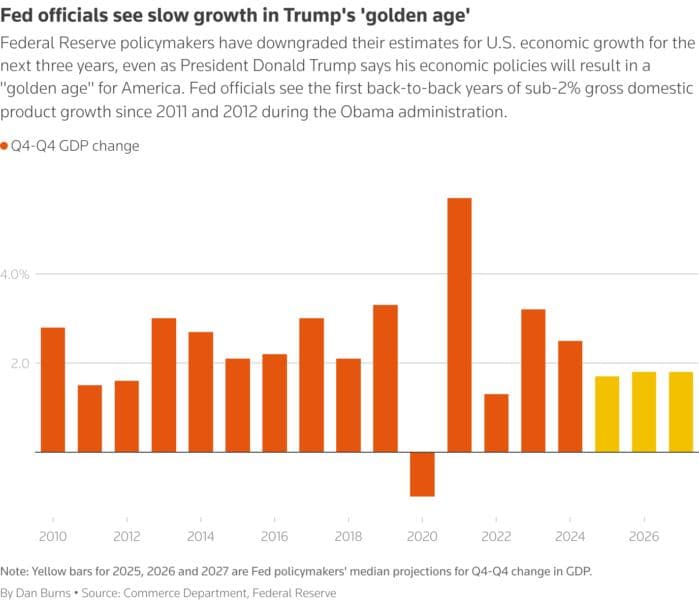

Federal Reserve officials are tilting toward a view that the U.S. economy faces a risk of stagnation — slower growth and weaker labor market dynamics — rather than the combination of rising inflation and stagnating output known as stagflation. That reassessment, evident in internal discussions and in markets' growing conviction that the central bank will loosen policy, will come into sharper focus when the Fed publishes updated projections for inflation, unemployment and the policy rate alongside this week’s decision.

Policymakers have watched a string of data showing inflation measures well below the 9%-plus peaks of 2022 and continuing to trend toward the Fed's 2% target, even as hiring has softened. Labor-market indicators that once alarmed officials — robust payroll gains and falling unemployment — have become less consistent. Payroll growth has decelerated from the breakneck 2021–22 pace to more modest monthly increases in recent reports, and some regional surveys point to weakness in hiring. Those patterns have raised concern inside the Fed that tighter financial conditions and fading fiscal impulse could bring higher unemployment.

The immediate market implication is a higher probability of a rate cut at the Fed's upcoming meeting. Futures and option markets have increasingly priced in at least a 25-basis-point reduction in the federal funds rate next week, reflecting a belief that the central bank will pivot to forestall downside risks to growth. Treasury yields have traded lower on that prospect, while equities have shown signs of relief after weeks of volatility tied to economic uncertainty and political pressure on the central bank.

Policy debates inside the Fed now center on how aggressively to respond. A move to cut rates would be justified by those who argue that the principal threat is a growth slowdown that could entrench higher unemployment. Other officials remain wary that premature easing could reverse recent gains in disinflation. In public remarks, Fed officials have emphasized a data-dependent approach; the updated "dot plot" of projections will reveal whether the majority now expects lower terminal rates over the medium term.

Political developments add an unusual overlay to the technical debate. President Donald Trump has publicly demanded rate cuts and has taken steps to exert influence over the central bank, including moves directed at the composition of the Board of Governors. While the Fed maintains its formal independence, such pressure complicates an already delicate balancing act for policymakers responding to mixed signals from the economy.

Looking beyond the immediate meeting, the shift from stagflation fears to stagnation risk has broader macroeconomic implications. If the labor market continues to cool without a resurgence in inflation, the Fed may find itself in a prolonged regime of lower rates, constrained by a lower neutral rate and structural headwinds such as slower productivity growth and demographic shifts. That scenario would change the calculus for fiscal policy, placing greater onus on targeted government measures to bolster growth without rekindling inflation.

Ultimately, this week’s projections will offer a statistical snapshot of how the Fed sees that trade-off evolving through 2028. For markets, workers and consumers, the central question is whether policy will ease enough to cushion a slowdown — and whether that easing will open the door to renewed inflationary pressures down the road.