Fed Seen Cutting Rates Twice More, 2026 Path Unclear

A Reuters poll of economists shows the Federal Reserve is expected to trim interest rates twice more this year, but forecasts for 2026 are highly dispersed as inflation remains persistently above the Fed’s 2% target. The mix of modest hiring and layoffs in recent private-sector data, a steady 4.3% unemployment outlook and rising consumer inflation complicate the outlook for markets, borrowers and policy makers.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

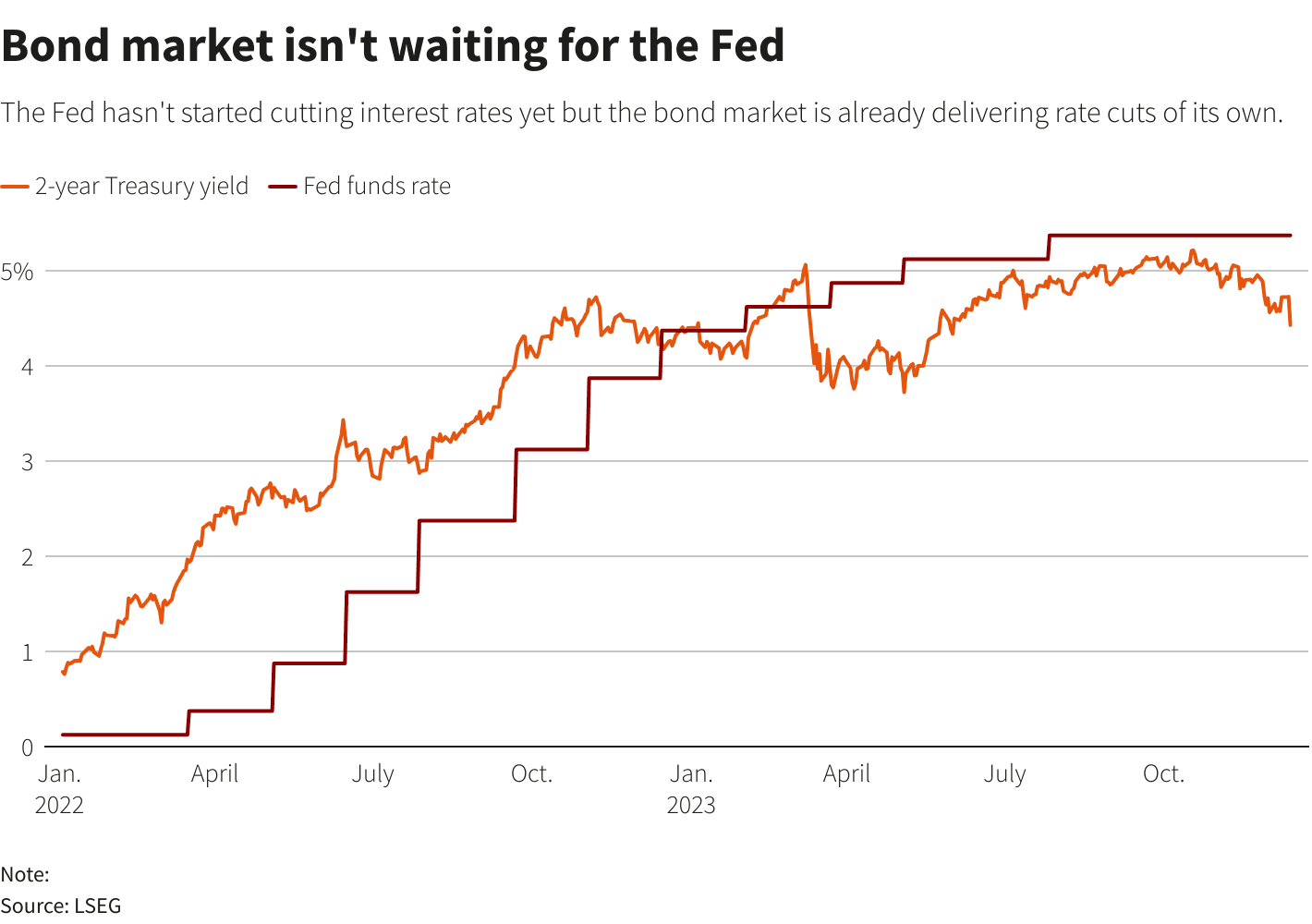

A Reuters poll of economists taken ahead of delayed government data showed broad agreement that the Federal Reserve will cut its policy rate twice more this year, but wide disagreement about where rates will stand by the end of next year. The poll underscored the tension at the center of U.S. monetary policy: a labor market that shows signs of cooling without collapsing, and inflation that remains stubbornly above the Fed’s 2% personal consumption expenditures target.

Private-sector payroll measures cited in the poll indicate both modest layoffs and modest hiring, a pattern consistent with a labor market that is shifting toward greater balance rather than undergoing a sharp correction. Poll medians predict the unemployment rate will average around the current 4.3% each year through 2027, essentially unchanged from last month’s read. That stability gives the Fed room to ease policy moderately without an immediate spike in joblessness.

Yet inflation complicates the calculus. Respondents to the Reuters poll expected inflation, by the Fed’s preferred PCE measure, to average above 2% each year through 2027. Delayed official data due on Oct. 24 were expected to show consumer inflation rising to 3.1% last month from 2.9% in August, reinforcing concerns that price pressures are not yet back at the central bank’s long-run objective.

The divergence in views on how persistent those pressures will be shows up starkly in forecasts for the policy rate. Economists were “split seven ways” on the federal funds rate by the end of next year, with projections ranging from 2.25%-2.50% to 3.75%-4.00%. That spread reflects both differing judgments about inflation persistence and uncertainty about the Fed’s eventual leadership: Chair Jerome Powell’s term ends in May, and debate over his successor has injected additional policy uncertainty into markets.

For markets and households, the short-term implication of the poll is a modest easing of borrowing costs if the two cuts materialize, with potential relief for mortgage rates, corporate borrowing and consumers carrying variable-rate debt. But stickier-than-expected inflation would blunt those gains and keep real borrowing costs higher for longer, weighing on investment and consumption growth, and potentially limiting equity market upside.

From a policy perspective, the outlook raises questions about the Fed’s path to restoring price stability without derailing the labor market. If inflation averages remain above target through 2027 as poll respondents expect, the central bank may face pressures to keep policy tighter than previously anticipated, or to accept a protracted period of above-target inflation to preserve employment gains.

Longer term, the poll highlights a more important trend: uncertainty about the natural—or neutral—rate of interest and the appropriate policy stance. The seven-way split in forecasts and persistent inflation readings suggest that central bankers, investors and households must prepare for a more volatile policy environment where small shifts in data or leadership could meaningfully alter the trajectory of rates and economic growth.