Fed Set to Cut Rates Twice This Year, Outlook for 2026 Murky

A Reuters poll of economists shows the Federal Reserve is expected to trim its policy rate by 25 basis points next week and again in December, but analysts remain sharply split on where rates will sit beyond 2025. With private‑sector data showing modest layoffs and hiring, unemployment projected to hold near 4.3% through 2027 and inflation forecast above the Fed’s 2% target, markets face a complicated policy signal with meaningful implications for borrowing costs and financial stability.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

The Federal Reserve is poised to reduce its key policy rate by 25 basis points at its upcoming meeting and to follow with a second 25 basis point cut in December, according to a Reuters poll of economists. The forecasted 50 basis points of easing this year comes against a backdrop of mixed economic readings that have left the trajectory for 2026 deeply uncertain.

Recent private‑sector data compiled for the poll indicate both layoffs and hiring are modest, suggesting the U.S. labor market is no longer red‑hot but remains resilient. Median responses in the poll project the unemployment rate will average roughly 4.3% each year through 2027, essentially unchanged from the prior month’s survey. That steady unemployment projection, combined with inflation expectations that poll respondents say will stay above the Fed’s 2% personal consumption expenditures (PCE) target through 2027, presents a classic central‑bank dilemma: how to ease policy enough to support growth without undoing hard‑won progress toward price stability.

Economists in the Reuters poll were "deeply divided" on where the funds rate will be at the end of next year, a split that reflects uncertainty about core inflation dynamics and the sensitivity of the economy to tighter financial conditions. The poll’s language underscores that while the near‑term path appears to tilt toward two modest cuts, the medium‑term course for rates — particularly 2026 — lacks consensus among forecasters.

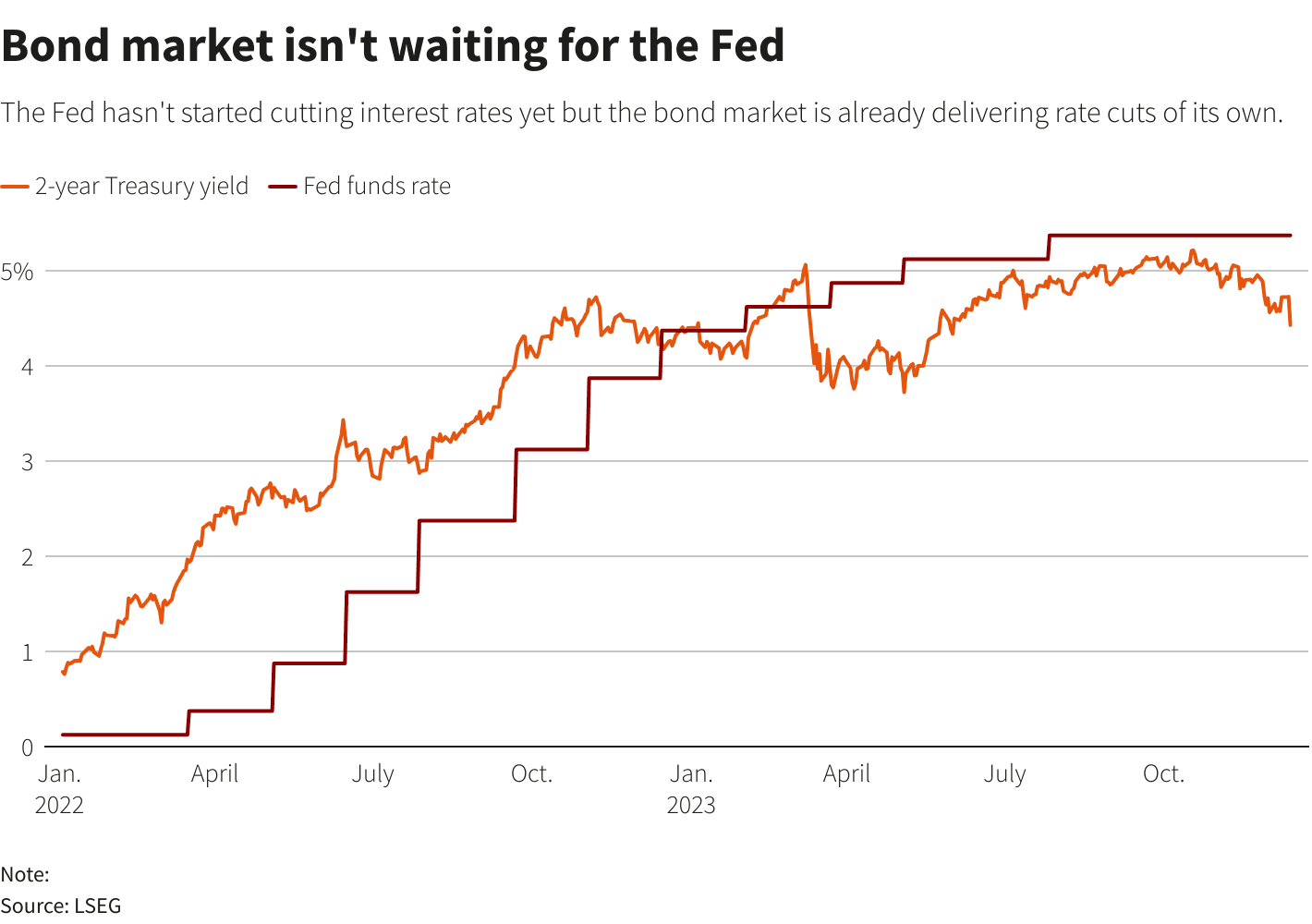

For markets, the immediate implication is a recalibration of short‑term interest‑rate expectations. Two 25 basis point reductions would lower the policy rate by about 50 basis points in 2025, a move that typically eases borrowing costs for consumers and businesses and can lift asset prices. But with inflation expected to remain above target through 2027, long‑term yields may not decline in lockstep, leaving the real interest rate environment ambiguous and complicating decisions for mortgage borrowers, corporate treasurers and investors.

From a policy perspective, the Fed appears to be threading a narrow needle. Modest hiring and layoffs reduce the urgency for additional tightening, yet inflation that does not comfortably return to 2% argues for caution. The poll’s projection of persistent inflation implies either slower disinflation than policymakers hoped or upside pressures from areas such as rents, services or supply constraints — factors the Fed will monitor closely before signaling further moves.

Longer‑term, the divergence between a steady unemployment rate around 4.3% and above‑target inflation through 2027 could signal a higher neutral rate environment than in recent decades, raising questions for fiscal and monetary planning. If inflation proves sticky, the central bank may need to reintroduce tightening sooner than current polls suggest; if inflation falls faster than expected, more easing could follow. For now, investors and households will be watching incoming data and Fed communications for clarity on a 2026 rate path that the Reuters poll characterizes as very unclear.