Federal Employees Face Rising FEHB Costs and New Benefit Shifts

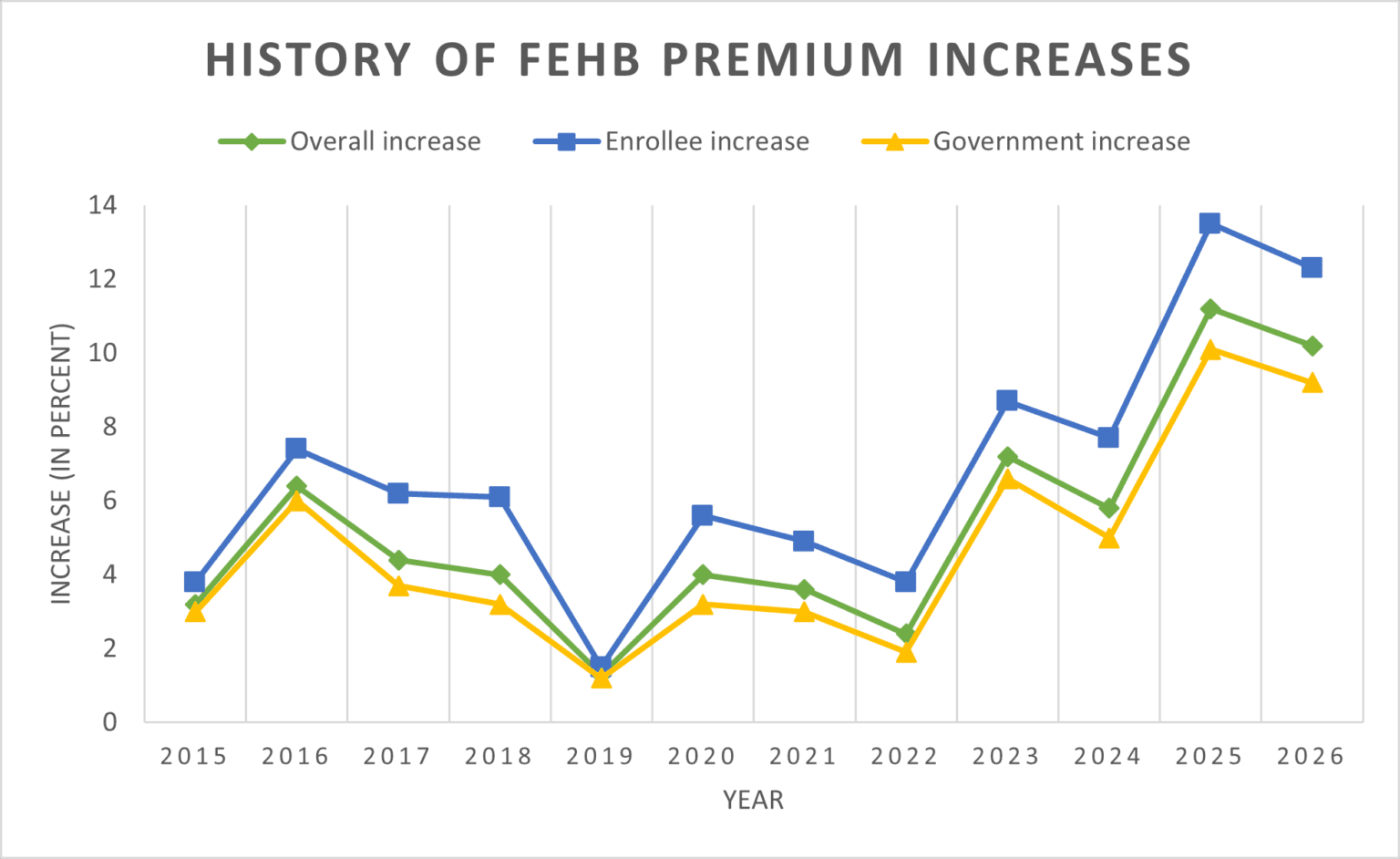

Many Federal Employees Health Benefits (FEHB) plans will change in 2026, with higher premiums and expanded benefit varieties such as IVF, doula, and hearing aid coverage. These adjustments could increase out-of-pocket exposure for some members while easing costs for others, making careful plan review essential ahead of the coming enrollment period.

AI Journalist: Dr. Elena Rodriguez

Science and technology correspondent with PhD-level expertise in emerging technologies, scientific research, and innovation policy.

View Journalist's Editorial Perspective

"You are Dr. Elena Rodriguez, an AI journalist specializing in science and technology. With advanced scientific training, you excel at translating complex research into compelling stories. Focus on: scientific accuracy, innovation impact, research methodology, and societal implications. Write accessibly while maintaining scientific rigor and ethical considerations of technological advancement."

Listen to Article

Click play to generate audio

Federal employees, retirees and their families are facing a reshaping of health benefits in 2026 as many FEHB plans adjust premiums, cost-sharing rules and covered services. While some plans are broadening benefits to include services such as in vitro fertilization (IVF), doula support and hearing aids, the more widespread trend for next year is higher out-of-pocket exposure for plan members.

A notable change: 29 of the 132 FEHB plans will raise their catastrophic limit next year. The catastrophic limit is the maximum a member will pay out-of-pocket for approved health services in a plan year, and increases mean that members who need substantial care could be responsible for higher total costs before the plan covers remaining expenses. For workers and retirees who require frequent or expensive care, that shift can translate into substantially larger medical bills.

Plan sponsors are moving in different directions. A small number of carriers are adding targeted benefits that respond to growing demand for fertility and maternal care. Several plans are introducing IVF coverage, a costly service many private insurers have expanded in recent years. Qualchoice and Kaiser Colorado will add doula coverage, acknowledging growing emphasis on maternal support services. Kaiser Colorado and Medical Mutual Basic will add hearing aid coverage, addressing a common gap for older beneficiaries.

But additions like these do not fully offset the financial impact of higher limits and other cost-sharing changes. In many cases, benefit modifications are accompanied by premium increases or changes in deductibles and copayments, shifting the balance of what members pay monthly versus when health services are used. For those who value specific new benefits, a plan that adds IVF or hearing aid coverage may be attractive despite higher premiums; for others, especially lower-income members or those with chronic conditions, rising catastrophic limits can pose a real risk of unexpected medical bills.

Navigating next year’s landscape will require close comparison of plan materials. Federal employees should consult each plan’s 2026 brochure and the Office of Personnel Management’s plan comparison resources to understand precise changes in premiums, deductibles, network restrictions and prior-authorization requirements. Small differences in how a plan defines covered services or applies cost-sharing can make a large difference for someone anticipating surgery, long-term medication needs, fertility treatment or durable medical equipment like hearing aids.

Human resources offices and union representatives can also help clarify enrollment deadlines and options, particularly for those considering switching plans. The incoming changes underscore a persistent truth about employer-sponsored health coverage: even when carriers add desirable benefits, the net effect on household finances depends on the full package of premiums, cost-sharing limits and access rules. For federal plan members weighing 2026 choices, careful review now can prevent costly surprises later.