Federal Subsidy Talks Falter, Colorado Families Face Higher Premiums

Negotiations in Washington over extending federal premium subsidies weakened, raising the prospect that millions of people will see big increases in health insurance costs starting January 1. Logan County residents who rely on marketplace plans or financial help to pay premiums should review their coverage and contact their insurer or state exchange about options.

Federal negotiations over extending certain health insurance premium subsidies deteriorated late last week, leaving the future of offsetting payments uncertain and putting millions of policyholders at risk of higher costs when the new year begins. Lawmakers had a compressed timeline to act before January 1, and political disagreements in Congress stalled progress, reducing the chances that subsidies will be extended.

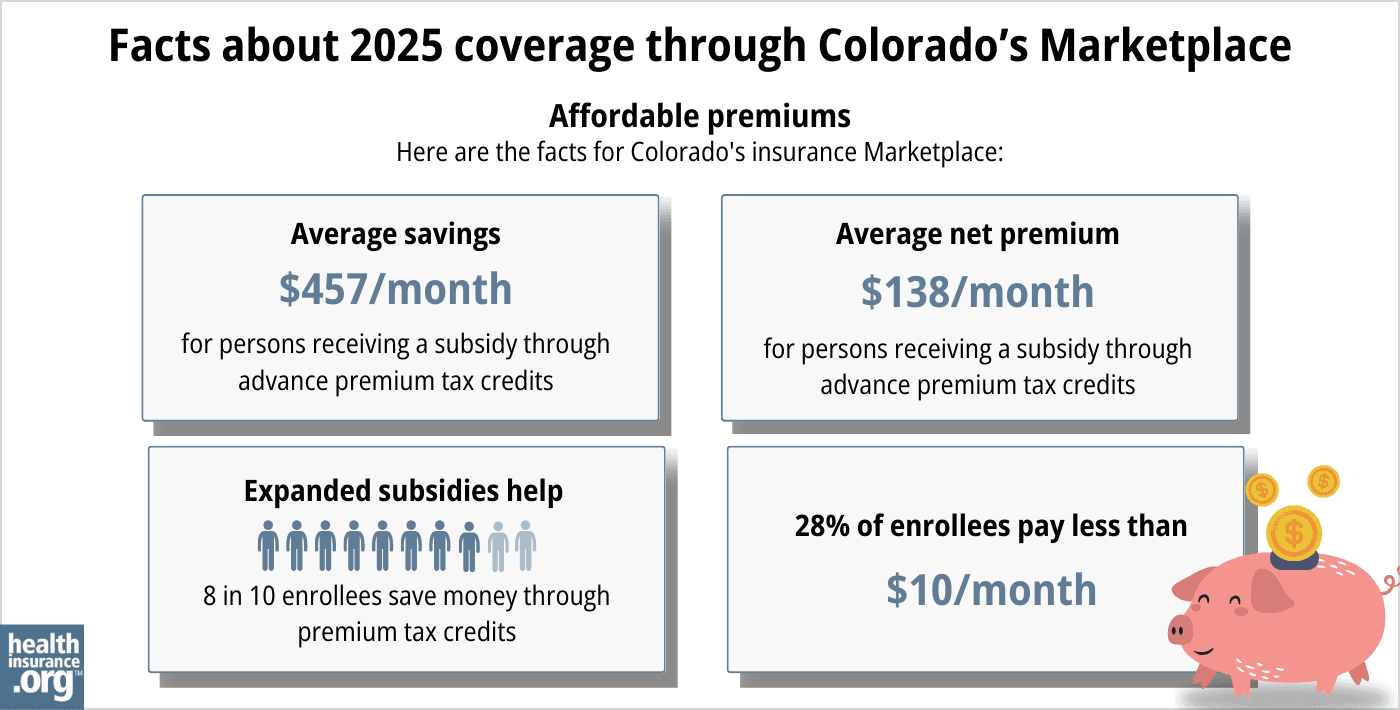

The policy under discussion affects premium tax credits that cap how much eligible households pay for coverage on the individual market. If Congress does not secure an extension or replacement before the deadline, insurers will no longer receive federal payments that hold down plan prices, and premium increases will likely be passed on to consumers starting January 1. National estimates project significant increases for many enrollees, and those impacts would reach residents in Colorado and in Logan County.

For local households that purchase coverage through the individual market and who currently receive premium assistance, the potential jump in monthly costs could strain household budgets. Those who receive subsidies based on income could see their out of pocket premiums rise substantially. Local employers that offer small group plans could also face cost pressure if broader market rates shift.

State level responses could shape how severe the local impact becomes. Colorado officials and the state insurance exchange can increase outreach, extend enrollment assistance, and provide guidance on plan changes and alternative options. Local clinics, hospitals, and community health centers may expand financial counseling and work with patients on payment plans or charity care where possible. County public health agencies and social service offices can help connect residents to enrollment help and explain eligibility for other programs.

Residents should verify their plan renewal notices and reach out promptly to their insurer or the state exchange to understand 2026 premium projections and any enrollment deadlines. For those who will struggle to pay higher premiums, contacting local health care providers and county assistance programs early will help identify short term supports and longer term coverage alternatives.