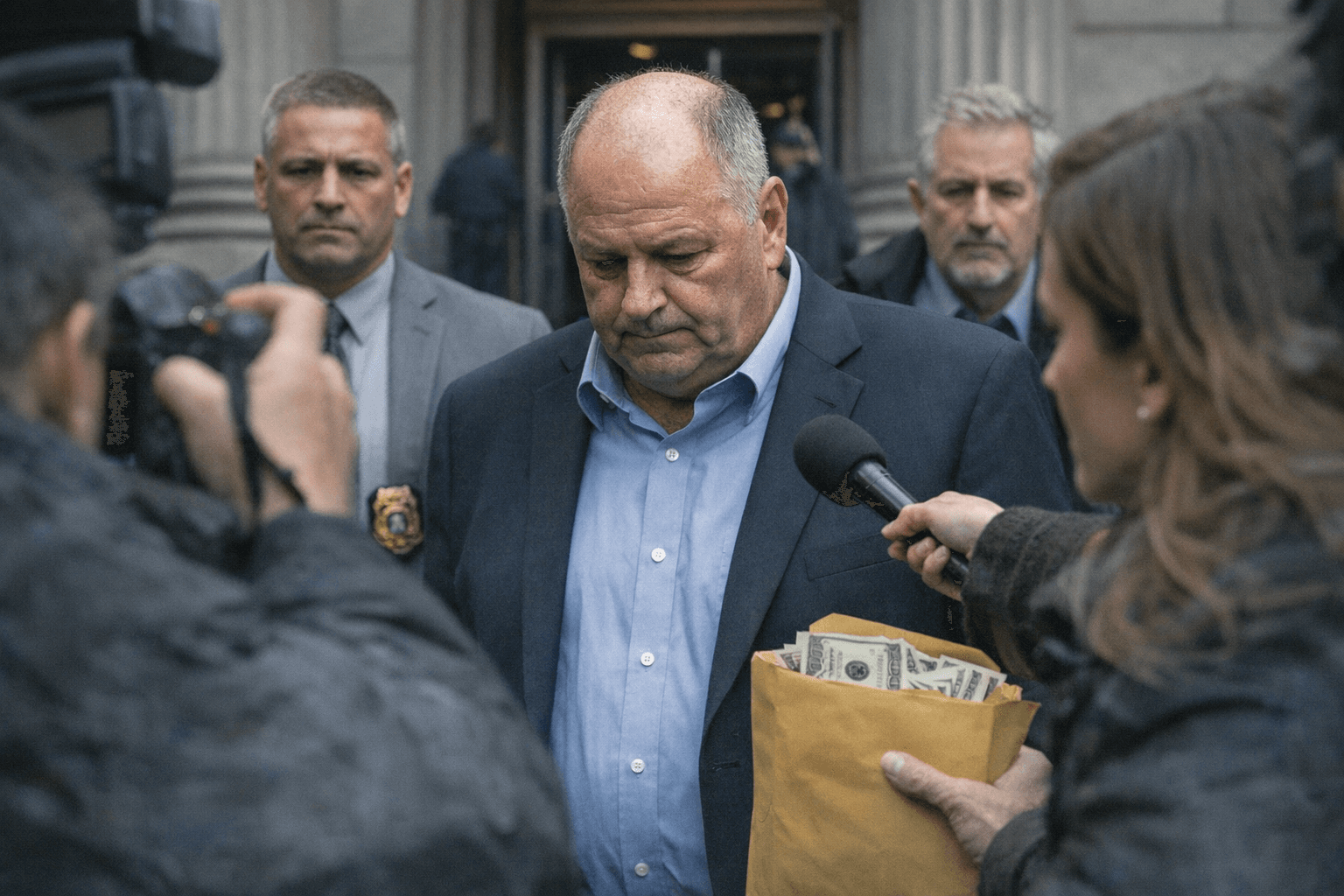

Former NY Troopers PBA president admits stealing union funds

A former PBA president admitted stealing union funds, and investigators identified Goshen-based Epic Risk Solutions in the probe; local members face scrutiny over benefits and contracts.

A former president of the New York State Troopers’ Police Benevolent Association pleaded guilty to stealing union funds, a development that has prompted renewed scrutiny of the union’s finances and its relationships with outside vendors. The admission was entered on Jan. 6, 2026, and law enforcement investigators have traced links between the union’s financial dealings and outside firms that provided insurance and benefits services.

Investigators reviewing PBA contracts and bookkeeping found patterns that led them to examine intermediaries that handled payments and benefits arrangements. One locally based firm, Epic Risk Solutions, with a listed address in Goshen, Orange County, was identified as part of the wider probe into the PBA’s contracts and financial arrangements. County residents and union members who worked with or received coverage arranged through those channels now face uncertainty about the integrity of prior agreements and the state of the union’s financial reserves.

The legal admission carries immediate procedural consequences. A plea admitting the diversion of union funds typically triggers a sentencing schedule, possible restitution orders, and civil remedies that can include recovery actions against individuals or entities that benefited improperly. For the union itself, the admission removes a leader from office and can activate internal governance mechanisms: trusteeship, emergency audits, interim leadership appointments, and expedited elections under the PBA’s bylaws. Those processes affect how benefits are administered and how vendor contracts are reviewed or renegotiated.

For local stakeholders the implications are concrete. Active and retired troopers whose insurance or benefit plans were arranged through intermediaries tied to the union or to firms operating in Orange County could see delays or disruptions if contracts are suspended pending review. Small businesses and brokers in the county that did business with Epic Risk Solutions or similar firms may be called on to provide records or face reputational fallout. At a community level, the case underscores the importance of transparent contracting and independent oversight when unions or associations control pooled funds that affect member benefits.

The situation also raises questions for policymakers and local officials who oversee public-safety partnerships and vendor vetting. Municipal employers and benefit administrators may want to verify contract terms, confirm the status of vendor licenses, and consult counsel about continuity of coverage for members.

The takeaway? Stay informed and demand documentation. If you are a member or beneficiary, request audit reports, copies of contracts affecting your coverage, and details from union leadership about steps taken to secure member benefits. Our two cents? Civic oversight works best when members show up, ask for records, and insist on transparent stewardship of funds that protect public-safety workers and the community they serve.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip