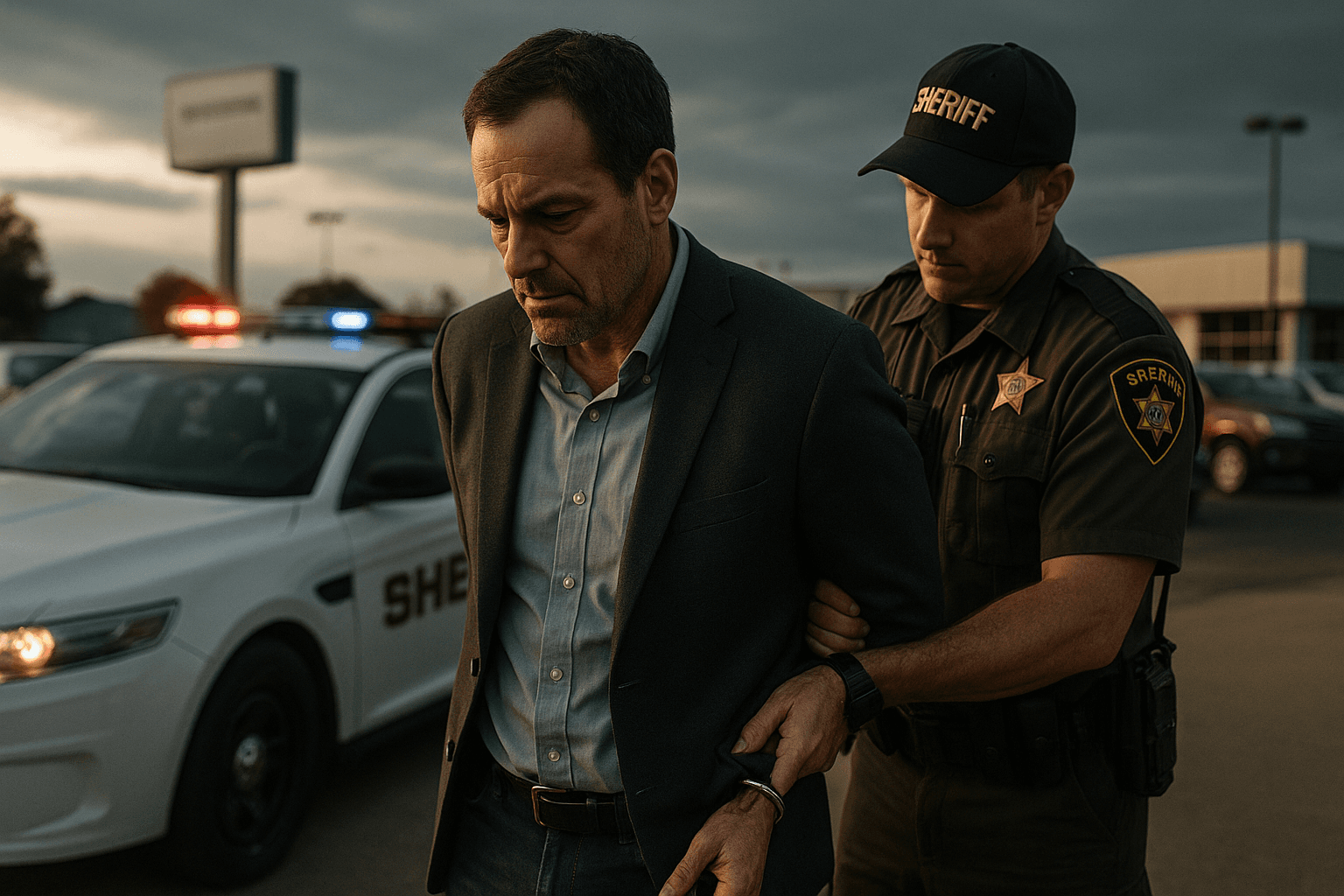

Former Storm Lake Dealer Arrested, Faces Multiple Felony Charges

Authorities arrest former Storm Lake auto dealer owner Dan Winchell on multiple felony charges tied to the collapse of Holzhauer dealerships, a case that could affect customers, local lenders, and county tax receipts. The allegations include withholding title and registration fees and selling vehicles without repaying bank loans, raising concerns about consumer protection and dealer oversight in Buena Vista County.

Authorities have arrested Dan Winchell, the 64 year old former owner of the Holzhauer dealerships, on multiple felony charges connected to last fall's collapse of the Holzhauer auto group. Winchell is booked Monday into the Cherokee County Jail and faces two counts of ongoing criminal conduct and four counts of first degree theft. The Iowa Department of Transportation has filed identical criminal charges in both Buena Vista and Cherokee counties alleging that Winchell withheld title and registration fees and sold vehicles without repaying bank loans.

Investigators say Winchell kept tax, title, and registration payments from customers last summer instead of forwarding them to county treasurers. In some cases customers paid those fees twice. The DOT also alleges Winchell sold vehicles "out of trust" and pocketed proceeds without repaying loans from Citizens First National Bank of Storm Lake and other lenders. Court records show the Holzhauer dealerships sold at least 80 vehicles without reimbursing Citizens, which later won a judgment against Winchell in Cherokee County District Court.

The three dealerships involved, Holzhauer Motors, Holzhauer Ford Cherokee, and Holzhauer Ford Storm Lake, closed last fall amid lawsuits claiming more than 15 million dollars in unpaid loans. Creditors liquidated the Ford dealerships through bankruptcy proceedings while Citizens secured additional judgments totaling millions against Winchell and Holzhauer corporate entities. A preliminary hearing in the criminal cases has not yet been scheduled. Winchell has appealed one civil judgment through his attorney Michael Kuehner of Des Moines. No attorney has filed an appearance for him in the DOT criminal cases.

Local impact is immediate and measurable. Customers who believed fees were processed may face administrative delays and costs to reissue titles and registrations, and some report paying fee amounts twice. Local banks and credit unions that financed purchases could see increased loss provisions and tighter lending standards for small dealers if recovery of collateral remains uncertain. County treasurers may face short term revenue timing issues because funds collected at point of sale were not forwarded.

On a broader level the case highlights longstanding regulatory and market vulnerabilities in retail auto finance, where dealer trust accounting failures can ripple through community banks and create consumer hardship. Policy responses could include stricter oversight of title and registration escrow practices, more frequent audits, and clearer notification rules for buyers and lenders when dealers close. For Buena Vista County the proceedings will be important to monitor for both legal outcomes and the potential for local reforms to prevent similar collapses in the future.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip