Gatesville Resident Targeted by Fake Toll Texts; Officials Urge Caution

A Gatesville man nearly paid a bogus toll bill after receiving a realistic text message demanding payment, all within a 12-hour window. Local officials and consumer advocates are warning Coryell County residents to ignore links in unexpected texts and to verify charges directly with official toll agencies to avoid financial loss.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

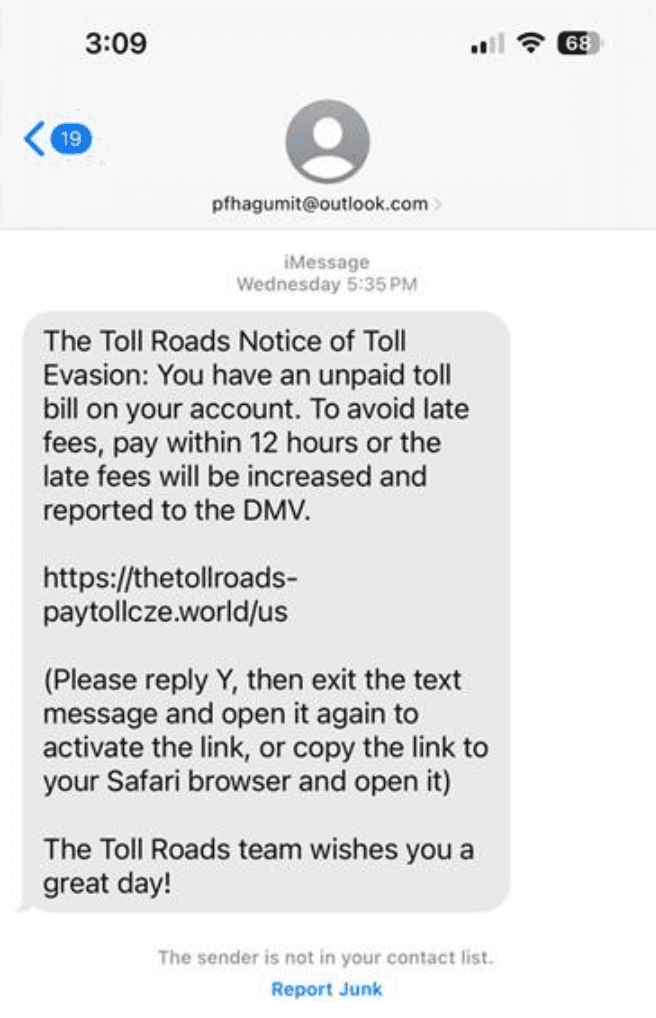

A Gatesville resident was targeted this week by a convincing text message that claimed an unpaid toll and directed him to pay online — a scam that nearly succeeded within a 12-hour period. The episode has prompted renewed warnings from local officials and consumer advocates in Coryell County about the growing risk of text-message scams tied to digital payments and tolling systems.

The incident underscores how quickly fraud can escalate. According to local reporting, the message appeared realistic enough that the recipient almost completed a payment before realizing the request was not legitimate. While no money was lost in this case, the near-miss highlights an important vulnerability for residents who regularly use electronic tolling and mobile payments.

Officials advise residents to avoid clicking on links in unsolicited texts and to verify any disputed toll charges directly with the official agency that manages the roadway. Consumer advocates emphasize contacting agencies via their published phone numbers or official websites and checking account activity through secure apps rather than following a message link. These practical steps are aimed at preventing the immediate financial harm and the downstream administrative burden that scams impose on victims and public agencies alike.

The local economic implications are twofold. For individual households, a successful scam can mean direct financial loss, disrupted budgets, and time-consuming disputes to recover funds. For local governments and regional toll authorities, an uptick in phishing and "smishing" incidents can increase call volumes, require additional fraud-prevention resources, and erode public confidence in electronic payment systems that are central to modern traffic management. Coryell County residents who commute to nearby employment centers are frequent users of toll roads and thus represent a segment of the population particularly exposed to this type of fraud.

The episode in Gatesville fits a broader trend: as payments and billing move increasingly to digital platforms, fraudsters are adapting by crafting targeted, realistic messages that mimic legitimate notifications. Policy responses at the state and local level typically include public education campaigns, partnerships between law enforcement and toll agencies to trace and shut down scam operations, and technical measures such as stronger authentication and clearer billing notices.

For now, the immediate advice from officials is simple and actionable: do not click links in unexpected texts about bills, verify through official channels, and report suspicious messages to local law enforcement and consumer protection agencies. As electronic tolling becomes more common, communities like Gatesville will need both individual vigilance and coordinated public-policy responses to keep residents’ money and personal information safe.