Global Stocks Rise as Traders Lean Toward December Fed Cut

Equity markets opened the week higher as investors pushed up the odds of a Federal Reserve interest rate cut in December, lifting major U.S. and global indices. Gains were concentrated in AI related mega cap and infrastructure related names, while lower volatility and softer Treasury yields signaled growing investor confidence ahead of critical U.S. economic releases.

Global markets started the trading week on a firmer footing as investors increasingly priced in a Federal Reserve interest rate cut in December. The Nasdaq led the advance, reflecting heavy gains in technology names tied to artificial intelligence, while the S&P 500 also climbed and cyclical infrastructure related stocks added breadth to the move. Market participants described the action as a repricing of policy expectations after comments from several Fed officials and a run of economic releases that left traders more confident about easing.

Equity indices rose broadly with the Nasdaq up roughly 1.4 percent and the S&P 500 advancing about 0.9 percent in early trade. The Dow Jones Industrial Average posted a smaller gain near 0.6 percent as industrial and materials names participated later in the session. The MSCI World index was up around 0.8 percent, with European and Asian benchmarks also posting modest gains in a holiday shortened week. Intraday swings were relatively orderly and the Cboe Volatility Index moved lower to near the low teens, signaling diminished demand for hedges.

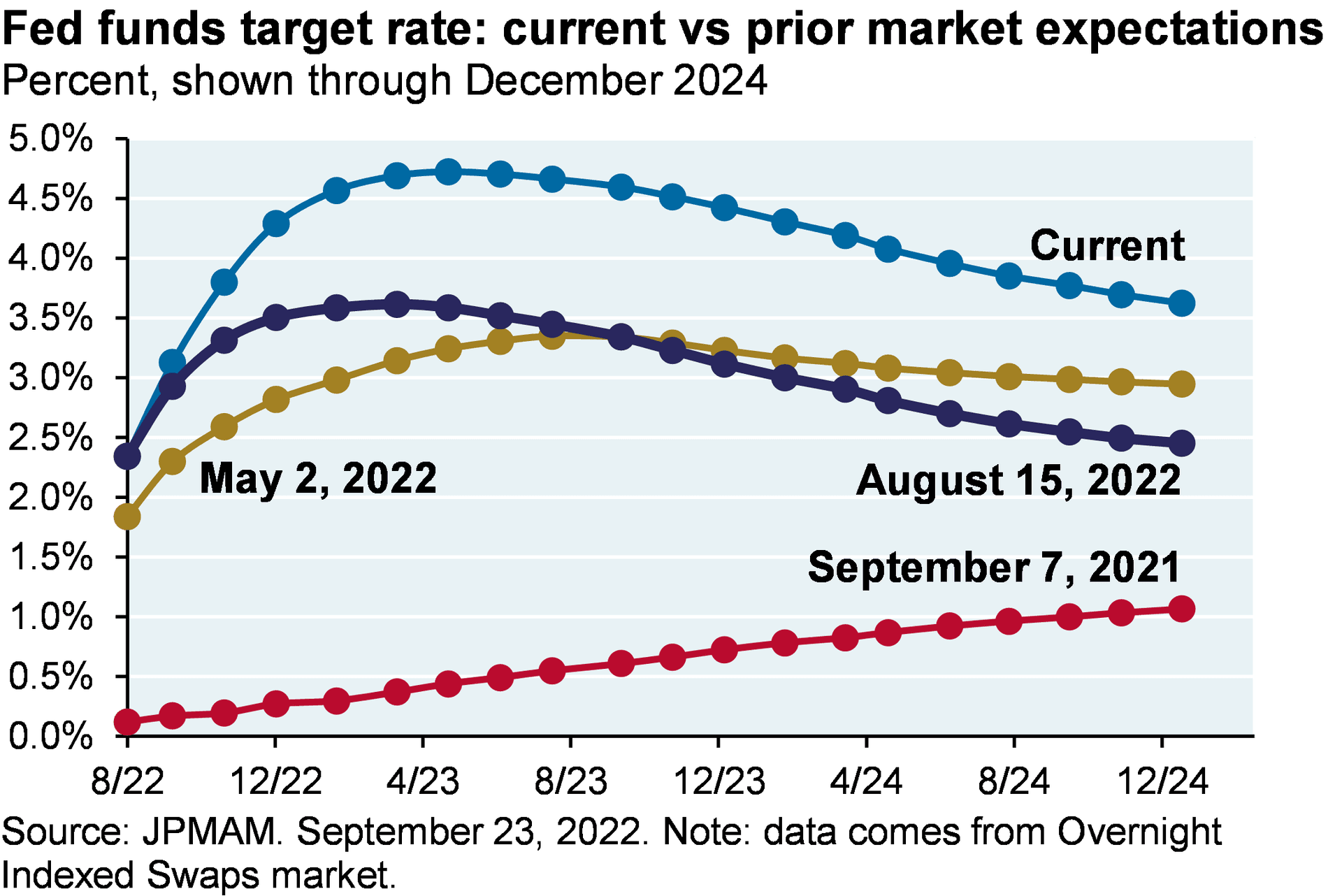

Fixed income markets reinforced the easing narrative. Yields on benchmark government bonds fell, with the 10 year U.S. Treasury yield dipping from recent highs and trading near the low four percent area. Fed funds futures priced a substantially higher probability of a 25 basis point cut at the December meeting than they did last week, reflecting traders shifting expectations after recent Fed commentary and softer inflation signals from some data releases.

The market rally was concentrated by sector. AI related mega cap stocks led technology outperformance, buoying the Nasdaq, while infrastructure related names contributed to gains in industrials and construction sensitive groups. This pattern underscores an investor preference for growth driven by technology adoption alongside selective exposure to economically sensitive assets that stand to benefit from lower borrowing costs.

Policy implications are significant. A December cut would mark a pivot from the Fed s campaign of tightening that began two years ago, and would accelerate the recalibration of discount rates used by investors to value long duration growth assets. Yet the Fed remains data dependent and markets are acutely focused on several near term indicators. Traders are bracing for U.S. retail sales and producer price index reports later in the week, both of which could either reinforce the easing narrative or prompt a rapid reversion in odds for policy easing.

Over the longer term, investors face a market where monetary policy expectations can rapidly alter risk appetite, amplifying concentration in AI and other winners when rates fall, while also creating opportunities for cyclical rotation if easing proves durable. For now markets are rallying on the prospect of lower rates, but the path to a confirmed policy shift will run through a tight calendar of data that could quickly change the directional bias.