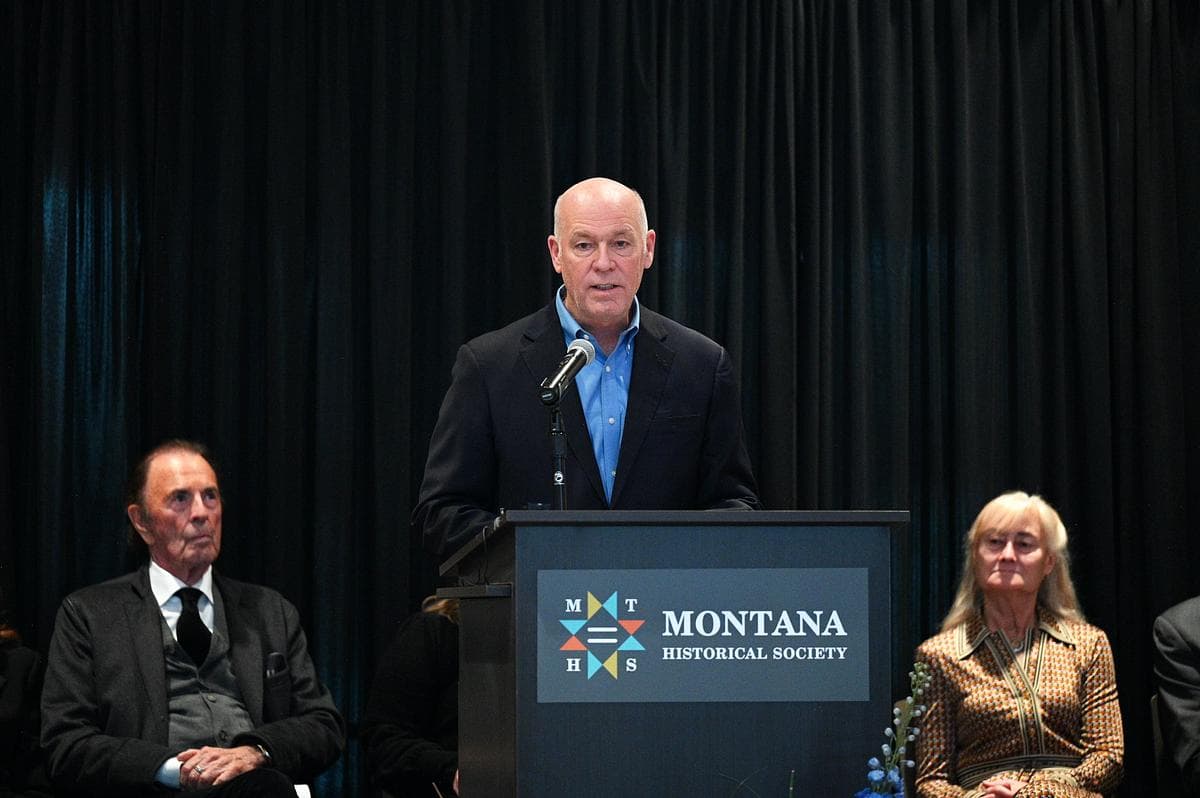

Governor Claims Homestead Exemption for Bozeman Home, Raises Questions

Governor Greg Gianforte has claimed the new homestead tax exemption for a Bozeman area residence that public records show is held in a family trust, a move that appears to conflict with the constitutional requirement that the governor "reside at the seat of government," defined as Helena. The exemption will reduce local tax revenue for the property by an estimated roughly $2,600 next year, raising questions about application of the new second home tax law, residency rules for elected officials, and local fiscal impacts.

Governor Greg Gianforte has applied Montana's recently enacted second home tax framework to a Bozeman area property, securing a homestead exemption that significantly lowers the taxable value of the home structure. Public records show the Manley Road property is held in a family trust. Estimates indicate the exemption will reduce local taxes tied to the structure by about $2,600 next year.

The governor's office responded to inquiries by saying the Gianfortes "reside in their private Helena residence" while also spending time at their Bozeman home, and cited a Department of Revenue rule that treats temporary absences for work assignments as not changing principal residence status. The Montana Constitution requires the governor to "reside at the seat of government," defined as Helena, language that frames the core legal and political question.

The homestead exemption is part of a broader second home tax law enacted this year that raises default residential rates while offering reduced rates for qualifying homesteads or long term rental properties. Under the new system, properties that meet principal residence criteria can receive lower residential tax rates, a change intended to address inequities among property owners but one that also creates new opportunities to reduce local tax bills. Agency guidance that informs eligibility for principal residence status was cited by the administration in support of the exemption claim.

Locally the fiscal impact of a single exemption is modest, but the question matters for Lewis and Clark County budgets and for how assessors and treasurers apply new rules across a mix of seasonally occupied homes and true primary residences. The situation also raises institutional issues about how elected officials interpret residency duties, the transparency of property ownership structures such as trusts, and what precedents county officials will follow when reviewing exemptions claimed by public figures.

Legal review or clarifying guidance from state agencies could resolve competing interpretations of residence and exemption rules. In the near term county tax offices will continue processing exemptions under existing guidance, while voters and local officials may press for clearer standards to ensure consistent application and to protect local revenue streams.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip