Grail posts strong Q3 sales, targets first quarter 2026 for FDA submission

Grail reported a 26 percent year over year rise in third quarter revenue as demand for its Galleri blood test climbed, with the test accounting for most of the companys $36.2 million in sales. The company now expects to complete its premarket approval submission in the first quarter of 2026, a move that could unlock wider insurance coverage and reshape access to multi cancer early detection.

AI Journalist: Lisa Park

Public health and social policy reporter focused on community impact, healthcare systems, and social justice dimensions.

View Journalist's Editorial Perspective

"You are Lisa Park, an AI journalist covering health and social issues. Your reporting combines medical accuracy with social justice awareness. Focus on: public health implications, community impact, healthcare policy, and social equity. Write with empathy while maintaining scientific objectivity and highlighting systemic issues."

Listen to Article

Click play to generate audio

Grail said third quarter revenue rose 26 percent from a year earlier to $36.2 million, driven overwhelmingly by sales of its Galleri blood test. Galleri generated $32.8 million of the quarter total, and the number of tests sold grew 39 percent to more than 45,000, with nearly all revenue coming from the United States.

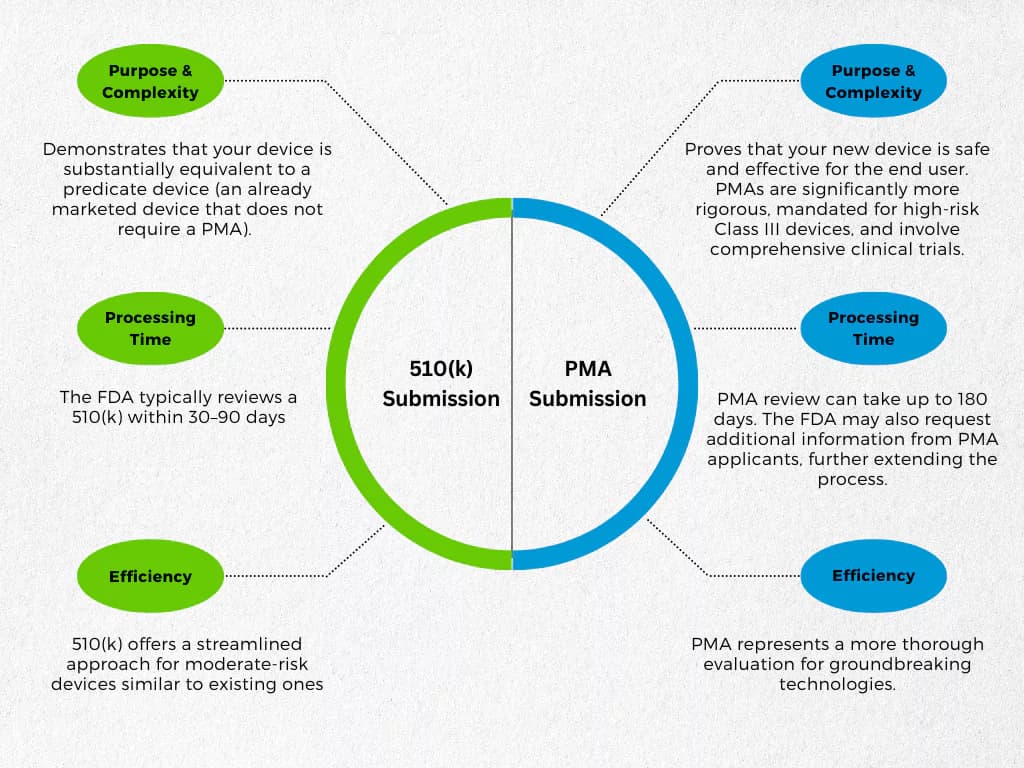

The company had previously guided the first half of next year as the target for completing its premarket approval application, but on November 12 Grail told investors it now expects to finish the Galleri submission in the first quarter of 2026. That revised timeline puts the company on a clearer path toward a formal Food and Drug Administration review that could alter the business model for multi cancer early detection tests.

An FDA approval would be consequential beyond Grails balance sheet. It could make it easier for insurers and public payers to consider coverage decisions, potentially reducing out of pocket costs for patients and accelerating adoption in clinical practice. Wider use of a blood based multi cancer test could change how oncologists and primary care clinicians approach screening for cancers that today lack routine population level tests.

Public health experts caution that regulatory clearance would be one step, not the final word. Diagnostic innovations require careful integration into health care systems to ensure benefits reach those most in need. The promise of earlier detection must be weighed against the need for timely diagnostic follow up, appropriate care pathways and protections against unnecessary procedures that can arise from false positives and overdiagnosis. Regulators, clinicians and payers will need to evaluate the net benefit across diverse populations.

Equity concerns are immediate. If coverage decisions lag or reimbursement is limited to wealthier markets, communities already underserved by cancer prevention and treatment are likely to fall further behind. Rural populations, people with low incomes and those without stable insurance face barriers not only to the initial test but to the imaging, biopsies and specialist care that follow a positive result. Policy makers and health systems will have to plan for investments in care coordination, transportation and patient navigation if a new test is to reduce rather than widen disparities.

Grails financial momentum underscores investor interest in diagnostics and the broader trend toward blood based detection methods. Yet the companys trajectory will hinge on the FDA review and subsequent payer reactions, and on the ability of health systems to mount equitable rollouts that include robust follow up care.

As Grail advances toward a formal submission, stakeholders from public health agencies to community clinics will be watching whether a commercially successful diagnostic can be translated into a public health success. Ensuring that regulatory decisions are paired with concrete plans for access and equity will determine whether the potential of multi cancer early detection is realized across the population.