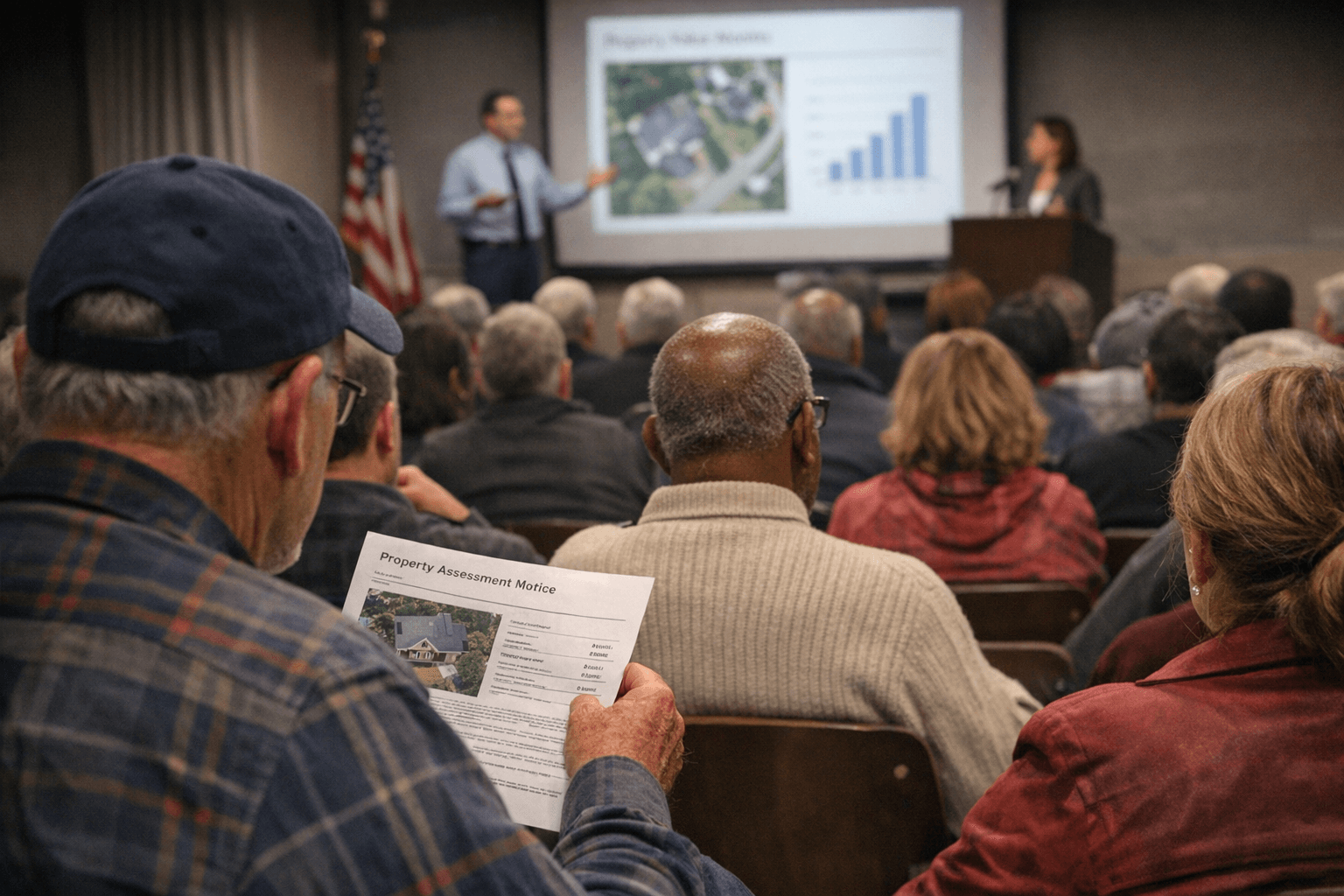

Guilford County Schedules Public Meetings on 2026 Property Reappraisal

On Jan. 8 the Guilford County Tax Department announced a series of public Tax Reappraisal Educational Meetings to explain the 2026 reappraisal process and available exemptions. The sessions aim to help residents verify updated property values online, understand the appeals process, and learn about elderly and veteran exemptions ahead of reappraisal notices arriving in February.

The Guilford County Tax Department invited residents on Jan. 8 to attend a trio of educational meetings this month designed to clarify the county's 2026 property tax reappraisal process. Each session begins at 6 p.m. and will include a presentation on how property taxes are assessed, how to verify updated property values online, how to navigate the appeal process, and how to pursue exemptions for the elderly and veterans.

County staff will be available for one-on-one consultations at the meetings to review eligibility for tax exemptions. However, property values and the county tax rate will not be released at the information sessions. Residents are advised that official reappraisal notices will be mailed in February.

The meeting schedule is set as follows: Jan. 20 at 6 p.m. at the Carl Chavis Memorial YMCA, 2757 Granville St., High Point; Jan. 22 at 6 p.m. at the Bur-Mil Clubhouse in Bur-Mil Park, 5834 Bur-Mill Club Rd., Greensboro; and Jan. 27 at 6 p.m. at the NC Cooperative Extension - Guilford County Center, 3309 Burlington Rd., Greensboro.

The county’s outreach is intended to prepare property owners for potential changes in assessed values that could affect tax liability and household budgets. Reappraisals periodically adjust assessments to reflect current market conditions, and accurate understanding of assessment results is critical for residents who may need to appeal valuations or apply for exemptions. The absence of specific values and tax rates at the sessions means attendees should plan to follow up when reappraisal notices arrive to determine actual impacts.

For seniors and veterans, the county is highlighting exemption opportunities and offering staff assistance to determine eligibility. The availability of one-on-one consultations aims to reduce confusion and support timely filing for exemptions that can reduce taxable value.

For more information the county directs residents to the reappraisal webpage at GuilfordCountyNC.gov/2026Reappraisal. County staff contact for the reappraisal program is Ben Chavis at taxappraisal@guilfordcountync.gov or (336) 641-4814.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip