Harris County 2026 property tax timeline and key deadlines

Harris County homeowners face deadlines for appraisals, exemptions, protests and the Jan. 31, 2027 tax payment.

Property values for the 2026 tax year are fixed as of Jan. 1, and Harris County homeowners should plan now for a sequence of appraisal, exemption and protest deadlines that will determine next year’s tax bills. The most consequential date for residents is the Jan. 31, 2027 due date for 2026 taxes, with penalties beginning Feb. 1 if bills are not paid.

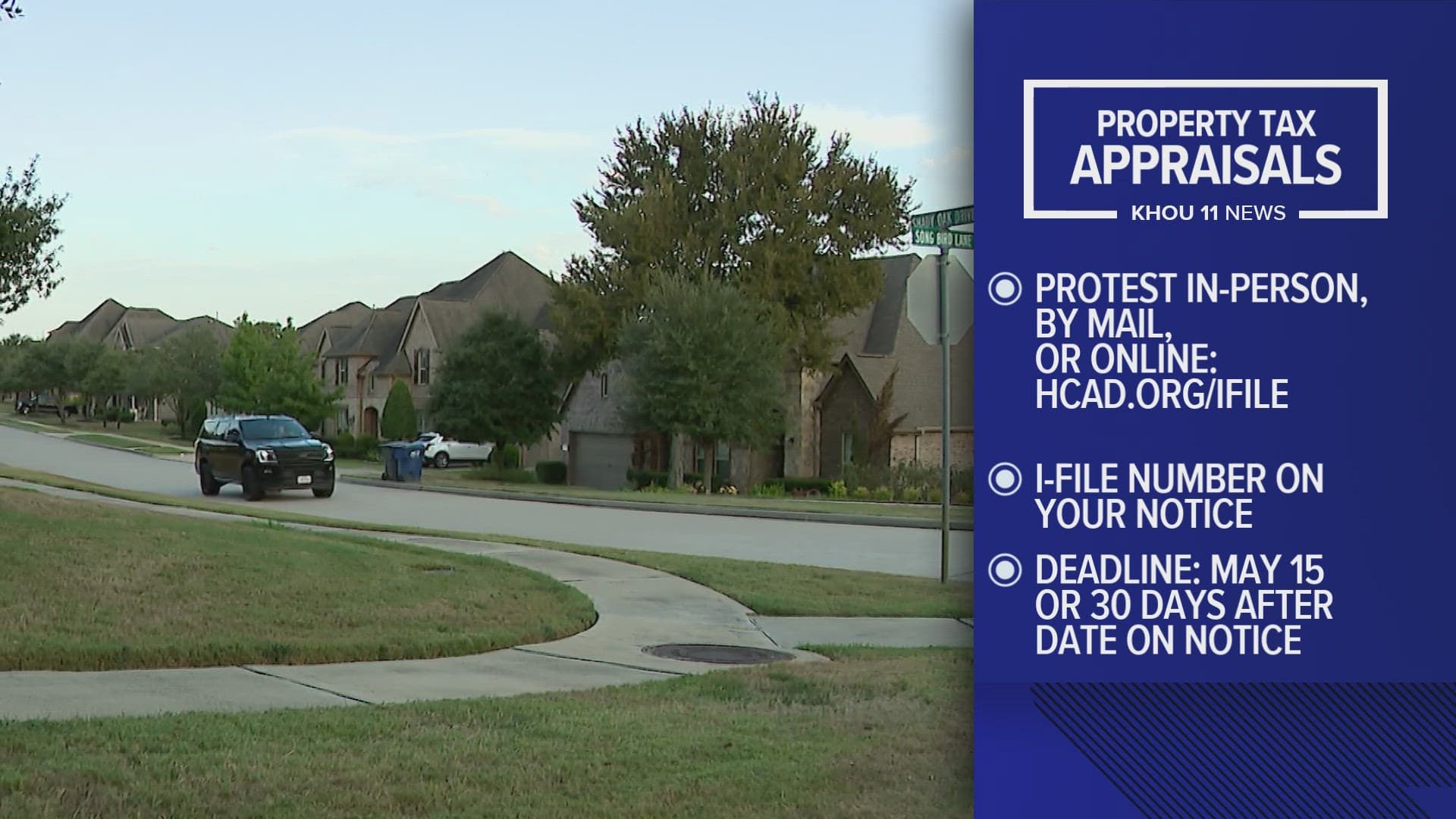

Appraisal notices typically arrive in April or May, and those mailings trigger a 30-day window to file a protest. Homeowners who believe their property was overvalued should watch the notice postmark dates closely; the standard statutory protest deadline is May 15 or 30 days after the appraisal notice is mailed, whichever provides the proper filing window. Protest hearings at local appraisal review panels generally take place from May through July, giving homeowners time to present evidence and challenge valuations before tax rolls are finalized.

Exemption filings are on a parallel timeline. Applications for homestead exemptions, disability exemptions and veteran exemptions must be filed by April 30 to apply to the 2026 tax year. Missing that cutoff can mean paying taxes on a larger taxable value for the year, so early filing or confirming existing exemptions are in place is essential.

Local taxing units set their tax rates in the summer and fall, and tax bills for 2026 typically mail in the fall once those rates are certified. That timing means residents do not receive a bill until after levy rates for school districts, cities and other local entities are established, but the underlying appraised values and protest outcomes are already locked in from the spring process.

These steps are broadly consistent across large Texas counties because state valuation dates and shared administrative calendars create a uniform rhythm for appraisal districts and taxing entities. That statewide structure helps explain why Harris County’s deadlines line up with neighboring counties and why homeowners who move across county lines see similar timelines.

For Harris County property owners, the practical actions are straightforward: monitor the mail and note appraisal notice postmarks, submit exemption paperwork by April 30, file any protests within the 30-day window or by the May 15 benchmark, and be prepared to attend hearings from May through July. Keep copies of paperwork, organize comparable sales or appraisal evidence if you plan a protest, and watch for your tax bill in the fall so you can budget for the Jan. 31, 2027 due date.

The takeaway? Treat spring mail like a financial alarm: check appraisal notices as soon as they arrive, lock in exemptions early, and protest promptly if values look off. Our two cents? A few minutes now — stamping a form, snapping photos, or confirming an exemption — can save you real money when bills come due.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip